The future of DEFI?

I've been thinking more and more about the token I'd like to one day create, and the idea of bonds keeps popping up. What is a bond? What is the purpose? Well, a bond is normally considered an extremely safe and immensely liquid asset that can be bought or sold at anytime for a discount or premium depending on market pressure. How does that work?

A bond is a loan.

You loan the government your money and the government promises to pay you back with interest. This is actually an interesting dynamic when you think about it, because since when does the government actually make smart financial decisions and profitable gambles? The answer is: nobody cares because US treasuries have never defaulted and thus the American government has a long outstanding history of paying back these types of debts... often by 'simply' printing more debt. Easy peasy lemon squeezy.

What is a junk bond?

A junk bond is a high risk loan with a much greater chance to default than US treasuries. To make up for this extra risk the issuer (often a corporation) will sweeten the deal by promising to pay back a higher yield at maturity (loan is paid back in full with interest after x years).

A relevant example of a junk bond would be Microstrategy acquiring billions of dollars worth of Bitcoin with their debt and buying the top. None of us are strangers to the idea that Microstrategy was going to get margin called during the bear market. Notice how nobody talks about this anymore and they act as though they never did? Such is human psychology.

The ironic thing about 'junk' bonds is that they make a lot more business sense than government bonds. Why does the government need to borrow money from its own citizens? How does that even make sense? Well it actually makes perfect sense when we realize that bonds were invented long before the Internet. In fact modern American bonds were invented in 1935 as a way to get the country out of the Great Depression, which is a very noteworthy year considering that the gold standard ended in 1932.

In order to understand history we must understand context.

Back in the 1930's everyone understood that paper money was bullshit. This is no longer true because everyone alive today has lived their entire lives under the paper-money standard. However, back then it was known that governments could not print money out of thin air. Money was silver (lots of money was gold). You could always turn in your paper to get the agreed upon amount of silver/gold.

Governments can not print silver.

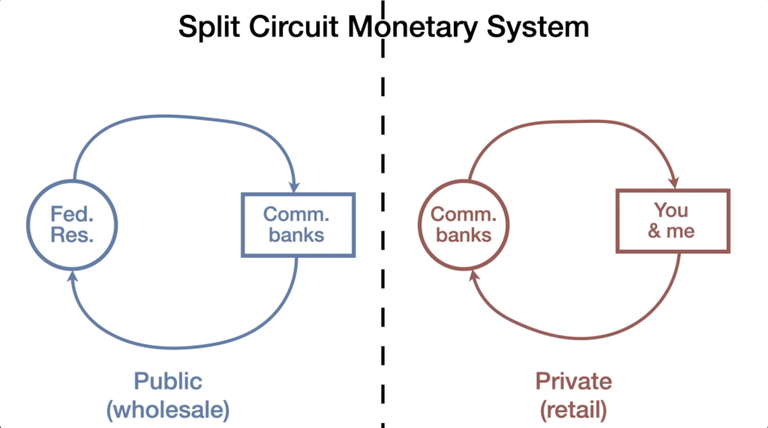

And thus all these 100-year old financial instruments we use today sort of revolve around this idea that governments can't just indiscriminately print out money. In fact with the 2-tiered split financial system (reserves vs fiat) government arguably can't print out money at will and need to get permission from central banks in a somewhat awkward checks-and-balances type way.

A $1 liberty head is now worth $20 just from the silver and that's likely undervalued.

So it very much makes sense why bonds still exist today. Once a government starts printing debt out of thin air they have little incentive to stop doing so. Social Security was supposed to be a temporary measure that ended up becoming permanent quite quickly.

What does any of this have to do with crypto?

Well crypto, and specifically DEFI, has decided it wants to start adapting these legacy financial instruments into the current paradigm. The problem? Adapting 100-year old financial instruments 1:1 into crypto doesn't make any god damn sense. We don't have a split financial system. We don't have these centralized checks-and-balances to worry about. We make our own rules and we don't ask permission.

So again why would Hive need bonds?

Why does Hive need a loan? What is Hive going to do with that money? I'll tell you what Hive is going to do with that money: absolutely fucking nothing, because it's locked in a contract on purpose and can't even be spent like a normal bond obviously would be.

Hive already has communal loans.

It's called the proposal system, and it's working just fine.

We print money out of thin air to fund projects with network consensus votes.

Hive doesn't need to borrow money from the community.

Hive can and does print money on demand to pay for things.

This is called 'subsidization', or if you want a negative connotation: 'socialism'.

So obviously, yet here we are.

So we have to ask ourselves what the allure of bonds on Hive/crypto would be. The answer is pretty simple. Bonds are deflationary. They lock up HBD for x amount of time and offer yield, which exponentially increases demand for HBD, which in turn burns Hive to create more HBD. Number go up. That's why we want bonds: number go up. That is the only reason. There is no other practical purpose of bonds.

And that's a dangerous mindset

Because if bonds don't actually have utility then the entire system is completely unsustainable. Every contract in life should have two or more parties involved, and all parties should theoretically benefit from the exchange. A bond is a loan. Both parties in a loan are supposed to benefit. The lender benefits by generated yield and the borrower benefits by leveraging the loan into an even better investment than the yield they have to pay later. This cannot happen on the blockchain (at least given the current environment).

Instead it just turns into a Ponzi scheme.

Number go up today but will go down when the loan needs to be paid back. In theory this could be beneficial to reduce volatility and prop up the price of Hive during brutal bear markets, but look what actually happened in reality. The people in charge of determining the APR of HBD started getting cold feet at literally the worst time. In the middle of a bear market whispers started circulating of the need to LOWER the APR of HBD when sentiment should have been the exact opposite.

There's also no reason why witnesses should control the interest rate.

Just like the proposal system itself and voting in witnesses: the HBD interest rate should obviously be a direct democracy of coin voting. There is no reason to give witnesses this power and it should be changed immediately. My vison of what this would look like is a vote that could push the APR up or down 1% every week or so (or more often not move at all). Point being is that we should not trust witnesses to be competent economists. That is simply too much to ask of them. But I digress.

And bonds are even worse than that.

Why? Because bonds have to be paid back at a predetermined time in which we have no idea where we will be in the market cycle. What happens if we have to pay back a bunch of debt at the absolute worst time possible (aka middle of the bear market). That would just crush the market even worse and increase volatility further, which was the exact thing we were trying to avoid in the first place. Not good.

The only way to win is to never pay back the loan.

I call this strategy: "The Drip". Why? Because it allows big lump sums to be taken off the market permanently, and allocated yield to the end of time. Of course such an interest rate would have to be variable (just like HBD APR) to avoid systemic failure and unsustainability, but I don't view that to be a problem. In fact such a thing increases simplicity by making all permabond contracts 100% fungible and identical to one another (which means they could be easily tradable on a secondary 'fungible nft' market).

Indeed, in crypto it never makes sense to allow a bond to mature and become unlocked. Why? Because again this isn't the 1930's. That's why. Federal treasuries were created around the system that was already in place and had to cater to the many other powers of the world at that time. This is not a thing in crypto. Crypto lords over itself and has none of these limitations, so imitating a 100-year old technology 1:1 and incorporating all those limitations on purpose is really foolish and naïve.

- Hive has direct access to every users bank account.

- Legacy bonds do not.

- Hive has direct access to the entire economic system.

- Central banks do not.

- Hive can print money on demand.

- Random branches of government can not.

It is all these variables and more that allow permanent bonding to be a viable strategy. The loan never has to mature because the APR on the loan can be high enough to pay for itself in a reasonable amount of time anyway. This is especially true given a secondary market where users could sell their position at a discount to recover say 95% of what they put into it.

Take 20% for example.

What's 20% APR after 4 years compounded monthly?

48 months at 20/12 (1.67%) per month.

1.0167^48 = 121%

Meaning that a permabond never has to mature because one can already double their principal in less than 4 years. This is not a reasonable expectation for a lower number like 5%, which is a pretty standard rate for bonds.

Conclusion

The literal point of a bond is for the money to be forked and double-spent (not really but it sounds good). The collateral of the bond is the reputation of the entity borrowing the money (gov or corp). The entire point of borrowing the loan is spending the money. Crypto bonds do not satsify this requirement by design, and are thus invalid. When the entire point of the crypto bond is to NOT spend the money, that's the opposite of what a loan is actually supposed to achieve. Loans are meant to be spent/shorted (not held) by definition.

Because of this, the only way crypto bonds make any sense whatsoever is if the principal never gets paid back, and instead are used as a tool to manage volatility. We can leverage permabonds to take vast quantities of debt off the market in an instant and then convert those vast quantities of debt into a drip that we pay back slowly. It should be obvious that such a strategy should only be employed during a bear market, and interest rates should be very very low during good times so they can later be jacked to the moon during bad times to balance out the ecosystem.

Read the entire post, I cant say how it could be better or worst but based on your theory I like it, I also agree that 20% yearly is not that crazy at all but the wording "permanent bonding" might scary a few, its true it would take money out of the system and lock it for ever paying back interest drop by drop so if enough money/Hive gets lock up that might push the price taking all that Hive out of circulation, I understand it similar to burning but not burning? ✌️

Ultimately what I never got around to talking about is how these things need to be prototyped on the second layer first before being incorporated into Hive. I really should be working on my own token to test this stuff but never seem to get around to it.

HBD APR should be determined automatically by the Hive blockchain itself, maybe in the next hard fork...

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 610000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPI have just a single question

If Hive decides to go for a loan today, how will they get it?

That's quite an interesting perspective and good points raised for bear markets. It only takes one bad or good news story to create some hype and then see it all change though which could impact a lot of things