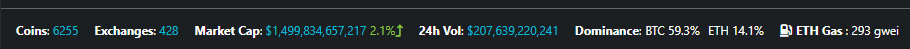

Most of us know what dominance is in terms of Bitcoin market cap. On Coingecko BTC dominance currently sits at 59.3% while Coinmarketcap stands at 60.3%. Why the difference? Coingecko probably lists a few extra networks, so BTC dominance becomes slightly diluted.

Dominance is an important technical analysis metric.

We've seen the pattern play out before. When Bitcoin dominance is high we are often consolidating during a bear market and alts are bleeding into the "main chain"; users attempting to retain their value.

However, during the mega-bubble year of 2021, we should see Bitcoin dominance start to recede as the price trades higher than $100k. As money gets pumped into Bitcoin all time highs, more and more alts tend to attract attention because they are a "better deal" with a lot of room for volatile upside.

My target range for Bitcoin dominance during this mega-bubble peak is 30%-35%, and I feel like we won't have to worry about a bear market starting until then. I expect the market cap for Bitcoin to be around $5T during that time (say $250k per coin), and the market cap for alts to be around $10T (so 33.3% BTC dominance). This would put the total perceived value of crypto at $15T, almost double that of Gold's market cap. I will drink the sweet milk of your tears, Peter Schiff. Get wrecked.

One of the big "selling points" of Bitcoin is to "be your own central bank" and take control of your own finances. If secured correctly, Bitcoin is very difficult to confiscate by force, and it can even be extremely difficult to even know how much someone even has.

Bitcoin is extremely private when we stop attaching our name and social security number to the public wallets. Tell me how much Bitcoin Andreas Antonopoulos has. Even as a public figure who gets paid entirely in Bitcoin, no one knows. His security is obviously legit because he knows exactly what he is doing.

The interesting thing about being a central bank? You get to mint your own currency. That's where platforms like BTC and ETH kinda fall flat on their own faces, while projects like Hive and LEO do exactly that. On Hive, 80% of all inflation is controlled by stakeholders, while on LEO a full 100% is locked in to be distributed by those who hold the token (or a derivative of it like virtual miners).

Powerup dominance

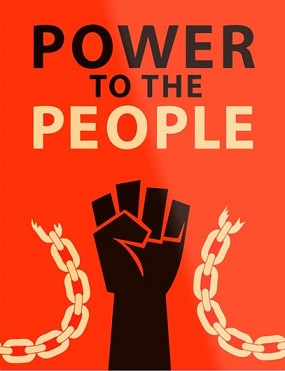

Meanwhile, powerup dominance is the percentage of tokens that have been powered up in comparison to the total in existence. This is something LEO is quite proud of.

WOW!

78.5% powered up!

That's some leet powerup dominance right there! So what is Hive at? 143M powered up and 383M total, for a dominance of around 37%. Now, many would look at this number and think "hm, not great", but I look at it like: "WOW, we have a lot of runway to move up on Hive."

So with LEO it would be literally impossible to increase our dominance by 25%, as that would equate to more than 100% of the tokens being powered up. However, with Hive, powering up 25% of the coins in circulation that would only bring us to 63% dominance, which is still pretty far away from LEO when we consider the logistics as this number gets closer to 100%.

Higher dominance = less Hive rewards

Hive creates a set amount of inflation no matter how much stake is powered up. Therefore, if lots of users power up their Hive the reward pool is getting leeched more, and everyone will earn less rewards.

However, this gets confusing because usually when that many people power up the liquid supply the price moons and everyone is making a ton of money. So even though everyone is earning less Hive per upvote, those coins are worth a lot more relative to USD even after reward pool dilution.

Shill Hive moar!

Truly, I hate to be shilling Hive like this when LEO is so close to a baller airdrop, but right now seems like a pretty good time to be powering up Hive (or at least buying it specutively). Even in the most bearish scenarios, I feel like Hive crashes to 10 cents minimum. The upside has a lot more wiggle room, and because of this dominance discrepancy it seems likely that the positive feedback loop of powering up in conjunction with a higher token price (incentivizing more power ups and higher token price) is upon us.

Conclusion

Inflation is seen as the enemy to Bitcoin maximalists. Their solution was to greatly eliminate inflation, reserving the little that was left for network security only (miners). And as we all know, that number gets cut in half every four years.

On Hive, and by extension all tokens on Hive (like LEO), inflation is the killer dapp, allowing users to control it directly and even earn it given the various systems we put into place. The better we allocate our inflation, the more we can prove to the world that inflation is not the devil: it's the people that control the centralized inflation of fiat that can't be trusted to do the right thing.

Over the next ten years it will be clear that the entire marketing campaign that Bitcoin maximalists have rallied around (21M coins total) is a complete farce. Bitcoin will not be able to compete with networks that allocate their inflation better than not having any at all. Inflation promotes growth in the areas we apply it to.

Bitcoin has very little inflation, and that's good for eliminating variables and making sure the network is solid and void of any potential corruption. However, this feature can also be interpreted as a bug, allowing other networks to move in and allocate inflation in a smarter way, thus outperforming Bitcoin in the long-term.

It's really a matter of risk vs reward. Bitcoin had to make the safe play. It needed secure blocks that take a long time to confirm that are also small so that anyone can run a node (decentralization). This opens up the door for networks like Hive and LEO to show just how valuable inflation can be.

Posted Using LeoFinance Beta

Oh I be shilling! I'm attempting to sponsor a longboard race, in hopes to attract the contestants to post their footage on the @skatehive community. Also being that it's in the Philippines, the money will go a lot further for them. Fingers crossed this leads to a decent number of them joining.

The Hive DAO has over 78 million coins locked up which cannot be powered up. If we take out the coins out of the equation we get what I call the available supply.

The percentage of vested hive relative to the available supply is ~47%. Now, the size of the DAO does play a role in the amount of coins that are minted since it is accounted for on the virtual supply so it does influence the market dinamics of the network although indirectly.

Posted Using LeoFinance Beta

https://peakd.com/@hive.fund/wallet

It is getting slowly converted into the dev fund after what? 5 years?

1.3M Hive a month getting dumped. Pretty significant.

Wasn't it like 83M when we started? Already shaved off 5 mill.

Those hive are not being dumped they are utomatically converted to HBD. Only 1% of the balance in that account is available to payout proposals so we are looking at 400 hive (in the form of HBD) added to the daily budget.

The point is that in all practical terms those funds are out of reach from the market. If anything the immediate effect of the DAO is that it reduces the total supply of hive by 40k per day.

I don't see it that way. Those funds could just as easily been powered up, and they were when Steemit Inc was in control of them.

I am trying to make the argument that Hive having low powerup dominance is bullish because we have a lot of runway to increase that dominance and choke the supply. It is being implied in this thread that actually our dominance is higher than that and we have less runway than I originally forecasted because of this locked up stake.

In reality, the opposite is true. This locked up stake gives even more incentive for users to power up their coins, because this locked stake is generating inflation and giving control of that inflation to the people that are powering up.

So even if my original numbers are off, the reasons to power up are even more pronounced.

Yield farming on Hive is back in a big way.

I totally agree with that.

Being your own bank is still far too difficult and at odds with living in society, but the door has been opened and hopefully that will get easier too.

I have been pondering what exactly TPTB could do to try (keyword) to derail BTC from a legal or technical perspective and one credible threat that I do believe exists is one that we may note from the recent GME / Wallstreetbets debacle with collusive entities working to eliminate fiat on or off ramps through legislative pressure such as India seems to be doing.

This would serve as a watershed event between the ideological or philosophically inclined users and those merely seeking profit which would likely panic presenting a problem albeit not one that would be insurmountable in my opinion.

People could still exchange crypto person to person which isn't nearly as nice as what we have now but nevertheless the user remains in control.

On a technical level, regulators would have a hard time playing whac-a-mole with node operators of decentralized exchanges and whatnot and hopefully they would eventually deem such efforts as being futile. It's hard to say what would happen if that day should come but sure diehards like us are ready to buckle in for the ride.

Interesting times we are living in and way I see it. The more power people take back from the ruling class who likes t play games with our livelihoods, the better.

I still think inflation is too high on hive, but thats another topic.

I am still waiting for hive and HBD to get picked up by the speculators and chartists. Why do you think SBD has been trading for 3.00-4.00$ for over a month now? In the past this has been the predecessor of the Steem bullrun.

I think it should be higher, add 10% for Stakeholders. This is the time, this is the way.

Are you worried about HBD printing going back out of control? Next bear marekt will be painful.

We can monitor the situation and profit on it the next time around. HBD printing only gets out of control when the price of HBD spikes high and doesn't come back to $1 for a long time.

Printing the HBD isn't the problem... the problem is that HBD doesn't get burned when the price starts going down. It's a good thing all Dev funds are printed in HBD because this puts downward pressure on the price.

Do you think this is because everyone wants their author rewards 50/50 in HP and HBD in that case? I think it makes a lot of sense to opt for 50/50 when HIVE spikes because you'll get a lot of HBD that has a price floor unlike extremely volatile HIVE that has massive downside after it has spiked.

HBD does get burned at the bottom when HIVE has stabilized and risen enough to make HBD's market cap relative to HIVE's market cap to get to 10%. That's when we'll see a long-time suppression of the price of HIVE owing to all the HBD->HIVE conversions happening.

We really, really need a collateralized debt based stable coin like DAI implemented on HIVE. Fees on Ethereum are atrocious. Hive has zero fees. Wrapped versions of major cryptocurrencies and HIVE itself could serve as the collateral.

That could bring capital to HIVE and make its price go up in a sustainable and stable manner along with allowing the creation of a working stablecoin.

Posted Using LeoFinance Beta

Party in the bull, worry about the bear tomorrow. :)

In all seriousness though, that's probably not the problem. Many of the projects that went up a ton in 2017 eventually went down by over 90%, projects that didn't have SBD/HBD. I think STEEM/HIVE would have probably performed in a similar fashion even without the over printing of SBD/HBD...

I think in the near future we may see a bitcoin hard fork, something like a new bitcoin cash. And inflation, as a limiting factor, will play a significant role in this.

Posted Using LeoFinance Beta

Would be an incentive to powering up a game changer?, well...that's what inflation does, you loose value if you have it liquid instead of staked right?.

We could add another incentive, the HPUD is a good one but I think that should be more rewarding.

Posted Using LeoFinance Beta

Interesting read. What Airdrop for LEO are you talking about and is it just for people powered up over there or is it mainly for activity?

I have a different thought process to where the market caps are going to be. I'm trying to stay more conservative and say we can go to 2Trillion marketcap.

Also while I think on a base level HIVE is interesting I don't feel it uses the inflation well and people don't want their money locked up for these longer time frames. There is no advantage of locking one's money up for months.

The power down should take no longer than 3 days for security reasons.

Plus the proposal system isn't utilized to market or anything.

Personally I think most things are going in the wrong direction. LeoFinance and DTube which is on it's own chain now are interesting though and seem to have better tokenomics.

Also

Leo is finishing a new app for microbloging, it will have it's own token and will be airdroped to everyone that has leo staked or in the uniswap pool. so most of the leo is staked. but even before that the staked % of leo was high.

they said it will be out end of February start of the March (if all goes to plan)

Locking up the stake is bad from a trader perspective, if you want pump and dump you don't want stake to be locked up.

If you see hive as a long term thing i don't see the problem with it. It could be shorter but 3 days don't really makes sense. If you look long term, you think about curation rewards that you can sell if you want to sell, and you use your stake to get more rewards.

3 days was something that exchanges wanted, and something that JS promised them, i would not want CZ and Binance to be able to have a say on the witness list. with 13 or maybe even 4-5 weeks they will never risk it.

over 30 days power down is a good thing to have if you do a major fuckup. enough to recover your account and not lose a lot of the stake.

we should have a proposal for marketing in short period of time. not sure how is that going, didn't really follow it in the last few weeks. we will see will it get funded and how will it look.

A marketing proposal for LEO Finance?

People just don't want to stake things for long durations. For instance with DeFi apps like Pancake Swap you can mistake and be liquid right away. Or with how DTube has it setup you are essentially always liquid.

The only reason I even say a 3 or 7 day power down is to allow a person to enter an email to notify them of a power down

I think a three-day powerdown period is absolutely too small. Remember what happened when the exchanges powered up STEEM held on them. The pain of not being able to pay users for three months was so intense that it's a deterrence against any of them doing so again.

I think a minimum of four weeks for full powerdown is appropriate. The strongest hands should be in control of the inflation.

Posted Using LeoFinance Beta

Fully agree with this, We are going to see Bitcoin continue to climb as that is the main entry point for most. However from there their eyes get opened to other projects going on and see other great investments or projects they believe in and want to support. From that comes a flood of money into alt coins and that's a clear direction we are heading. Still massive room for growth. I think we could very well see $75,000 bitcoin maybe even $100,000 bitcoin by years end and it's dominance lower around 50% as other projects will gain traction and new startups show up.

Posted Using LeoFinance Beta

Wasn't the dominance of bitcoin around 35% at its peak during the last rull market? That's what I remember anyway. And that would make your assumption very plausible.

Posted Using LeoFinance Beta

I think so, too. BTC dominance dipped quite low around new year when alts were going bonkers.

Posted Using LeoFinance Beta

HIVE being listed on so many external Exchanges (compared to LEO) might also make the price easier to pump during these altcoin seasons... which is sort of what we are seeing right now.

so are you saying hive could be a better investment in the long run ( let's say 3-4 years ) ? I love the bullish sentiment around hive but I can't forget how of the mark were the people predicting $10 per steem at the end of 2018

Posted Using LeoFinance Beta

Really? STEEM did hit $8.59 in early 2018.

Anyone who predicted $10 at the end of 2018 was a noob unaware of how the crypto market cycles work.

Posted Using LeoFinance Beta

ups I meant to say 100 :P

$100 by the end of 2018?

Posted Using LeoFinance Beta

https://steemit.com/steem/@taskmaster4450/steem-incredible-wealth-for-all

Certainly no noob but considering that BTC just crashed, the safe bet would definitely be to predict the crash of altcoins.

Posted Using LeoFinance Beta

Thanks for explaining this stuff so well

Interesting thoughts on dominance and inflactions.

I also think that inflation if used well is not a bad thing but a tool available.

I have many things to learn in this wonderful decentralized world and this post has been an important input for me, so thank you.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @libertycrypto27 for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.