Financial markets are a zero-sum game.

For every winner, there is a loser.

This is just an unfortunate fact.

Hopefully one that crypto mitigates over time.

However, we currently do not live in the future.

It's important to be aware of potential signs of a mega-bubble peak, else we shall be swept away in the FOMO and allow all our gains to fizzle back to the ground floor. (Which honestly wouldn't even be that bad for yours truly, but I digress.)

Flag #1: Bitcoin is x10 above the doubling curve.

Right now everyone is looking to the $100k six-figure unit-bias level. This is almost guaranteed to create a dip, but not signal the top. Rather this will be the ultimate bear trap that tricks fearful investors into selling the local bottom (~$70k) right before the market really pops off.

Seeing as the doubling curve will be $25k around the end of the year, my target has always been $250k Bitcoin. This is where I start aggressively selling everything into more stable assets. I expect that it could go all the way up to $400k pretty easily, but I personally will not allow FOMO to stop my DCA strategy. If the price keeps going up, just keep selling more (slowly over time in 5% chunks).

Most people will fall into the FOMO trap during this phase and keep buying, or even worse go long with margin trades. Never margin trade a volatile market in either direction or the chance of liquidation will skyrocket. Spot trading is more than enough to fully capitalize on a market this risky.

That being said if we do actually get to $400k I will definitely open up at least an x2 short position. There's no possible way Bitcoin is getting to $800k this time around, which is what it would take to liquidate an x2 short position at $400k. IMO that's just free money sitting on the table if BTC gets that high (x16 the doubling curve).

Flag #2: A dozen ETF approvals.

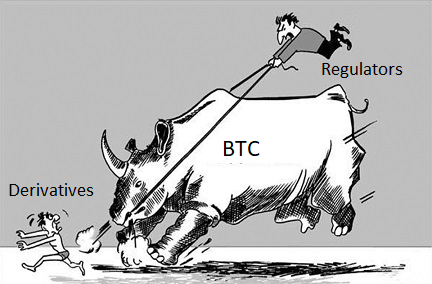

Institutions have been trying to get ETFs approved for YEARS. What a 'coincidence' that they start getting approved right before the mega-bubble cycle. I've been calling out this blatant an obvious manipulation for just as many years. It was so clear that they'd wait to capitalize on such events as much as possible. Well, here we are, and it looks like these futures markets will get approved one after the other, creating massive FOMO and opening faucets to liquidity pools that didn't exist before.

Many who suffered through the 2018 bear market are already crying foul and getting triggered by the CME futures launch in Q4 2017 that seemingly crashed the market. The doomsayers have arrived on the scene early to declare the end before it has even begun. This time around these ETFs will be part of both the pumps and the dumps due to the timing of their arrival. Got here just in time to get that Christmas cash.

The sheer unabashed lies coming from the regulators is quite par for the course. They will always claim to be "protecting investors" and "preventing market manipulation" when they themselves manipulate these markets in the background. A spot market ETF was never approved because of "market manipulation" yet these futures ETFs are getting approved even though they are even more prone to manipulation.

At the end of the day the regulators want a paper asset that they control, which is why they stop the spot BTC ETFs from going live while allowing the futures contracts to flourish. These people are our enemy. The key and ultimate solution to these problems is to avoid using their services and hold crypto secured by our own private keys rather than outsourcing that ownership to these financial slavemasters.

Already we see that Grayscale's version of Bitcoin can't even hold the peg, going from a 30% premium to a 20% discount once the competition rolls in. These futures assets are pegged to bitcoin through delusion, and in my opinion they will eventually implode and those who participated in them will lose everything. Gold and Silver are one thing, but the beast that is Bitcoin will not be contained by these manipulators.

Flag #3: AMM farms will eat up all liquidity.

AMM technology is superior to order books in almost every way in terms of liquidity and depth. The crux becomes allocating inflation to incentivize said liquidity. DEFI tokens are the new and vastly improved ICOs of 2017. We'll know we're near peak FOMO when there is a new token launch every day followed by wild pump and dumps and constant hysteria.

These liquidity honeypots are bound to gobble up BILLIONS dollars due to the infinite liquidity that AMM provides. However, yield farmers are no stranger to impermanent losses and have wised up a bit. Once the 'infinite' liquidity of AMM starts to run out, we'll know we're in trouble.

How does one run out of infinite liquidity?

Ironically LP providers are going to be sick and tired of how many impermanent losses they've taken and a lot of liquidity will get removed from the pools. This is going to jack up yields to the moon because the price keeps going up and LP providers remove the LP tokens and shove all in, pushing prices up higher while simultaneously lowering competition in the pools. That's when you know shit is getting really crazy (easy 100x for some tokens).

This will be the perfect time to hedge our bets and all in the stable-coin LP pools like CUB/BUSD, which will not only be massively hedged against the downside, but also be producing insane yields because FOMO has convinced everyone that's exactly where they don't want to be (this market's never coming down!) When the crash does come we will be perfectly hedged, and while prices are still going up our losses will be minimal at this point due to the insane yields provided.

Flag #4: shitcoins tada moon.

Many new-money millionaires/billionaires will be wondering where they should spend their money. Some will buy a house or flaunt their New Lambo (not recommended) others will be looking to gamble the money and pump it into the microcaps (expect some projects to go x1000 within months).

IMO I think RUNE is guaranteed to go at least x50 during this time, as it is the only game in town. There is no other way to trade assets WITHOUT using inferior pegged tokens like ETH and BSC have (which are very prone to centralized attack vectors). ThorChain is the only way to trade permissionlessly while retaining security of the respective chains it's paired to.

The kicker? All pairs on ThorChain are paired to RUNE. I'll repeat that: every single pair on the only real DEX in the world is going to be paired to the native RUNE token. That means half of all liquidity on the network will be locked as RUNE, which will skyrocket the price at least x50 on the low side and probably higher than that during a mega-bubble materialization. I'm still pretty annoyed with myself that I haven't bought any. It may have gone x20 already but it has a long way to go. Same is true for things like Splinterlands SPS token. x4 is nothing, there's still plenty of time to buy in before shit gets crazy.

Remember failed experiment CakePop? Yeah stuff like that will moon as well. Everyone's going to be looking for the tokens that haven't popped yet and dump millions into them. Security doesn't matter. Dev team doesn't matter. Business model doesn't matter. Everything gonna get pumped because easy come easy go might as well.

Flag #5: The flippenings.

Many assets are going to "unexpectedly" flip their "superiors" during this mega-run. No matter what the maximalists say, ETH can easily flip BTC this time around. They are already nipping at the heels with a simple x2. Once ETH flips BTC in 3 months, all the bandwagon jumpers that only invested in BTC just because it was number #1 (just like in sports) will jump on over to ETH just because of the flip.

This would be a prime red flag that should send our spider senses tingling. If anyone thinks the regulators/bankers are just going to sit on ass while all this is going down, think again. They'll be out for blood looking to short the market and crash it by force. Good thing they approved all those ETFs in advance, amirite?

Ripple's XRP?

Don't be surprised if XRP goes on a tear and gets back into the top 3 coins. XRP is the "bankers coin" and pretty thin liquidity. A pump there signifies maximum greed, and if they happen to win or settle this lawsuit with the SEC they will pump ferociously during the mega-bubble, bringing a ton of outside money into the cryptosphere from all directions.

Hive to x100?

I'm personally targeting a peak of around $5 minimum and $80 maximum for the Hive token. It's a gigantic range because Hive is totally unpredictable and untethered to the market (which is nice). Lot's of resistance in the $5-$10 range. Hopefully we are testing that range next month so we have a better chance of going even higher.

Hive is one of those tokens that I will only turn bearish on if I'm absolutely positive that we will crash so I can personally support the lower levels. For me this isn't financial, it's political. I feel it is my responsibility to support this network to the fullest, and that means selling high so that I actually have the dry powder to buy low when the time comes. Again, it's not about making money. It's about political power on Hive, and I want more. I could care less about the USD value of my stack. I want to control things around here and lead this platform to glory with the rest of the whales. #dreambig

Red Flag #6: FEES!

OMFG THE FEES CRYPO WILL NEVER SCALE!

Expect Bitcoin fees to be around $500-$1000 per transaction this time around. ETH's will be even higher due to the bloat of smart-contracts. It's not going to be pretty, as it will become painfully obvious to all that BTC is a niche asset who's specialty is security for huge transactions. Therefore, who does BTC ironically cater to in the end? The mega-wealthy and custodians like centralized exchanges, corporations, bankers, Wall Street, and the like. It is inevitable.

People don't seem to realize it yet, but Bitcoin exists to protect the billionaire's wealth, and with fees that high it will become painfully obvious that the little guy isn't going to get much benefit out of the OG network unless they submit to the rule of the custodians.

This is fine considering the hypocrisy we've seen in their community for the last decade. Maximalists are insufferable hipocrits, constantly talking about decentralization while hailing Bitcoin as the only solution. These people are greedy and toxic, and they remind us everyday of that fact. I can't wait to watch them melt down as they get flipped by other networks during the times in which security and censorship resistance are not a high priority (aka times of prosperity where we are not being attacked by the legacy system).

Crypto is about community, and it would be foolhardy to believe that one token would absorb the entire world in some kind of globalist utopia (Ironically claiming this to be "decentralized"). Balkanization is coming for not only currency, but government itself. Let decentralization reign supreme. Let the free market decide. Libertarians and anarchists unite!

Red Flag #7: Where'd all the doomsayers go?

All the bears will be turned into bulls and those that don't fall into the black hole of FOMO will be completely drowned out. Discord will be filled with noobs constantly asking noob questions (count me out). Hive will be filled once again with kiss-ass fake politeness because that's how you beg for upvotes apparently. 2017 was pretty insufferable in this regard.

All of the bears that remain will be fully ignored. That's when you know you should turn bearish with them: when no one is listening, the price can never come down (or at least not as much as last time), and the noise and hysterics are so intense we won't be able to hear ourselves think.

Red Flag #8: Hacker's paradise.

Do you have $1M on an exchange? Oops, hackers stole it all! Better luck next time, scrub! FDIC insurance? lol no, GTFO.

The honeypot created by a mega-bubble is going to turn every exchange and institutional custodian into the world's biggest hacker target by x1000. I'm expecting Mt GOX levels of hacking to occur, and a huge hack might be the straw the broke the camel's back and usher in the year long crypto winter. This is annoying because it could happen at any time, and it could be an inside job or even the military industrial complex / CIA / NSA that does it. We'll have no way of knowing but at least I'll have plenty of conspiracy theory posts to write.

Red Flag #9: scaling failure.

This one is intrinsically connected to high fees. Most chains will grind to a halt (including Hive). We will be stress testing our RC system for the first time ever in the field, and there will be bugs. On top of this, Hive node operators will not be able to handle on-demand bandwidth. Scaling takes time, and node operators will not allocate resources to scaling up until forced by legitimate demand.

I also believe that the way Hive works is a bit incorrect and is more in line with WEB2 than WEB3 at the moment. WEB2 is all about free service and monetizing data. In WEB3, it makes a lot more sense that users would have to pay for their resource consumption (micro charges).

This is where RCs come into play, but the RC system does not apply to our API and individual nodes being overloaded with database requests. It would be foolish to think Hive wouldn't crash when we could barely manage that big pump in usage from Splinterlands adoption.

Of course networks like BTC and ETH will be absolutely destroyed by the scaling limitations and lots of people are going to ragequit and complain that it cost them $200 for a failed transaction that didn't even work, and then complain again that this failed transaction resulted in the liquidation of their margin position and they lost another $20k on top of that. It's going to get very ugly, and Hive will actually be in a good spot comparatively. In fact it might be this very thing that "moons" Hive x100. I put "moons" in quotes there because we still won't even be in the top ten.

Red Flag #10: Friends and family all ask the same questions.

Do you still have crypto?

What crypto should I buy?

How do I do XYZ?

When will Doge make me a millionaire?

Wen moon?

Of course the answer you should give them is that every time someone new asks you sell even more. By the time the rabble is interested in buying it is already way too late. You didn't want to buy at $10k but now you are talking my ear off at $50k? Typical. When should you buy? How about last year when I told you to? Jackass!

Conclusion

So what do you think? Do you think we are at the peak of this bubble? LOL... it's a laughable notion at this point when we look at the evidence. All the signs point to an epic Q4 followed by perhaps one of the most epic financial disasters of all time in 2022.

What has happened before will happen again. Even the most world renowned analysts are going to get blindsided, just like they always do. There's a sucker born every minute, and most people tend to not learn from their past mistakes. Don't let the FOMO consume you... or else!

Don't be that person. Do not enter and exit this market 100% like a compulsive maniac. Dollar cost average. Reduce volatility. Hedge your bets. In a market filled with this much risk and reward this is the only respectable strategy that will keep us sane in the long run. When you get the urge to sell/buy everything, sell/buy 5% instead . You can thank yourself later. I have not regretted this strategy 100% of the time so far.

We haven't even come close to seeing a mega-bubble materialize yet. Guess what? That's the entire point. People can feel it coming but they are already getting ready to jump ship before number go up. It's weird because the timing couldn't be more obvious. Just wait till the end of the year and refactor then. We've been waiting for this for FOUR GODDAMN YEARS. Getting cold feet now would be disastrous, not only for our bankroll but also our mental health. Only three months to go. Hang in there.

Posted Using LeoFinance Beta

What did you smoke, I want that too!

haha :D

Posted Using LeoFinance Beta

^^

Lol I don't smoke but sign me up for this one

Probably only the best stuff!

Posted Using LeoFinance Beta

You have been SO right about everything thus far. I will forget about the BTC short that just went wrong. It is crazy to think how much things have escalated to this point... and the hype is nowhere near 2017 December levels yet. I remember there being front page covers on the newspapers (front, inside front, back, outside back) advertising BTC exchanges. All of these old rich dudes on facebook were bragging about making their first BTC purchase (at $18K)... we are not there yet. But, this is a good reminder, as the FOMO is contagious and it is easy to get swept up in the hype... then you wake up holding your bag of steem at 20 cents wondering what happened. Not this time...

I've been away from the scene so long I didn't even know people were still FOMOing and selling and buying and being scared and all that bull.

There's so much to anticipate and it's thick in the air. Why bitch out now???

Loved the post though. Forgive the ass-kissing.

Posted Using LeoFinance Beta

ah The good old days. These days people just pretty much demand upvotes..lol

When I hear some crazy figures you throw out like BTC at $400k sometime in the future it lets my imagination run wild. Even if it doesn't happen anytime soon, I wonder what the cap would eventually be when the really mega, mega bubble arrives

Well...I am just trying to figure out the major catalysts to drive retail into BTC. I can't really find anything besides the ETF approval.

Posted Using LeoFinance Beta

On the long run I wouldn't consider $100 HIVE to be unlikely a all. I agree with many of the prediction you are making. Not everything we are looking at is a base layer of HIVE. There will have to be some form of fee structures to maintain many of these. Ads like the ones we are seeing on https://leofinance.io won't be out of question either.

It will be very interesting to see what kind of reaction we would get from microblogging platforms like @dbuzz which I am a big fan of.

!PIZZA

Posted Using LeoFinance Beta

11th red flag. El Salvador thinking they are a first world country.

Posted using Dapplr

First of all, nice pictures, do you make them yourself?

The bear trap is really scary, I don’t know when to take profit, that’s the reason I choose coins that I can stake. So I can sell off my stake rewards.

If you sell a small percentage on all big run ups and keep track of the transactions, you can always buy back the dips that inevitably follow the run ups. It is the big moves that can kill.

Like 5% for every top?

something like that. if it keeps going up... you only lose out on 5 %, if it dips back... you can buy more... it should even out long run and as you near the top once you are happy with the gains and are starting to feel weary of the actual top... stop buying back on dips.

Posted Using LeoFinance Beta

That’s a good plan

I will be stabilizing the price with you! HBD is perfect for this, as we can shove it as dry powder into the savings account!

Wow that was a huge dose of feeling good crypto man.

Whenever doubts start to come to my mind, I'll read this one :D

Hey RUNE still cheap at 8, what are you waiting for...

Posted Using LeoFinance Beta

I'm just commenting to kiss your butt for some sweet sweet Leo tokens! Just kidding. Or am I? But seriously, $250k sounds just right. You're the first person I've seen call for $400k top?! Previously the highest I've seen for this cycle is $300k. And I miss John McAfee's glorious predictions.

Posted Using LeoFinance Beta

Wow that was a seriously bullish piece. Thanks, informative and funny 50% 50%

!PIZZA

!BEER

Posted Using LeoFinance Beta

PIZZA Holders sent $PIZZA tips in this post's comments:

eirik tipped edicted (x1)

renovatio tipped edicted (x1)

@vimukthi(2/10) tipped @edicted (x1)

Learn more at https://hive.pizza.

Also... RUNE. Buy RUNE. Lot's of RUNE. Rune is likely going to play an integral role in the bull run, and potentially be the cause of the termination of said run. But before that happens... as you said... 50X

Posted Using LeoFinance Beta

We have chosen to support your post because you are one of the good promoters of Hive on Twitter based on our Hive Twitter Daily Report.

We appreciate your time and enthusiasm for promoting Hive!

Good tips, I switched to Stables a long time ago it was a safe bet and I stopped doing other forms. It doesn't make as much but it is better

Posted Using LeoFinance Beta

So If you sell in 5 percent chucks you ride the risk while still banking some of the profits along the way.

Wen moon tho?

Posted Using LeoFinance Beta

Could not have put it in this format and could not have provided that much background, but this is pretty much what I have been saying.

I am not that certain about the timeframe, though: I would not be surprised if things pump until deep into 2022, before we enter a bear market.

I agree also on the unpredictability of HIVE, but only see it in the 3-8$ range this time around.

great summary and post, you nailed it :)

man, i love your posts it's so good see people with good opinions about the criptos

so far different, when we see people on twitter say things that they never studied

Posted Using LeoFinance Beta

!PIZZA

Posted Using LeoFinance Beta

Great Post. But as you said: Hang in there and wait.

Fantastic advice

Posted using LeoFinance Mobile

besides the buy-sell bets, I think about a blockchain game with price bets. would be so funny IMO.

A real wallstreet casino :D Maybe with custom bets. That would make things even funnier :P

I think to take profit and reduce positions with higher prices is not that bad.

Posted Using LeoFinance Beta

This guy just keeps speaking raw shits :)

The best stables assest to invest before the crypto bubble burst are... looking for some ideas my hiveans brothers

Posted using Dapplr

HBD

Semangat