Alright so this market is heating up something fierce. I watched as volume shot through the roof as the price crashed, losing all the gains we made from the last flag up. I watched as the gap between buyers and sellers was spiking up to $50-$100. For me, this signals an extremely significant chance that the top has blown off this volcano.

How should I trade this?

Simple, if you're not worried about tax events (it is January, after all) then sell a bunch of Bitcoin into stable-coins and see what happens over the next 24-48 hours. This market has been put to the test for three months, and the strong-handed investors who have been propping up the market might finally realize that the market is bubbled and not worth buying for a while.

The chance of there being another spike up within the next couple days is pretty slim. Usually (especially now) the market flags up and then waits a week to see what happens before committing to another pump up... Well we just had that pump within 24 hours, so I wouldn't expect another possible flag up for at least 5 or 6 days (unless this current run isn't over yet). This is especially true after the insane volatility and dumping we just got.

I'm basically going to do what I did before... sell at all time highs or near it, hope the market crashes, but if it doesn't... simply buy back in with stop-losses or when market volatility lowers 3 or 4 days later.

For example

We can easily sell here at $32,225 with a stop-loss to buy back in at $33,500. If we lose that bet, we only miss out on a 3.9% gain. However, if we win the bet, we could earn as much as 20% in the event of a flash crash.

Flash crash scenario

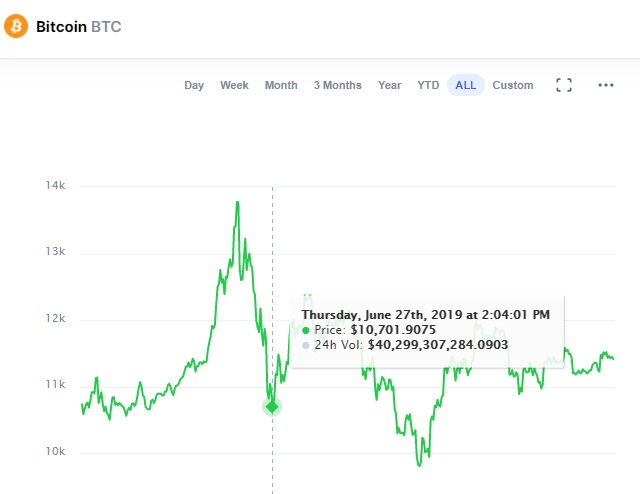

This is what happened in summer 2019, and it very well could be replaying this very second. The market peaked at $13.8k on June 26th. It flash-crashed to $12.6k, but then made a quick recovery in the same day back up to $13.3k.

Sound familiar? Because this kind of action is literally exactly what we just saw with Bitcoin. We flagged up to $33.3k, flash-crashed to $30.2k, and are now in that recovery mode back up to $32.3k. This market has become volatile and unstable, and we are on the third flag up, exactly where you would expect a peak to be, during exactly the right time.

If I'm right, there should be an epic flash crash over the next 24-48 hours. A lot of people will panic sell there, but not me... I'm going to buy and ride the dead cat bounce back up like a boss.

Conclusion

I hope I'm right... I do not recommend this trading strategy to anyone... I'm going full ham right now and I'm probably going to get wrecked... everyone loves pointing and laughing at my trading history so it's all good.

Posted Using LeoFinance Beta

Good luck.. but it seems like you know what you're doing

Posted Using LeoFinance Beta

I think your confidence is misplaced :D

Confidence is easy when it's someone else's money..

Posted Using LeoFinance Beta

Yeah right, the bull run has just begun! OMG did u sell your bitcoin? haha 😂 lol Whuhahaha Pamp eeet

It looks risky but it's a good strategy. You can play with the stop-loss option as well so, let's say you put a stop-loss at 31K, selling BTC at that stage. If BTC keeps rising then you rise as well your stop-loss and so on...

oh right I forgot to talk about the stop-loss to the down side... I'm posting mine aggressively to the upside.

Haha aggressive stop loss, huh? Well better than me. I set a limit sell at 30k usd yesterday and well.. we see how that turned out.

Maybe you and I are going headlong into the 🐻 trap. 🌈🐻s that we are. Jk (short term at least)

I swear I didnt get exactly what is your strategy :)

He sold, that's his brilliant strategy! haha we'll see! I don't want no crap stable coins he's on his own! Dip already happened.

because that's what you do during a possible x20 mega-bubble year right? Sell at x3 :D

Well by now I guess the more experianced know that its never a good idea to sell or buy at once. You sell only a fraction. Dollar cost average selling and buying ..... bit boring but safe

The sky is falling... sell here :D

looks like it's still mewning to me!!

Yep that's what they all say until it flash-crashes 20%.

It just did a mini flashcrash, I bought more on 5x and flipped it already. Made more real btc ! yeah I buying this dip!!! We’ll seee! 😎 😳

January during the bull market has always been a batshit and volatile time.

Lot's of crazy opportunities to swing/day trade.

Yeah, I’ve been swinging them, thanks! 🤙

Bought the dip at 31.6k. If it goes up, I'm good. If it goes down, I get a better price to buy more. While gambling sounds exciting, haven't really lost anything but a little patience with the only accumulate strategy.

Also as someone who witnessed nothing but short squeezes last year to demolish my short bets in the traditional markets, I'm not standing in front of a frothy bull, the downside isn't worth the upside.

During the mega-bubble year... nothing could be closer to the truth.

I'll never learn. Go on without me.

Again I agree. Closed my longs with a nice profit. I don't have enough balls to sell, willing to take the dip and wait it out (opening longs at the bottom hopefully)

We're talking about $30k Bitcoin like it ain't nothing. Good times man, good times 😄

Also, stop.losses scare the shit out of me. Always feels like I'm gambling

Posted Using LeoFinance Beta

This is a stupid bet. But I imagine if it 'crashes' 10% ~ 20% the people who thought 20k+ was ridiculous will be like 25k is the new awesome.

The only rational strategy is to buy when you can afford it and HODL.

Anyone who was around and didn't figure this out during 2018 deserves their fate.

If I had to guess, below 50k is the bargain of the decade.

You can imagine how it's somewhat comical that a guy with the tag @abitcoinskeptic would imply that Bitcoin is now more than doubling in value every year, because doubling in value on average isn't fast enough.

I like to gamble, and one of these days I'm going to stop losing my money boy howdy :D

Shorting BTC is riskier than shorting APPL or TSLA, especially if you go for the 10X leverage on Binance or whatever.

I keep hearing things like if it gets to 100k the SEC will start to regulate it, especially for retail investors, but I can't really see that even hurting the price. Besides 100k would be nice, lol.

I like to keep gambling and speculating separate.

I think altcoinskeptic would be a better name, but it's not as clever.

What's your take on the USDT printing situation and Tether SEC case?

So as to not succumb to cultish optimism, I do peruse a bit of the activity of skeptics like /r/buttcoins and they seem to think much of the volume is being propped up by unbacked tethers being printed.

I do believe the situation is a bit tenuous so I am considering a stop loss to buy back if we do see a flash crash scenario. Ofc timing the market is exceedingly difficult and with my luck I will miss the window should it occur.

I've had mixed luck with little slivers here and there but not sure how much of my stack I am willing to gamble.🤔

People who accuse BitFinex of printing USDT out of thin air and dumping the market with it don't understand basic liquidity. If you do that... the value of Tether loses it's peg. We see the opposite in the bull markets... Tether starts trading higher than a dollar because they aren't printing enough and getting them out to all the exchanges that need it.

Like, seriously though... Bitfinex is going to buy Bitcoin at the peak and then eat the losses when it crashes and lose money? It's an idiotic conspiracy theory. And even if they are doing that, who gives a shit? As long as they maintain the peg it doesn't matter how much USD they have in the bank.

Does the Federal Reserve need to back the money they print out of thin air with another asset? Nope. It's a simple matter of trust. Do you trust the issuer of the stable coin to buy back the token when the value drops, or not? That's it... and they probably only need 20% collateral to accomplish that.

Think about it this way: Is Bitfinex really obligated to maintain the peg? Let's say Tether drops to 50 cents a coin and people are like wtf buy back the token with USD to maintain the peg and they just say "no" even though they have the money to do it. What then? It doesn't really matter if they have money in the bank or not.

I'm not trying to rant here but this conspiracy theory is being founded on the idea that Bitfinex is buying high and selling low but also somehow turning a profit from these actions even though all the market prices point to the opposite conclusion... it's ridiculous.

Posted Using LeoFinance Beta

100 TETHER = 94.81 :o

Nope, Tether is doing fine.

Which exchange is that? Bittrex?

You know which exchange prints Tether, right?

Show me the price of Tether on Bitfinex.

Nope, it was actually Binance.. I don't know why but the last two days the balance is showing different numbers.. Right now is okay, but..

When there is crazy high volume and users on not-Bitfinex are dumping Tether, it is very hard for Bitfinex to maintain the peg during massive dumps on other platforms.

Makes sense! I'm very much interested to see how things play out the 15th... (Or I suppose sooner if there is a dump.)

Thanks for slapping the 🐻 out of me w this thoughtful reply.

I live to serve :D

I could take a flash crash on Monday. I really would as I will come into some cash then. Not before, though. So, market participants, please remain calm tomorrow.

Posted Using LeoFinance Beta

Your strategy makes a lot of sense.

Good luck riding the waves!

Posted Using LeoFinance Beta

Give me a price near the 10k and I will buy in for the long term. But I don't think it will retrace so much if it goes under 20k I think it would be a wonder with all the big companies that are IN and other ones waiting to enter the market.

Posted Using LeoFinance Beta

Man this post is making me sweaty...

I'm on the same page as you but running this just a bit further until I get to my limit...so far so good

What stable coin could you suggest and why you prefer one more than another?

Have a !BEER 🍻 and a huge hug, dear @edicted! 🤗

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @amico for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.$33.3k? LOL

Reminds me when BTC moved up to 333 billion market cap ATH, 3333 days after the Satoshi whitepaper.

Posted Using LeoFinance Beta

It's true buddy, if there's a drop you have to keep it up, don't panic, the gains in crypto are long term and what's predicted is that by mid-year the Bitcoin will continue to increase.

I don't think stop loss strategy work because there will be stop loss hunt from the both side.Its Better to stay away from this

Yeah but then no one would laugh when I crash and burn.

People love that shit.

Lol, I know you aren't the type that panics, and I think you know how this thing goes as you have rightly analyzed it and even compared the strategy with the recent bitcoin bull and bear.

Well, if I am to say anything, I would say I want to be like you when I grow up😅😂

Posted Using LeoFinance Beta

It’s not a bad call. It’s extremely over bought and needs to cool off. But yeah it could just sit and consolidate then blast off again... so me, I am just still doing my daily dollar cost average, lol. Not selling any sats anytime soon!

Posted Using LeoFinance Beta

Bookmarked for reread, still digesting it.

Posted Using LeoFinance Beta