Circling back to 21M

Yes, it's become a cliché and complete parody of itself, but the facts are facts. Somehow it seemed appropriate to discuss this topic after watching that Gamestop GME short squeeze documentary. During peak GME fomo when price was peaking at the absolute top within a matter of days there were a lot of degenerates going full delusional; spinning stories that GME stock was going to "eat the world" and blackhole all the world's value into a single security.

Sound familiar?

It should because that's the exact same story that Bitcoin maximalists spin on the daily. Of course with Bitcoin the principal is a lot more sound than with some random security. A security can be printed out of thin air and dumped on the holders of that security under several different premises. These rules are part of the foundation for why the Securities Exchange Commission exists in the first place. Securities are assets that are centrally controlled by the company that issues them.

Yes, it is true that if you own a bunch of a company's stock you can vote at board meetings and decide what the company does and does not do, but how many people that own stock actually exercise their shares in this way? I gonna go ahead and say less than 1%. I've personally never met anyone who's talked about voting with their stake (except on DPOS and DAO crypto platforms). When it comes to securities only the big boys do it, and even extremely wealthy people are more than happy to delegate that responsibility to an intermediary like Blackrock or Fidelity. Hell, delegations are quite popular on Hive as well. There's a reason why we have them; it's a needed function of stake-based voting.

But with regard to gobbling up the world's lunch, it's not possible for a security to do such a thing even if the current shareholders did everything in their power to make that happen. Imagine if it was even possible. The establishment would just shut it down from the outside. Regulators win. Degens lose. Common theme.

With Bitcoin though... it can't be printed out of thin air... and it can't be shut down. So the idea that Bitcoin could gobble up everyone's lunch is at least possible even if it doesn't make sense in theory or practice. In fact it's against the entire ethos of decentralization in the first place. Imagine getting into this tech to disintermediate power only to find yourself championing the thing to consolidate all the power (for yourself). New boss same as the old boss vibes; quite embarrassing really.

Jesus Christ

Just saw this little gem on X. The market has really allowed MSTR to scoop up 2.5% of the world's supply of Bitcoin. Mindblowing. That figure doesn't even factor in how many coins are lost or will otherwise never be spent again. So bump it up a little to something like 3%. Of course a lot of people point out that the price does not reflect how much these institutions claim to be buying, so the speculation is that MSTR doesn't actually have this much BTC and sooner or later the paper Bitcoin ponzi will collapse and everyone will realize that these institutions don't really have any coins at all.

While this would be in line with what's happened in previous cycles I'm hesitant to assume BTC is going to bankrupt every single institution that adopts it because they are all lying about how much they own (by proxy or otherwise). This isn't some Podunk FTX situation we are talking about here. Coinbase has been around for multiple cycles. Banks are independently setting up custodial services. Institutions may try to rehypothecate some Bitcoin at some time but it's pretty presumptuous to assume we are already in full blown scam mode.

In fact the only reason why that narrative is given any weight whatsoever because, "QQ my bags aren't going up these whales must be cheating the system." If number was going up no one parabolically no one would believe that these purchases were paper in name only.

And why wouldn't number be going up?

Because paper hands are selling and shorting at one of the dumbest times ever. Of course it doesn't seem like the dumbest time ever now, but it will in retrospect. The economy looks bad. It's a risk off environment. It's so risk off that institutions all around the world are dumping the safest investments in the business and jacking up bond yields. Banks are getting squeezed from all sides and they have zero reserves. Inflation is bad, blah blah blah etc etc.

Everyone is bearish and also everyone cries about market manipulation pushing the price down. Pick a lane; you can't have both. There is no manipulation. A lot of people are selling here... selling their hard-earned coins to institutions at a discount in the most paper-handed fashion of the century. After all that toiling and hodling this is how it ends. Crazy.

It's more obvious than ever that something big is going to break in the economy, and when it does money printer will go brrr something fierce. My guess is a banking collapse but that's a pretty lazy guess with little research behind it. Europe seems pretty cooked, and I expect something pretty messed up will happen there that sends shockwaves with everyone scrambling to stem the bleeding.

Why I don't mess with ETH anymore

For one the ETH foundation simply controls too much of the network, but the main reason is that ETH is not a secure chain. Or rather it is a secure chain but it doesn't matter because you can't actually read or interpret the contracts to know what they are doing. Having a hardware wallet is worthless if when you go to sign it just displays gibberish to the screen and you hit the send button.

This was most recently revealed with North Korea stole all that ETH in the biggest hack of all time. Even the top players in the industry just see a random hash of a transaction and go "looks good I guess I'll approve it". lol. What a terrible way to do it. Even the way Hive does it is better because users can at least read the JSON code if the operation might be risky or high value.

Conclusion

It's a bit redundant for a sophisticated audience such as mine, but Bitcoin really is better than every stock out there simply for the fact that it's a highly secure network in which no one can cheat or print more. As cringe as it is to see maximalists high five each other while parroting the same boring narratives like "21M" and "1 BTC = 1 BTC" there is still some truth to it.

At the end of the day it isn't the spot price of Bitcoin that matters, it's the cost to actually use the network, and right now even at $85k it costs less than 50 cents to move an unlimited amount of BTC from one wallet to another. So while it is annoying to see so many new custodians and institutions pop up to offer their services to unsuspecting plebs... they undeniably are making it easier for the real users to use the real chain. The only question is how much underlying risk are we adding to the next bear market... but even then it would be fun to watch these big institutions go bankrupt for pulling the same stupid moves as FTX and friends. Food for thought.

State retirement funds voting their stocks is how they got corporations to adopt 'drug free workplaces' back in the 80's.

Btc and eth both suffer the same logistics nightmare, when folks start really using it fees go up.

What prevents BlackRock, that has a controlling interest in ~90% of stock corporations of the world, including those that own the cables, radio transmitters, and satellites that enable global communications, from refusing to transmit any BTC transactions?

I submit that is the only mode.

I can only assume you mean other than me.

Is there some means I am not aware of that prevents miners from stepping on transactions now? I confess I haven't been attentive and sure could have missed some regulatory or other method of compelling transactions to be included in blocks. I recall back in 2017 transaction costs hitting ~25%. Is that not entirely at the sole option of block producers to this day?

Thanks!

Do I need to hold your hand and explain the definition of every word/term I use in my blog? Nah. You're so bonified right now.

I am getting more bonified daily, as the season progresses. I stick ladders in places worms can't wriggle and have to do pullups just to get up and down. Problem solving is only as fun as it is challenging. My nuclear winter survival kit (also known as the cooler I keep my 6 pack in) is rapidly being consumed by the effort to keep it above ground.

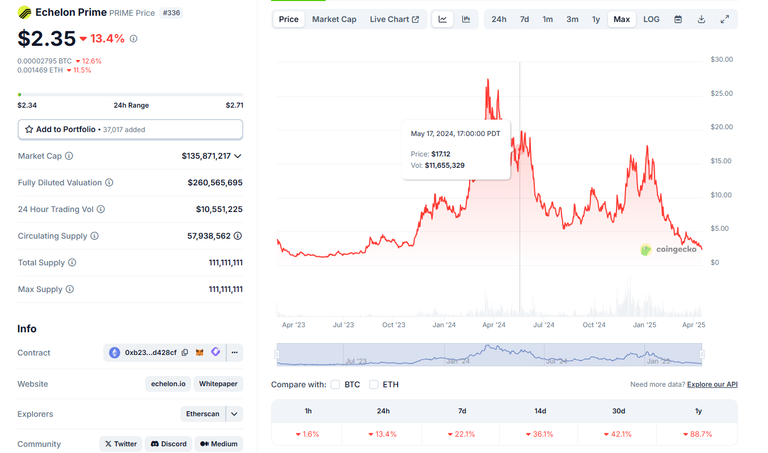

BTC is holding up quite well, the altcoins are in the dumpster right now, especially Gaming category, for example the recently hyped up Gaming / AI coin PRIME is looking like it has completed a full bull market to bear cycle:

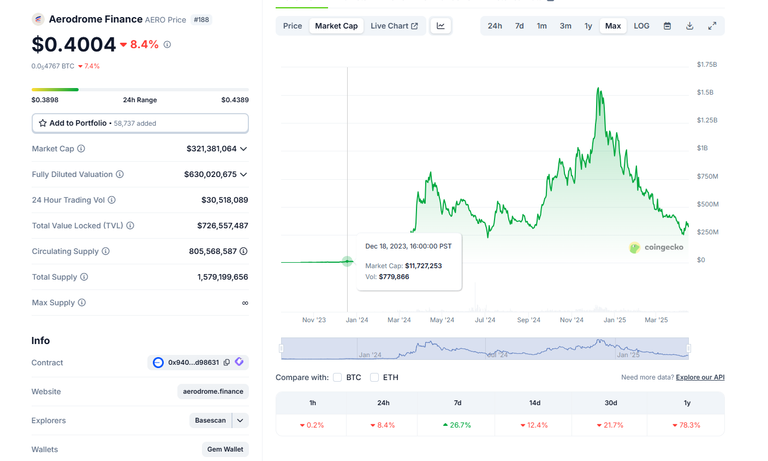

Coinbase Base chain proxy AERO had its recent market cap of over 1.5 Billion dollars cut down to quarter billion these look like we had a bull market and now in bear market:

These two charts in particular are almost a copy of the classic:

Like we are somewhere between Panic and Anger stages...

alts have been experiencing quite a bit of panic lately

sentiment shifts with the wind in crypto though

we could be at panic today and trill tomorrow

Litecoin, Cardano, BNB, etc. all have maximum supplies too, but Bitcoin has first mover advantage, as well as the most hash power. Some people argue that makes Bitcoin the most secure cryptocurrency, while others say it has a flawed security model. I may be wrong, but I think it's 1.7 trillion dollar valuation has distracted many people from noticing its flaws.

At the end of the day, cryptocurrencies are like religions and the strongest ones will keep growing, especially during the bull-runs. Those that eat the world will be censorship-resistant, have predictable supply curves, innovate, and above all build resilient communities.

There's still plenty of world for them to eat.

There is no first move advantage.

If anything it's a disadvantage.

Look at all the people who won't get into Bitcoin because it's "too expensive" or "low tech".

Look at Myspace and Netscape; did they have a first move advantage? Nah. Crushed.

ADA and BNB can't even be on that list because they aren't mined.

BNB is more of a stock 2.0 coin... well at least before the EVM network came into play.

LTC is a decent example though.

It's a great example of how people do not respect POW technology or understand the value or usecase.

They'd rather jump into some new thing that promises the world and never delivers.

The rewards earned on this comment will go directly to the people( @uwelang ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Your path to Bitcoin Maximalism seems completed. Will you bend the knee to the Maxi's in your next post? 😉😆

Nah I still need to sell all my shitcoins take some ice baths embrace god and go on an all meat diet.

This is the way. Make sure to remove Defi and yield from your dictionary. LOL 😂

So basically, just keep buying BTC. Got it!

couldn't... hurt?

I actually think it's a good time to rotate into alts right now from bitcoin but that's well beyond the scope of this topic

I've been seeing some hype about ALGO again. I still have a stack from the first time I bought. I have a feeling it's just baseless hype though.

I think that with bitcoin, scarcity is the biggest plus, which is not the case with altcoins. This is why my major % is in BTC for now.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 198000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPWell stated edicted, I've been around a long time and I have seen the shift from:

"F the man, we can p2p our currency!"

to

"Oh yeah!! Comex is picking up Bitcoin"

to

"Come on Banks and Countries, use Bitcoin"

I'm like... uhhhh wasn't it the point that we didn't have all of this... you don't NEED any of it... it was supposed to be independent, where the people put the value on the coin, due to its utility... rather than the people being told how much their currency is worth...

But oh well... we shall see :)

the price of bitcoin might go down or rise but at the end of the day it has been consistently being on the top