Hello dear friends of the hive

Today I come to share with you my experience in using the Netback methodology to establish the sales rates of a product, I hope you like it.

Restructuring of Sales Tariffs using NetBack

Netback is a methodology that allows establishing profit margins and rates from the market price of a product, this is done by adjusting each production cost and profit margin involved in the manufacture and sale of the product or service, as its name refers, it starts from the last phase of the process and goes backwards until reaching the initial phase.

Netback can be used to establish business and reach an agreement on the rates of a product through sales contracts, but this has a set of implications that must be considered at the time of implementation and determine the feasibility of its possible use.

Each link or point that a product must pass through to reach its final customer and that goes from obtaining the raw material to its sale or delivery to the customer establishes costs and profit levels associated with the activity that is executed, in the case of transportation and marketing FEE (rates or interest) are established, the sum of the costs of all these activities are those that define the price of the product or service.

However, there is a set of products and services that are regulated by contracts or sales commitments that are affected to a greater extent than others by the effects of price variation in the market.

Let's do an exercise using the cost structure of gas in LNG whose sales destination would be Japan (the values used are not real).

One million BTU is abbreviated MMBTU.

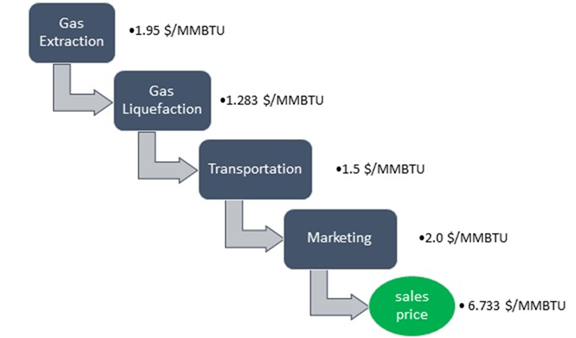

Let's assume the following costs with their profit margins:

Cost of Gas Extraction is 1.5 dollar per MMBTU + 30 % Profit = 1.95 dollar per MMBTU.

Gas Liquefaction Cost is 0.95 dollar per MMBTU + 35 % Profit = 1.283 dollar per MMBTU.

Transportation FEE from the liquefaction plant to the port of Japan = 1.5 dollar per MMBTU.

Marketing FEE = $2 per MMBTU.

The sales price to customers would be USD 6,733 per MMBTU and through this scheme the base price is established in some contracts. But what happens when there is a drop in gas prices due to some effect in the markets?

If in the clauses of the contracts it was established that the price adjustment mechanism is by means of NetBack, there is a backward adjustment of the chain, starting with the commercialization until the gas is extracted.

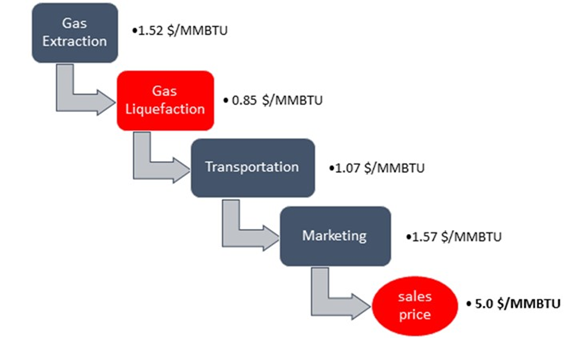

Let us assume that the price of gas goes from $6.733 to $5.0 per MMBTU, the difference is $1.733.

Each of the elements that make up the production and marketing chain would have to proportionally adjust their revenues and reduce their costs in order to meet the new selling price. It would be assumed that the difference of $1,733 would be divided by the number of links (4), with each link reducing its earnings by $0.433.

Turning to:

The problem that arises is that the liquefaction stage would be at a loss since its production costs are $0.95 per MMBTU, resulting in a loss of $0.10 per MMBTU. Therefore, a mechanism must be established whereby lower prices do not affect any element of the product phase.

What is stipulated is that each link establishes the minimum margin of income for which it can work and that the greatest impact is absorbed by the marketing stage, which is at the end of the chain and continues adjusting backwards until it reaches the initial stage.

Congratulations @edmarr! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: