Dollar-cost averaging is a strategy for investing that consists in buying periodically the same amount of money of stock, despite the changes in price. After many periods of time the investor is going to pay the average price per stock which will be below the present price, if stock prices always increase despite variability the investor is supposed to get a higher return compared to buying the lump sum from the beginning. This is supposed to lower the risk of entering the market during an inconvenient price and risk is not assumed all at once from the beginning of the investment.

(Hayley 2010) compares DCA to a equal stock strategy that purchases the same amount of stock at each of the time periods to explain a behavioral bias when preferring DCA. (Constantinides 1979) was one of the first authors in the literature to disprove DCA and (Statman 1995) talks about the cognitive biases that drive the preference for DCA.

Here I compare two strategies: DCA vs Lump sum.

If you take the lump sum strategy and spend all your money b_T at the beginning of the experiment you buy the following amount of shares, at the initial price .

In this setting the return is simply the final price divided by the initial price.

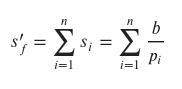

If you spend the same amount, 𝑏 in each time period to buy shares at the end of the experiment, you are going to accumulate 𝑠′𝑓 shares:

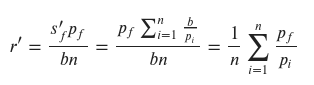

The return for the DCA is the value of the stock bought by the end of the experiment divided by the total money spent to buy it:

This is the average return of all the possible lump sum strategies at each periods from beginning of the experiment to the end of the experiment.

𝑝𝑓 and all 𝑝𝑖 values are not known at the beginning of the experiment. If the price is a random walk process then both strategies should render the same return of zero. However markets have positive return in the long term (according to the data available so far) and comparing both strategies is subject to the asset to be bought and its behaviour. You can find many complex analyses in the literature that usually put DCA as an inferior strategy. This time I want to compare these two strategies just by backtesting on random investment experiments along on Ethereum and Hive. Simulations allow to test these ideas without entering into complex mathematics and statistics and give a good example of application of these ideas in the real world.

Simulations

To backtest DCA returns in comparison with Lump-sum (LS) we make the following simulations using Ethereum daily price data from Coingecko.

Lump sum strategy

DCA

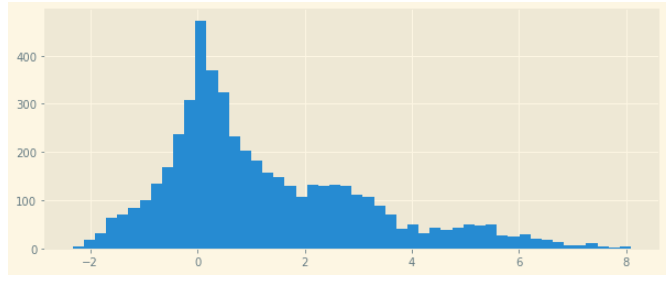

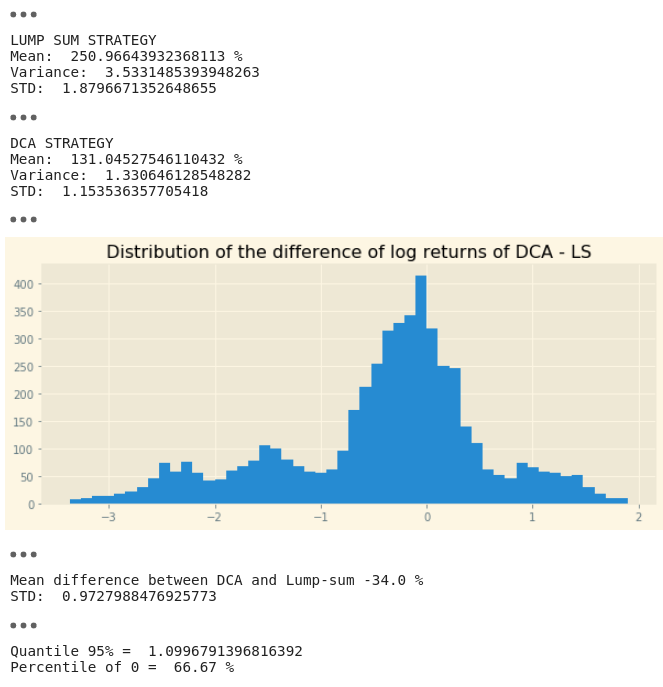

Results for simulation over ETH price data

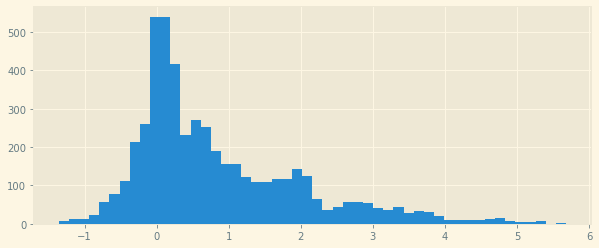

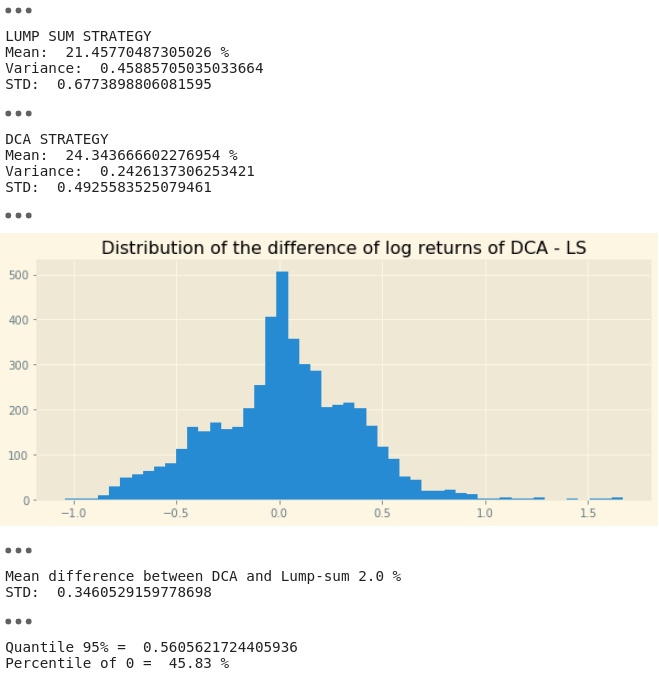

Results for Hive

Conclusion

The simulations over ETH price data show that in average DCA gets a return 34% smaller than LS. Furthermore, the distribution of the simulated returns include the 0 in a one sided 95% of the distribution interval (analog to a bayesian posterior distribution). This can be interpreted as a lack of evidence that LS is often (more than 95% of the times) superior to DCA. However, 66.7% of the times LS was better than DCA for this asset.

These results depend completely on the date ranges and the asset selected for the simulation. Since we are analyzing prices since early life of the asset, returns tend to be large, specially in crypto which has large volatility and large growth compared to other assets like stocks.

Results for Hive show a different outcome. Since Hive is a fork of Steem, we have about 1 year of data and it's price has not been growing in the same way ETH has. Hive did not went through the same early growth periods because it wasn't born as a new asset but as a Steem clone. The results for Hive show a better return rate for DCA strategy at a lower risk. This sounds great for the mathematical pseudo-rational investor. However, when you look at the difference in the returns between both strategies, DCA beats LS by only an average of 2% (this doesn't sound very good) and if Hive is going to grow largely in the coming years, we may see in the long term that LS may beat DCA similar to the ETH outcomes.

There is plenty of evidence showing DCA inferiority. However, we found that DCA shows high returns and lower risk in the case of Hive, which sounds quite promising. In the long term this may revert but for those that applied DCA in Hive, congratulations. Of course, you could make many more times that by investing early on high value/infrastructure projects like ETH. I don't think Hive is a low value project, though but it's inflationary and limited use (originally only for text content, however this may change with things like SMT and Hive engine and other proposals) make it much less flexible than infrastructure projects like ETH.

A very reasonable justification for DCA is that most people don't have $100,000 in their pockets right now to invest. But I wouldn't use a constant buy amount like vanilla DCA strategy. There are many other ways to automate investing such as grid bots or using signals like RSA. There is always large risks associated with it and winter seasons in crypto can make you lose value with any single simple investing strategy, so be ready to lose in the short term. In the long term crypto is going to grow and things like DeFi can really help to passively decrease exposure to risk instead of active strategies.

(Let me know if you want access to the python notebook used to generate this analysis.)

References:

Hayley S. (2010) EXPLAINING THE RIDDLE OF DOLLAR COST AVERAGING