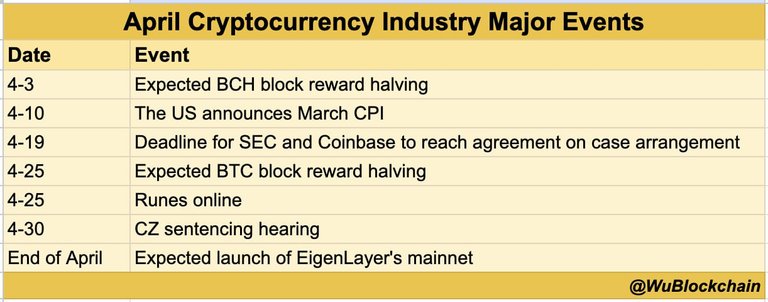

April looks set to be another event filled for crypto enthusiasts. Many big events are set to happen within the month. It'll be hard for the crypto community to keep track without help. This article lays out some major events expected to make news in the coming weeks. Knowing about the key events ahead of time helps handle any unexpected developments during April. Whether an experienced investor or new to crypto, read on to stay informed about what April holds for the crypto world.

BTC Halving

As most of OG knows, Bitcoin halving happens every 4 years. Where the reward for miners reduces by 50%. April's halving will cut block reward from 6.5 BTC to 3.125 BTC.

How it impacts Bitcoin price

Historically, after halvings, Bitcoin's price rose a lot. This is due to a few reasons. First, new coin supply cuts in half, so Bitcoin gets scarcer over time. Some say this increasing scarcity drives up prices gradually. Additionally, the prospect of lower future rewards can motivate miners to hold their existing coins rather than sell them. Both of these effects have contributed to massive bull runs after prior halvings.

CZ sentencing hearing

For those not in the know, CZ, former CEO of Binance crypto exchange, faced charges for money laundering and anti-sanction law. This is related to Binance US branch having over 100,000 transactions that include those from terrorist group. His sentencing hearing happens mid-April, with major consequences possible.

As the longest-standing and largest crypto exchange by volume, any resolution that meaningfully impacts CZ or Binance's operations could shake up the entire industry. On the one hand, a lenient sentence might be taken as a positive sign by markets. But a harsher penalty poses major risks and uncertainty. The hearing is sure to be closely watched by all with skin in the crypto game.

US March CPI

CPI is a crucial economic metric. It tracks average price changes over time for consumer goods and services, like housing, energy, food, transportation. Measuring inflation levels. It has a significant influence on Federal Reserve policy decisions around interest rates.

The March CPI data to be released soon, will show the latest inflation trends. Many analysts are closely watching this report's impact on future monetary policy decisions.

The CPI remains a closely monitored indicator that can impact asset demand, as shifts in inflation and interest rates can influence investors' preferences across various asset categories.

SEC and Coinbase lawsuit

In late March, the SEC unexpectedly sued America's largest crypto exchange Coinbase, alleging the platform had offered unregistered securities in the form of certain crypto lending products. Coinbase strongly denied any wrongdoing.

This high-profile battle represents ongoing tensions between the crypto industry which champions innovation, and regulators seeking to apply existing frameworks. It could set precedents for how crypto lending is classified long-term.

Both sides will present their arguments over the coming months. The ultimate resolution carries implications for what types of services crypto platforms can offer legally under current rules. It's a lawsuit with reverberations far beyond just Coinbase.

Bitcoin Cash halving

Similar to Bitcoin, Bitcoin Cash is programmed to undergo a halving of its block reward every four years to control supply. Its third halving is scheduled for early April, slashing the BCH block reward from 6.25 to 3.125 coins.

As the 4th largest cryptocurrency, the BCH halving will be closely watched. Prior halvings corresponded with short-term BCH price rallies. However, unlike Bitcoin, BCH's future is less certain as it faces ongoing competition from newer blockchains. Still, the halving introduces both scarcity and uncertainty that could drive volatility.

Eigenlayer mainnet launch

Eigenlayer is a confidentiality-focused scaling solution for Ethereum, that employs zero-knowledge rollup protocol. Following extensive research and development efforts, the team aims to launch their mainnet around mid-April, introducing a novel approach to enhancing Ethereum's scalability while preserving user privacy.

This will allow decentralized applications for the first time to take advantage of Eigenlayer's zk-rollup architecture and its promise of massively increasing Ethereum's transaction throughput while maintaining privacy. The launch will be a major test for the technology.

Rune testnet launch

Rune is a layer 1 blockchain designed as an open alternative to Cosmos SDK. After lengthy development, the team plans to launch their public testnet in early April.

This testnet debut will allow developers to build and test applications using Rune's proof-of-stake protocol for the first time. It's an important milestone as Rune looks to gain traction and challenge other layer 1 blockchains in the smart contract and interoperability space. The testnet stability and developer experience will be crucial.

Token airdrops

A number of protocols have airdrops scheduled for April that could see new tokens distributed to qualifying wallets. This includes:

Ethena: The Ethena blockchain aims to provide cheap and fast transactions. It will airdrop its WEN token to Wormhole and ION users.

Wormhole: The interoperability protocol will distribute its native token to users who have bridged assets between chains like Solana, Terra, and Ethereum using Wormhole.

ION: The zero-knowledge scaling solution plans to airdrop its tokens to those who have helped secure the network to date.

These airdrops represent an opportunity for speculators and long-term believers in the technology. It will be interesting to see if they drive more usage of—and investment in—the underlying protocols.

Conclusion

April 2024 shapes up to be an important month for the cryptocurrency industry. Major protocol milestones like the Eigenlayer mainnet launch and Rune testnet debut will test promising technologies. Meanwhile, scheduled token airdrops may reward long-term users and drive further adoption.

However, macroeconomic and regulatory developments also carry significance. The inflation report and Fed actions could impact risk assets like crypto. And the SEC vs. Coinbase case may set precedents around innovation.

Overall, April offers the opportunity for protocols to prove progress on scalability and usability. But volatility looks certain as investors weigh geopolitical instability and a complex regulatory landscape. The month ahead will provide valuable insights into the maturation of this emerging digital asset class.

As an investor, stay vigilant but keep the long-term conviction. Monitor both fundamental drivers and technical milestones closely. Most of all, diversify and only allocate within your risk tolerance as this transformation continues to unfold.

Posted Using InLeo Alpha

https://inleo.io/threads/fexonice/re-fexonice-2hyuduwuh

The rewards earned on this comment will go directly to the people ( fexonice ) sharing the post on LeoThreads,LikeTu,dBuzz.