Home equity makes up a large part of most families’ wealth.

This article/advertisement in Essence Magazine caught my attention today.

To summarize, I will use this quote from the article”

“44% of Black families own their home while 73.7% of white families own theirs...Home equity makes up a large part of most families’ wealth, so increasing minority homeownership is a key factor in decreasing and ultimately closing the wealth gap.”

The article is actually an advertisement for The Change Company, a Community Development Financial Institution (CDFI). CDFI’s provide debt financing to financially distressed communities that are left out of the traditional banking sector. However, finance rates are essentially no different than in the traditional banking sector, offering little to no advantage.

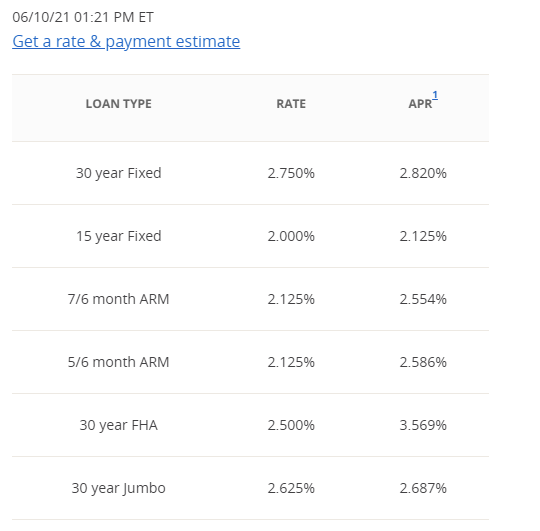

First American Credit Union (CDFI Bank) - source

Chase Bank (Traditional Bank) - source

As you can see, the traditional bank offers .5% lower rate than the CDFI Bank for a 15 Year Fixed Mortgage. The lower rate should be accessible to financially distressed communities, it is not.

Most people's wealth should not be wrapped up in their home.

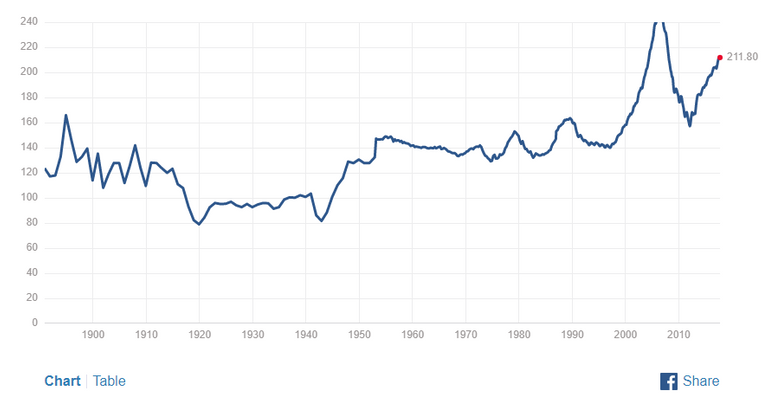

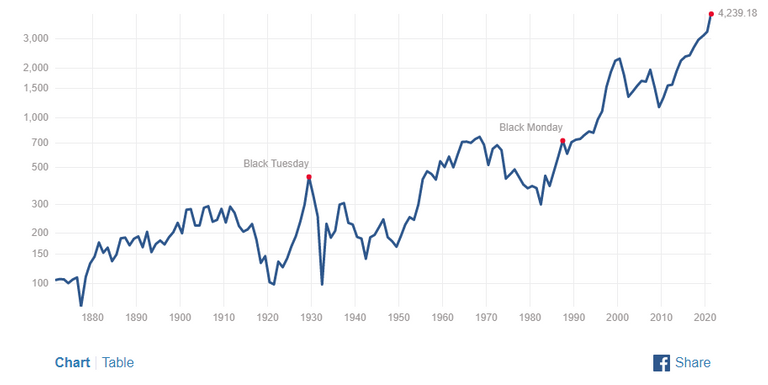

Even though the above quote from the article is true, most people's wealth should not be wrapped up in their home. It should be in liquid assets like stocks and crypto because the long term ROI in stocks is at least 4x as much versus a home value appreciation.

Besides, a home is an illiquid asset, and the only way you can tap into the equity is to borrow against it, like with a home equity line of credit, which you should never do, because debt is the opposite of wealth.

Since 1971, the inflation adjusted S&P500 price has increase 12.1% annually. In that same time, home prices have increase 3% annually. This is a 400% difference in wealth accumulation. So equities are an obvious choice for building wealth, not a home.

Case Shiller Home Price Index - source

Inflation Adjusted S&P 500 - source

The quote also should say that these families don't actually own their own home, they own a mortgage.

63% of all homes that are “owned” are actually owned by the bank. 32% of people over the age of 70 have a mortgage (home debt), as well as 84% of people under 40 - source.

You're not buying an asset, you’re incurring debt.

So essentially, the vast majority of first-time home buyers have debt and very little equity in their home. When a person buys a home, they are not buying an asset, they're incurring debt.

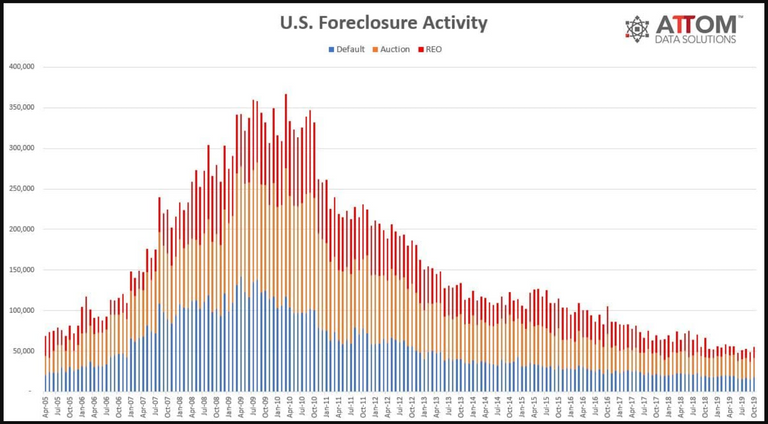

And if a recession forces someone out of work and that person doesn't have enough income to cover the debt service payments, that person could lose their home and much of the equity in it because they are selling at depressed prices to cover their outstanding house debt. And if most of their net worth is in their home, then most of the net worth will be lost. Millions of American went through this in the aftermath of the 2008 Financial Crises, why repeat it?

U.S. Foreclosure Activity 4/2005 to 10/2019 - source

Don't get me wrong, buying a home builds wealth, renting an apartment doesn't. But a home in not an investment vehicle, its a place to live. The wealth accumulation in a home is just icing on the cake, not a retirement plan.

Addressing the problem of wealth inequality.

The bottom line, if we want to reduce wealth inequality, we need to increase our income and not our debt. The only way to increase income is to provide better paying jobs. To provide better-paying jobs, we have to produce things that people are willing to buy. If we want to produce things people want, we have to invest in our nation's infrastructure, education, R&D, domestic supply chains and competitiveness.

The premise of the article is that if a person incurs debt by buying a home, somehow that is the best vehicle to wealth. It is not! The 2008 financial crisis and the years of foreclosures was proof of this.

Income, savings and investments in financial assets leads to wealth. Not debt in a place where you live. So here in the United States, if we want to address wealth inequality and help our people; add income, not a mortgage.

Stay frosty people.

Thanks for reading.

.PNG)

You just made me remember reading, Cash flow quadrant by Robert Kiyosaki and he had said the same thing

Our homes can only be assets if and only if they are generating money

if I remember correctly, I think Robert said, when he bought one of his home or land, the debt incurred by the purchase was paid off by a part of the plot and not his pocket

For me, when I watch my landlord receive the rent we pay yearly and still use it to repair the places we live, I have already zeroed my mind about ever thinking that a house is an asset because it is not

This place constantly takes money out of his pocket instead of putting it in. He may not see it, but I see it as a liability as it is always needing one repairs or the other

Posted Using LeoFinance Beta

I haven't read that book. I should check it out.

“Our homes can only be assets if and only if they are generating money.”

I like this. Having a positive return on any asset; more equity than debt; and the income must exceed expenses and debt service payments; is essential to growing one’s net worth.

Debt is a funny thing. I like to call it magic money. It's magic in the sense that people do not recognize it as a liability (or lack of ownership), only as a payment.

And to use a physics analogy, cash is matter, when debt is antimatter. Both cancel each other out. But people give more value to cash because they’ve earned it, as opposed to debt which they didn't. When something is easy to get, like debt, people subconsciously place less value in it. It's not unheard of that people have $50,000 (outside of their emergency fund) in their savings account, and $20,000 in debt, and they continue to hold the debt and keep the cash.

Interesting article and thoughts about the housing and debt market.

I mostly agree with you BUT I feel for a lot of people (myself included) having my capital locked into my house and paying the monthly mortgage allows me to build wealth slowly.

I know very well that I can invest in risky assets and lose a lot of money because I am not very risk averse. Therefore I am happy to have my house as an illiquid asset.

I don't know if I was clear. COngrats on being selected by @hodlcommunity

Take care,

@vlemon

Posted Using LeoFinance Beta

"invest in risky assets and lose a lot of money"

I 100% understand this. Losing 50% of one's retirement in the 2008 Financial Crisis or 80% in the 2018 Crypto Correction is extremely stressful! That said, when you're older it's better to put your money in less volatile assets, but when you're young, it's better to put it in risky assets because you have a lot more time to recover from a financial crisis. But I do understand what you're saying; there's enough stress in life, adding investment stress too it just sucks...lol.

"COngrats on being selected by @hodlcommunity"

Thank you so much @vlemon :)

Upvoted 👌 (Mana: 28/112) Liquid rewards.