Decentralized finance (DeFi) is a relatively new phenomenon that has gained significant traction in recent years. DeFi refers to a range of financial services and products that are built on decentralized technologies such as blockchain and are often offered by non-traditional financial institutions. These services can include lending, borrowing, trading, and payment processing, among others.

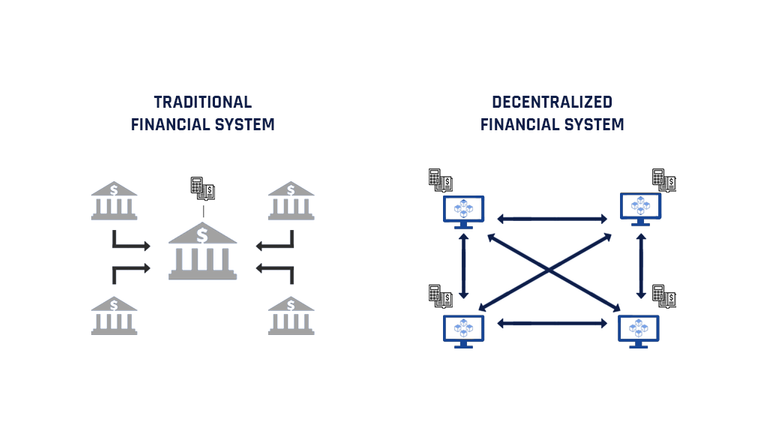

Traditional finance, on the other hand, refers to the financial systems and institutions that have existed for centuries, such as banks, credit card companies, and investment firms. These institutions are typically centralized and regulated by governments or other regulatory bodies.

There are several key differences between DeFi and traditional finance, and these differences can lead to both benefits and drawbacks for users of each system.

DeFi is built on decentralized technologies, which means that it is not controlled by a single entity. This can make DeFi platforms more resistant to censorship and interference, and it can also make them more transparent, since transactions on a blockchain are visible to all participants.

Another benefit of DeFi is that it often offers higher returns and lower fees than traditional financial products. For example, DeFi lending platforms may offer higher interest rates to borrowers and higher returns to lenders than traditional banks. DeFi platforms may also have lower fees than traditional financial institutions, since they do not have the same overhead costs.

However, DeFi also has its drawbacks. One of the main drawbacks is that it is still a relatively new and untested technology, and there have been several instances of DeFi platforms experiencing technical issues or suffering from hacks. This can make DeFi platforms more risky for users, especially those who are not familiar with the technology.

Another drawback is that DeFi is not as regulated as traditional finance, which means that users may not have the same level of protection if something goes wrong. For example, if a DeFi platform experiences a hack or goes bankrupt, users may not have the same recourse as they would if a traditional financial institution failed.

DeFi and traditional finance are two very different systems with their own set of benefits and drawbacks. DeFi offers the potential for higher returns and lower fees, as well as the benefits of decentralization and transparency. However, it is also a newer and less regulated technology, which can make it riskier for users. Traditional finance, on the other hand, is more established and regulated, but it may offer lower returns and higher fees. Ultimately, the choice between DeFi and traditional finance will depend on an individual's risk tolerance and financial goals.

Posted Using LeoFinance Beta

A lot to be excited about especially the DeFi potential on this blockchain.

Posted Using LeoFinance Beta

blockchain technology is really exciting

Congratulations @firatozbek! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 7000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!