Hello! LeoFinance users I take some updates about BTC

Bitcoin bulls are put to the test as the price of BTC corrects to $36,000. Thursday marked a downturn for the crypto market, triggered by the SEC's decision to delay multiple ETF verdicts. This move prompted traders to capitalize on recent profits and brace for a downward correction before contemplating reentry into the market

Source screenshot

Amidst a mixed performance in the stock market, indications surfaced that U.S. consumers might need to curtail spending due to persistent inflation. Simultaneously, trader confidence in the Federal Reserve's early 2024 interest rate reduction waned.

At the day's close, the S&P and Nasdaq posted gains of 0.12% and 0.07%, respectively, while the Dow recorded a 0.13% loss. West Texas Intermediate crude oil also experienced a 5% dip, settling just above $73 per barrel, marking its lowest price in four months.

According to TradingView data, Bitcoin, having peaked at $38,010 on Wednesday, succumbed to bearish pressure throughout Thursday's trading session, reaching a low near $35,500 before rebounding to just above $36,000 with the intervention of dip buyers.

Source screenshot

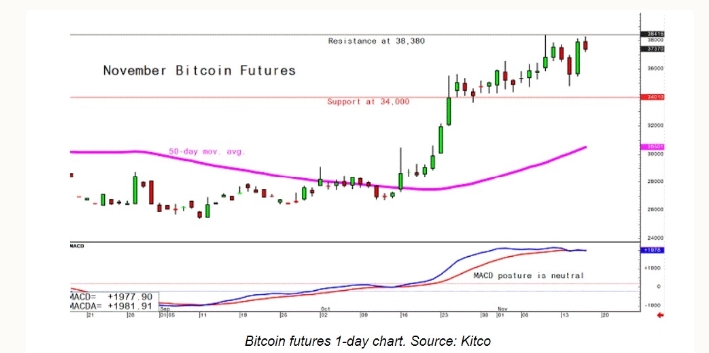

The bearish onslaught prompted Kitco senior technical analyst Jim Wyckoff to observe that "November Bitcoin futures prices [traded] weaker in early U.S. trading Thursday." He noted the pullback, which ensued after robust gains on Wednesday. Despite this setback, Wyckoff highlighted the BTC bulls' retention of a firm overall near-term technical advantage, emphasizing the persistence of a price uptrend on the daily bar chart. He asserted, "The path of least resistance for prices remains sideways to higher in the near term.

Source screenshot

While speculation surrounding ETFs has been linked to the heightened volatility, Markus Thielen, an analyst at DeFi Research, argued that the fluctuations were more intricately tied to developments within the U.S. government.

The heightened volatility in the Bitcoin market, according to Thielen, stems from the avoidance of a U.S. government shutdown. Such an event could have delayed any approval for a Bitcoin ETF until at least January 2024 or even longer. Reflecting on the recent note, he highlighted the rapid price surge from $35,500 to $37,800 within the last 24 hours, marking a 6.4% increase. Looking ahead, Thielen envisions BTC rallying to $40,000, and possibly reaching as high as $45,000 by the year's end. He points to two substantial options expiries on November 24 and December 29, boasting $3.7 billion and $5.4 billion in open interest, respectively. With an 85% dominance of calls over puts, particularly at the 40,000 strike, he anticipates a surge in Bitcoin purchases as the market approaches the $40,000 mark, driven by hedging activities. The widespread interest in pushing prices to this level, he suggests, makes the likelihood of reaching it quite high.

Source screenshot

Thielen also highlights the noteworthy inflow of $1 billion into digital asset investment products over the past two months. However, he emphasizes a more influential factor: the significant issuance of Tether (USDT) stablecoins, amounting to nearly $4 billion. This, in his view, signifies that major market players are converting fiat into crypto, a pivotal reason for the robust interest in both Bitcoin and altcoins. The resurgence of Fear of Missing Out (FOMO) among traders is evident, leading to a sense of panic.

Moreover, Thielen attributes part of the bullish momentum to dovish comments from Federal Reserve Board members and the resumption of the downtrend in U.S. inflation after a gradual rebound over three to four months. According to his inflation model, this trend is expected to persist, with inflation likely to drop below 2.0% in 2024

Source screenshot

He anticipates aggressive interest rate cuts by the Federal Reserve as a response, given the current 3.2% U.S. inflation rate compared to the 5.25% interest rates—a 2.0% difference. If the inflation model holds, this spread could widen to 3.0%, suggesting a potential 200 basis points of rate cuts in the coming year, a development that Thielen views as bullish for the market.

BTC has retraced to the MA20, prompting concerns from market analysts like Doctor Profit and Chartist JT, who both warn of potential further declines. Doctor Profit highlights the risk of BTC dropping to the $33,000-$34,000 range if it fails to hold support at the MA20. Chartist JT concurs, stating that a breach of this level could lead to a further slip in BTC's value. However, JT reassures long-term investors, advising those focused on hodling and uninterested in short-term trading to remain calm, as higher time frames appear stable.

Despite the overall market downturn, a handful of tokens managed to secure double-digit gains amid the sea of red. Yearn.finance (YFI) led the pack with an impressive 28.26% surge, reaching $14,332. Render (RNDR) followed with a 20.1% gain, while Kaspa (KAS) and other tokens such as Beam (BEAM), Ordi (ORDI), and Avalanche (AVAX) posted gains ranging from 11.6% to 17.8%.

Conversely, Memecoin (MEME) experienced the most significant loss, plummeting by 20.9% to trade at $0.0313. Celestia (TIA) and dYdX (ETHDYDX) also faced declines of 12.4% and 9.5%, respectively.

The overall cryptocurrency market cap currently stands at $1.38 trillion, with Bitcoin maintaining a dominance rate of 51.1%. The contrasting performances of individual tokens amidst the broader market trends underscore the dynamic nature of the cryptocurrency space.