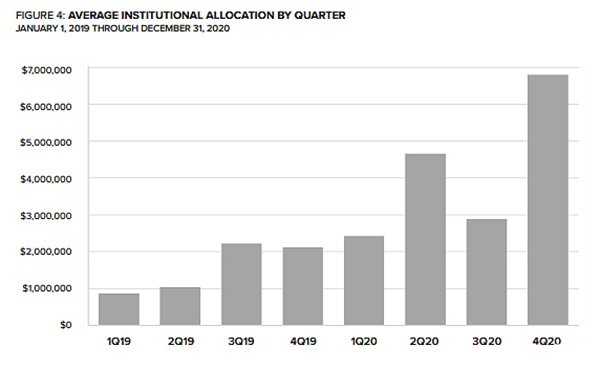

On January 15, Grayscale released its digital asset report for the fourth quarter of 2020. At the beginning of the year, Grayscale’s asset management scale was only US$2 billion. By the end of the year, Grayscale’s assets under management had exceeded US$24.7 billion in assets, of which 93 % Of investors are institutional investors. In 2020, Grayscale raised more than US$5.7 billion in its investment product portfolio, which is more than four times the company's cumulative revenue of US$1.2 billion from its establishment in 2013 to the end of 2019.

After this round of skyrocketing, the name Grayscale is no longer unfamiliar to all investors.

But there are still many details around grayscale that are not very clear, and many questions linger in everyone's mind:

· How did Grayscale increase its holdings of encrypted assets?

· Why do investors choose Grayscale GBTC products?

· Why is there a premium for grayscale?

Taking this opportunity, Gyro Finance specially consulted Chain Hill Capital, an encrypted digital asset investment institution, and asked the most interesting questions for everyone.

1. Recently, I often see a saying called "Gray to work", but there is not much news about its own position information, purchase method and purchase time. Can you explain it to you? Will Grayscale buy digital currency in person? Where do you go if you buy it?

Chain Hill Capital: (1) Gray-scale going to work is a relatively popular expression in the industry, and its normal "working time" is the legal working day in the United States.

Investors can submit a trust share subscription before 4 pm New York time or between 4-6 pm on a working day. The subscription before 4 pm is a T-day subscription (same-day subscription), and the T-day subscription is confirmed at 4 pm on the same day. The purchase at 4-6 o'clock belongs to the next day's purchase, and the share is confirmed at 4 pm New York time on T+1 working day.

(2) Its position information can be viewed in the Bitcoin Trust column of the official website (https://grayscale.co/).

(3) Purchase method. Investors can purchase in cash (USD) or in kind (for example, Bitcoin), and purchase online at the "START INVESTING" entrance of the official website.

(4) Grayscale will not purchase Bitcoin in person. Grayscale will authorize a company as an authorized dealer. Currently, the dealer is Genesis Global Trading, who is responsible for processing customer asset transactions and calculating trust shares. Genesis is a related party of Grayscale, a subsidiary of the DCG Group.

(5) Where does Genesis buy coins? Grayscale Bitcoin Trust does not allow anyone to go to an exchange to buy cryptocurrency. They have a risk control system in the process of purchasing cryptocurrency.

Grayscale or Genesis will screen all cryptocurrency trading platforms in the global market. There are at least three risk control processes in this link.

First, exclude exchanges that do not have a compliance license, including federal and state licensing requirements;

Secondly, evaluate the activity on the remaining trading platforms and choose platforms with higher trading volume;

Third, choose a platform with better transaction depth from the remaining platforms.

Through their assessment, during the three reporting periods of December 31, 2018, December 31, 2019, and June 30, 2020, the selected trading platform was the Coinbase Pro exchange.

2. On January 14, Grayscale announced that XRP Trust will return cash to investors after direct liquidation. Does Grayscale have the right to liquidate directly? Does liquidation need to be discussed with investors in advance?

Chain Hill Capital: Since the XRP trust has been liquidated, the official page has closed the relevant information of the XRP trust, so we cannot verify the description of the liquidation authority in the relevant documents. However, both XRP trust and BTC trust belong to Grayscale's single-asset trust. We can borrow Bitcoin Trust to take a look at Grayscale's regulations on such events.

Taking Grayscale Bitcoin Trust as an example, the trust will be dissolved when the following events occur:

(1) US federal or state regulatory agencies require the trust to close or force the trust to liquidate its cryptocurrency, or seize or otherwise restrict access to the trust’s assets.

(2) There is any ongoing event that prevents the normal operation of the trust or invalidates the trust’s reasonable efforts to determine the price of cryptocurrency in a fair and reasonable manner.

(3) There are any incidents that hinder the trust's conversion or invalidate the trust's conversion of encrypted currencies into U.S. dollars.

(4) Proof of dissolution or revocation of the sponsor’s articles of association has been submitted (and its articles of incorporation have not been restored within 90 days from the date of issuing the notice of revocation to the initiator), or the initiator has been revoked, ruled or admitted bankruptcy or insolvency.

Gray can decide to terminate the trust by itself when one of the following conditions exists:

(1) The US Securities and Exchange Commission determined that the trust was an investment company registered under the Investment Company Act of 1940.

(2) CFTC determined that the trust is a commodity pool under the CEA;

(3) According to the regulations issued by FinCEN in accordance with the "Bank Secrecy Act of the United States", the trust is determined to be a "money service business" and is required to comply with certain regulations of FinCEN.

(4) The trust institution must obtain a license or register under any state law that regulates money transmitters, money service businesses, prepaid or stored value providers, or similar entities, or virtual currency businesses.

(5) The trust is insolvent or bankrupt.

(6) Circumstances where the trustee resigns or is removed without changing.

(7) All trust assets have been sold.

(8) The sponsor believes that the relationship between the total net assets of the trust and the trust expenses makes it unreasonable or imprudent to continue to run the trust affairs.

(9) The sponsor receives a notice from the US Internal Revenue Service or the trust attorney or sponsor that the trust does not comply with the grantor trust treatment under the Code or will not be regarded as a grantor trust under the Code.

(10) If the trustee informs the promoter that he chooses to resign, and the promoter does not appoint a successor trustee within 180 days.

(11) It is advisable for the promoters to decide by themselves to suspend the trust affairs for any reason.

We can see that among Grayscale’s document regulations on Bitcoin trusts, one of them is that “it is advisable for the initiator to decide to suspend the trust affairs for any reason”, which shows that Grayscale has the right to voluntarily based on the actual market conditions. Decide on the termination of the trust.

We can think that there is no need to discuss with investors in this case.

3. In addition to XRP, Grayscale has also temporarily suspended ETH trust subscription purchases recently. What is the reason for this?

Chain Hill Capital: The terms of Grayscale Ethereum Trust state that it is open for subscription (Daily), but Grayscale can adjust the subscription time window by itself. There is no specific reason for the closure of the Ethereum subscription.

4. For American users, there are many legal ways to buy BTC and other encrypted assets. Why do so many people choose to buy grayscale products at a premium?

Chain Hill Capital: In fact, this has to consider the results of investors behind grayscale products.

First of all, investors who invest in Grayscale products are mostly institutional investors. For these investors, on the one hand, it is considered that Grayscale is a regulated and compliant channel with convenient exit methods and safe institutional-level custody. Service, so they solve many of their concerns about entering this market.

Second, investment in gray-scale products is tax-friendly relative to directly holding cryptocurrencies.

Finally, many retail investors who cannot participate in the primary market subscription can directly choose to purchase GBTC or other grayscale products with their U.S. stock accounts. The operation is convenient and the threshold for learning is much lower.

5. Why does the gray-scale encrypted asset trust asset have a premium compared to the actual price?

Chain Hill Capital: The premium situation is closely related to the non-open redemption of Grayscale. Since the primary market is not open for redemption and there is huge external market demand, it maintains a positive premium to a certain extent.

In addition, since there is an interval of 6 or 12 months between the issuance of trust products and the listing, the shares are not directly supplied to the market after the issuance, and a certain premium will be maintained when the market demand is strong.