Lessons from Rich Dad Poor Dad That Can Change Your Financial Life!

Rich Dad Poor Dad by Robert Kiyosaki is one of the most influential personal finance books of all time. It challenges traditional beliefs about money, jobs, and investing, providing a mindset shift that can lead to financial freedom. In this post, we’ll explore some of the most powerful lessons from the book and how you can apply them to your life.

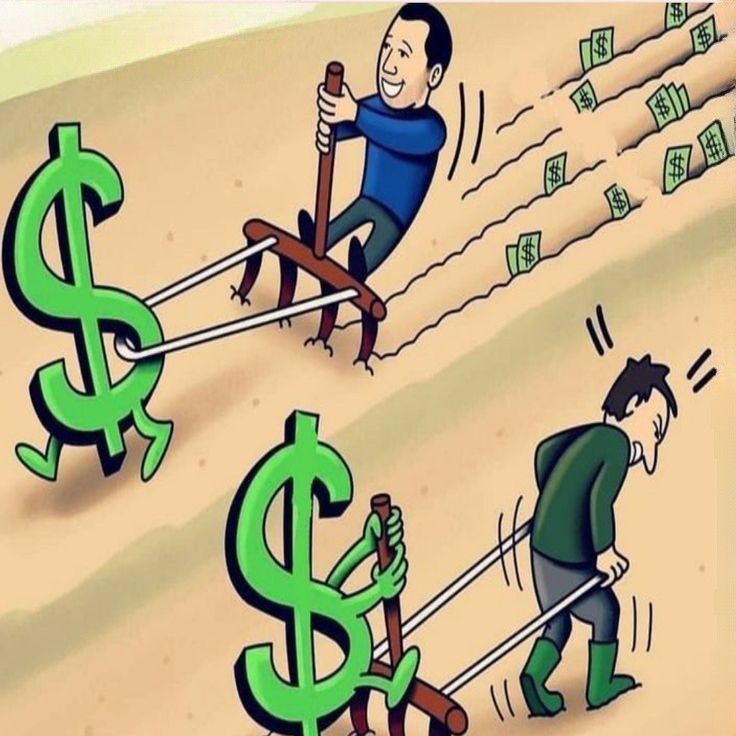

1. The Rich Don’t Work for Money – They Make Money Work for Them

Most people trade their time for money, working long hours for a paycheck. However, wealthy individuals focus on acquiring assets that generate passive income. Kiyosaki encourages readers to invest in businesses, stocks, and real estate that can grow wealth over time.

✅ Takeaway: Don’t just rely on a salary—find ways to make your money work for you.

2. Financial Education is More Important Than Job Security

Traditional education teaches people how to be employees, but it rarely teaches how to build wealth. Kiyosaki emphasizes the importance of financial literacy—understanding assets, liabilities, and cash flow.

✅ Takeaway: Learn about investing, entrepreneurship, and managing money to gain financial independence.

3. Buy Assets, Not Liabilities

One of the biggest mistakes people make is spending money on things that take money out of their pockets instead of putting money in.

✔ Assets: Stocks, real estate, businesses, intellectual property (books, courses, etc.)

❌ Liabilities: Expensive cars, credit card debt, unnecessary luxury items

✅ Takeaway: Focus on acquiring assets that generate income and avoid liabilities that drain your finances.

4. Work to Learn, Not Just to Earn

Many people chase higher salaries, but Kiyosaki suggests taking jobs that provide valuable skills—especially in sales, marketing, and investing. The goal is to develop skills that help you create wealth in the long run.

✅ Takeaway: Seek knowledge and experience that will help you build financial success, even if it means stepping out of your comfort zone.

5. The Importance of Taking Risks

The fear of failure keeps many people from taking action. Kiyosaki encourages people to take calculated risks, invest wisely, and learn from mistakes rather than avoiding opportunities due to fear.

✅ Takeaway: Smart risks and continuous learning lead to financial growth. Start small, but start today!

Final Thoughts!

Rich Dad Poor Dad is more than just a book—it’s a mindset shift. By changing the way you think about money, assets, and investing, you can set yourself on the path to financial freedom. The key is to take action, educate yourself, and build a future where money works for you, not the other way around.

💬 What’s your biggest takeaway from Rich Dad Poor Dad? Let’s discuss in the comments! 🚀