Hello guys, today I want to go a bit deeper and talk about Risk Management in Forex trading and how it works.

First of all, you need to know what Risk Management is:

-Probably the most important part of Forex trading. Forex risk management comprises individual actions that allow traders to protect against the downside of a trade. More risk means a higher chance of sizeable returns – but also a greater chance of significant losses. Therefore, being able to manage the levels of risk to minimize loss, while maximizing gains, is a key skill for any trader to have.

-How does a trader do this? Risk management can include establishing the correct position size, setting stop losses, and controlling emotions when entering and exiting positions.

Implemented well, these measures can prove to be the difference between profitable trading and losing it all.

Now I want to talk about different fundamentals of Forex Risk Management:

1.Appetite for risk

-you need to ask yourself how much am I willing to lose in a single Trade? If you don’t know how much you are comfortable with losing, your position size may end up too high, resulting in losses that may affect your ability to take on the next trade – or worse.

-So how much should you risk? A good rule of thumb is to only risk between 1 and 3% of your account balance per trade. So, for example, if you have an account of $100,000, your risk amount would be $1,000-$3,000.

2.Position Size

-Selecting the right position size, or the number of lots you take on trade is very important. To select your position size, you need to work out your stop placement, determine your risk percentage and evaluate your pip cost and lot size.

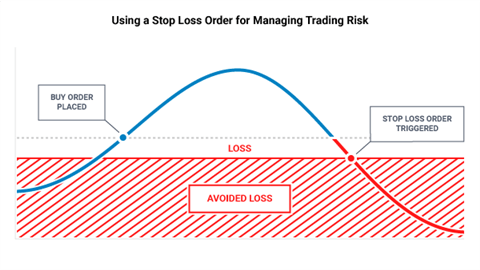

3.Stop Loss

-Using Stop Loss will avoid losing all your money with a single trade if you for example forget to check your trade or overnight while you are sleeping. It’s just security for your account and you can use the 1-3% rule to set your right Stop Loss.

-Traders should use stops and also limits to enforce a risk/reward ratio of 1:1 or higher. For 1:1, this means you are risking $1 to potentially make $1. Place a stop and a limit on each trade, ensuring that the limit is at least as far away from the current market price as your stop.

4.Controlling your emotions

-Emotions are one of the most important aspects of trading. If you are not able to control your emotions you will end up losing money again and again.

-Simple example: Everyone who loses money will get emotional and wants to make that money back like you playing in the casino and losing 200 dollars and spend another 200 dollars to get that money back that you lost but guess what….you lose another 200 dollars.

You need to know where your limit is and have some daily and goals for your wins and loses and when you reach them you will stop trading and not try to get your money back or make more.

-DO NOT GET GREEDY !!!!

I hope I could help you guys a little bit if you are thinking about trying or starting with Forex trading.

With regards

Iman Iranmanesh