Brave ads keep flashing across my screen, serving up info faster than my eyes can read. Sometimes an interesting promotion grabs my attention, like it did today with the 1inch DEX Aggregator.

Like any good crypto-preneur would do, I started off wondering if I could get a better swap fee-rate using 1inch. That search led down a rabbit hole. I return from that mystical trip with new knowledge to share.

What Is The 1inch DEX Aggregator?

You're likely familiar with the self defense teachings of master Bruce Lee. One of his popular offensive techniques is his self-dubbed, one-inch punch.

In essence, 1inch acts as a gas saving swap dApp!

Does it really save you on gas fees? 1inch claims it does. They back their claim with a code/theorum along with the CHI Gastoken. I put the DEX Aggregator to a preliminary test today and you can see the subsequent results. Scroll on!

Back & Forth Between Uniswap and 1inch

It took some quick fingerwork with the cellphone camera to capture screenshots before the gas fees slipped to a new rate.

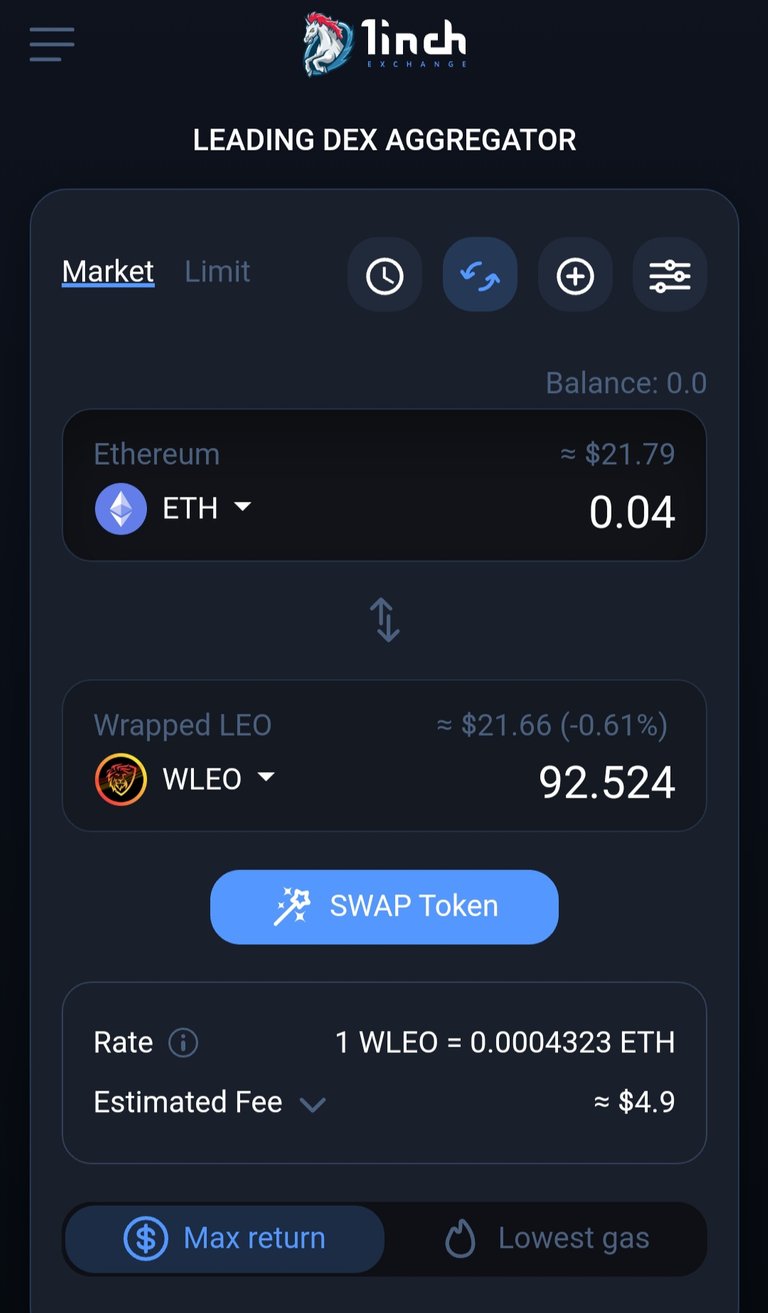

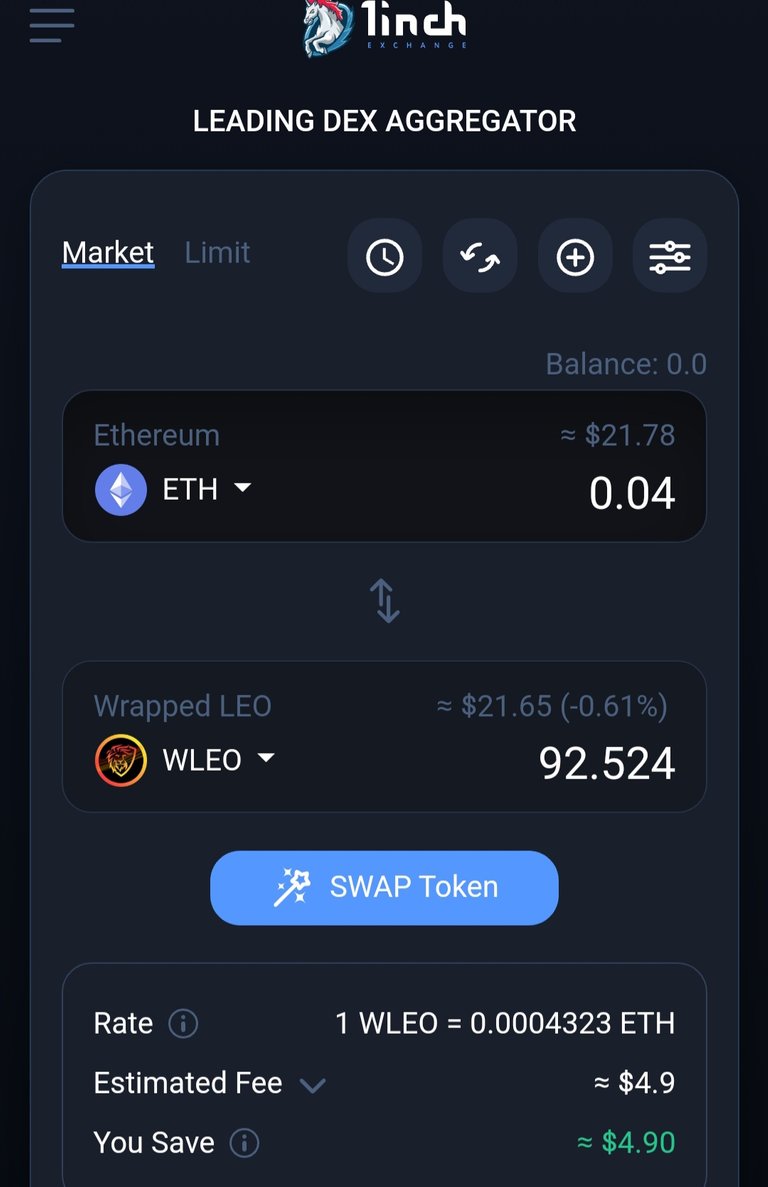

Starting with 1inch, you can see the estimated fees for an ETH to wLEO swap:

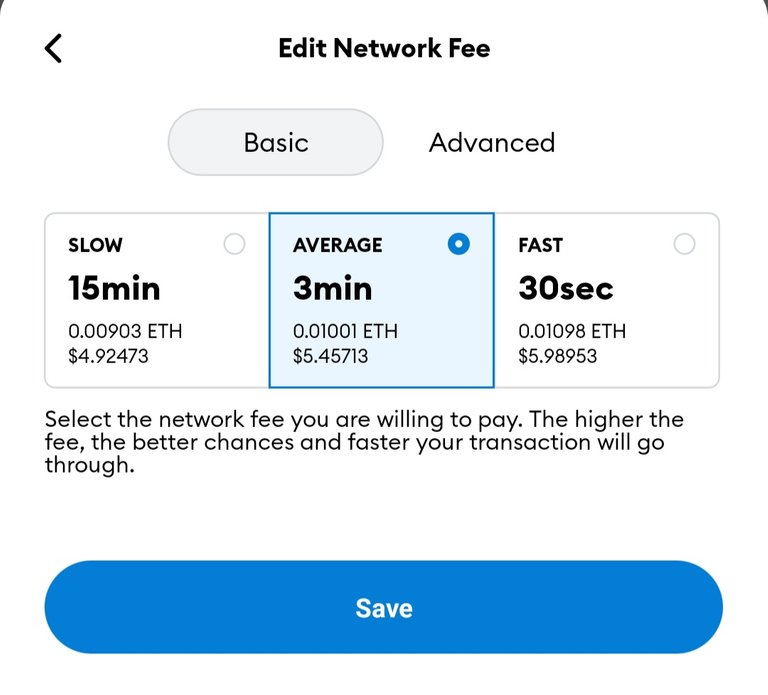

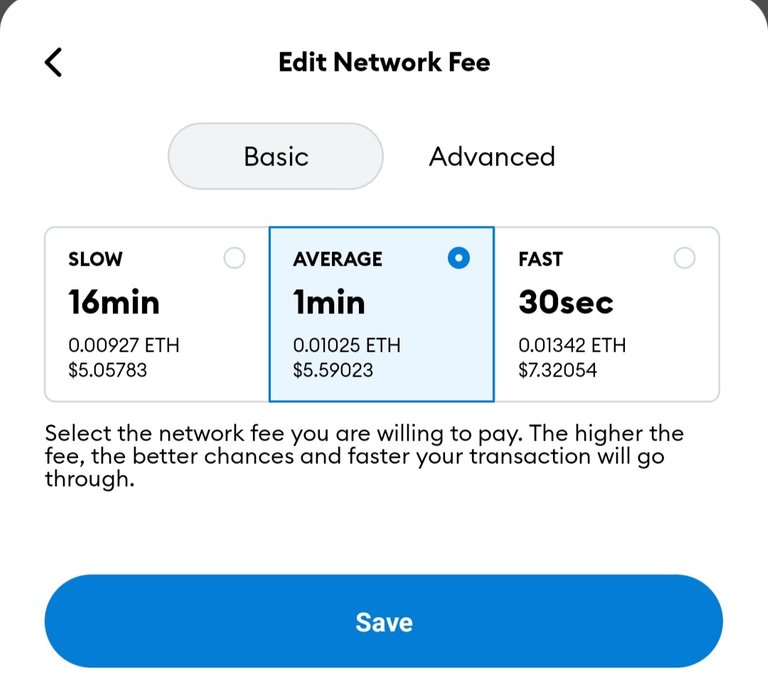

I also captured the fees up to the point of declining the transaction in my MetaMask wallet:

As you can glean from the images above, the fees estimated by 1inch vs the Ethereum network match up. That being the case only if I set the transaction speed to slow.

It's not the smartest move as rates are more likely to slip, causing your transaction to fail. And you'll still end up on the hook for some gas fees!

Quickly Over To Uniswap

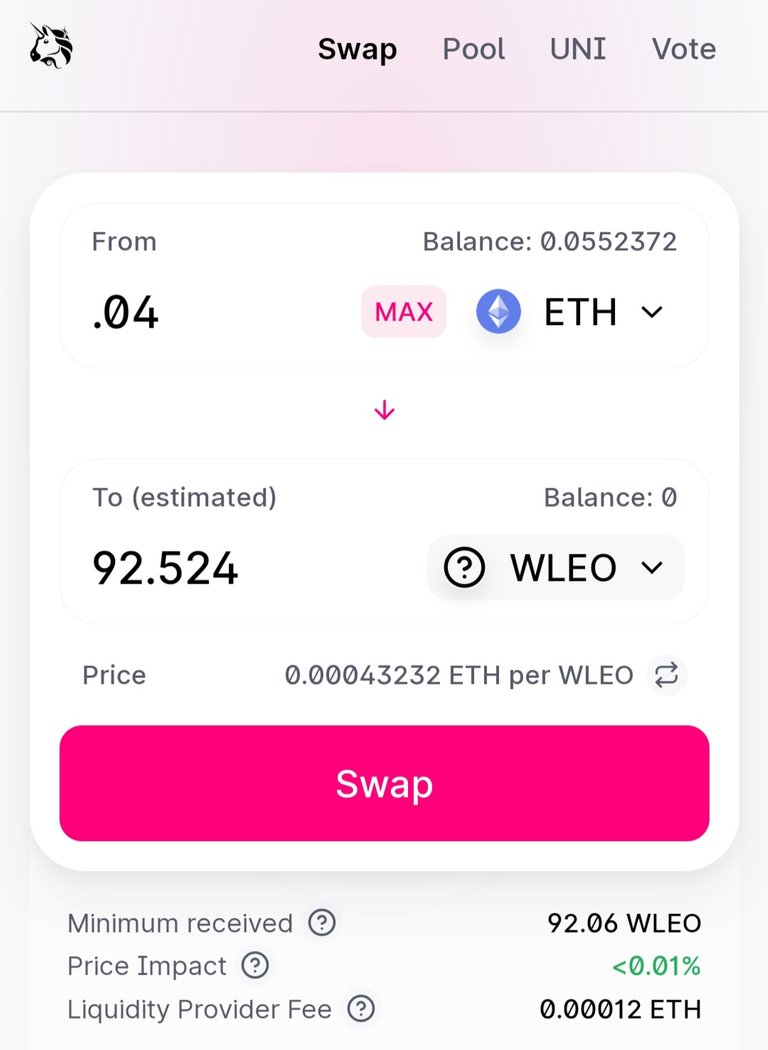

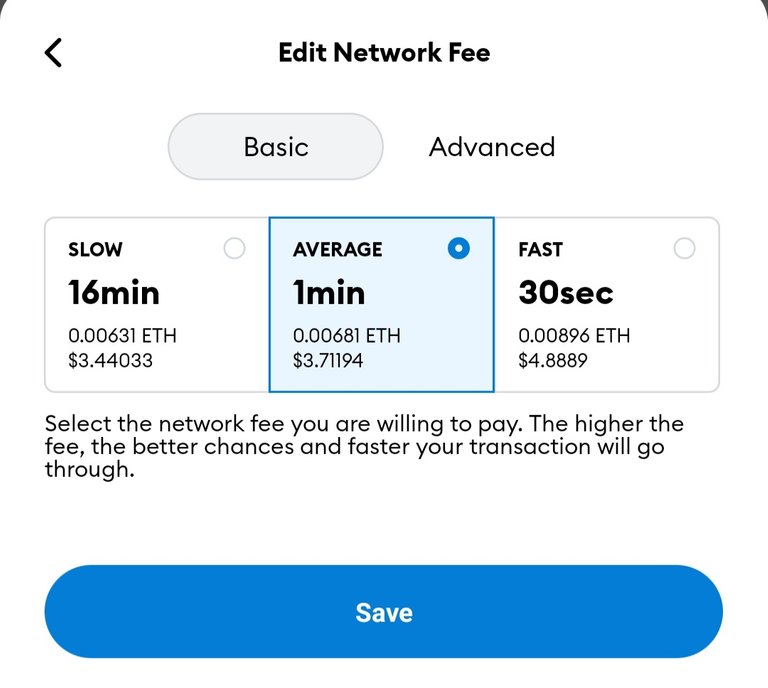

After capturing the screenshots from 1inch and Metamask, I opened the Uniswap dApp. Setting the same swap perameters as fast as possible, I got surprisingly different results. See the images below:

Uniswap shows the Liquidity Provider Fee. It doesn't give an estimated cost of gas fees. You can see the obvious difference between Uniswap and 1inch in the MetaMask authorization pop-up.

It would be almost $2.00 less in fees to swap with Uniswap vs 1inch. Is that what high liquidity does? Or perhaps it's because wLEO has its contract on Uniswap? To make certain that has fees hadn't changed, I ran the process one more time on 1inch. The results were more or less the same.

For whatever the reason, 1inch wasn't going to save me gas today. At least, not when trying to exchange ETH for wLEO. But as I said, the rabbit hole was calling.

1inch & A CHI Gastoken? What's That?

When aspects of an investigation get techinical, it's often best to use quotes. I wouldn't want to misrepresent the information. With this in mind, what is the CHI Gaslight token and what is its utility? From the 1inch CHI Gastoken launch article on Medium.com:

Every transaction on the Ethereum network requires some gas. A Gastoken facilitates transactions with the same amount of work but less gas. A Gastoken takes advantage of the Ethereum storage refund, see Ethereum Yellow Paper. To encourage smart contracts to erase unnecessary storage, Ethereum provides a refund for each zeroed element. So, in the process of burning, a Gastoken’s smart contract erases storage that were filled during minting. The most efficient storage gas refunds are achieved by creating and destroying sub smart contract, not by direct writes and erases of the storage.

The function of the CHI Gastoken once implemented into a smart contract is to reduce the cost of gas. CHI accomplishes this by burning tokens during a transaction. CHI Gastokens can be mined or aquired on the 1inch DEX Aggregator.

The CHI Gastoken As An Investment?

Another interesting line that sticks out from the same Medium.com article:

Very important to understand for everyone:

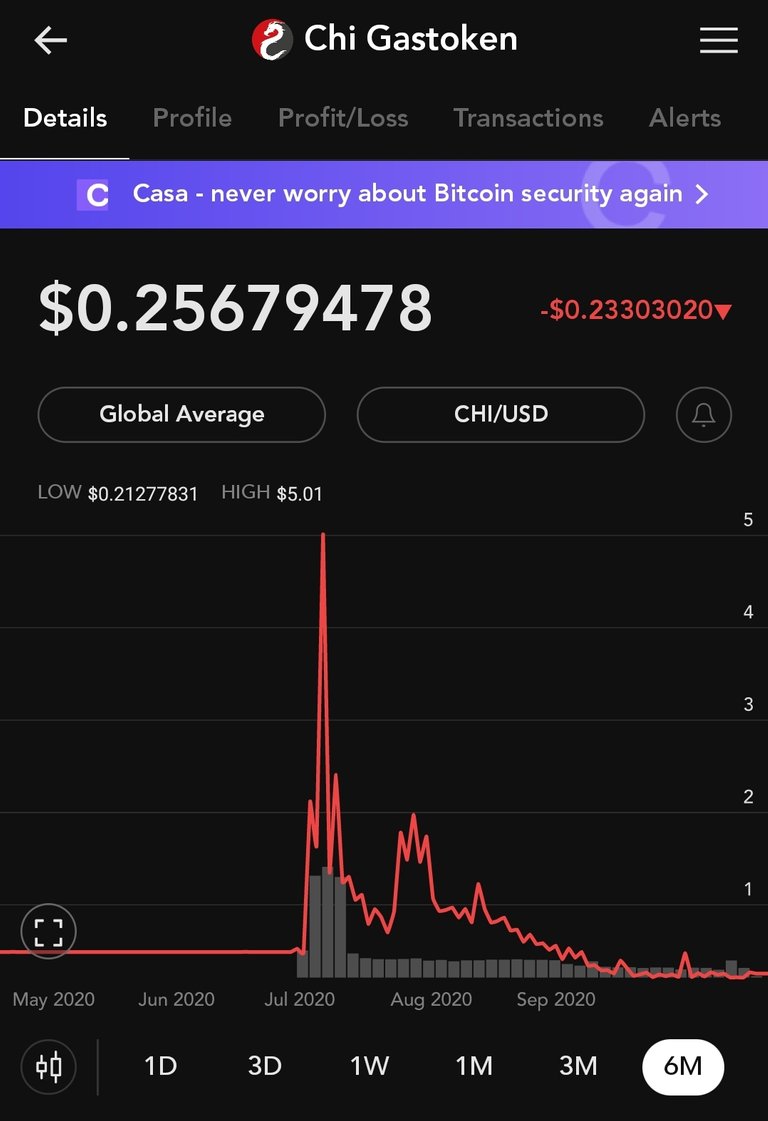

Imagine Chi token as tokenized version of actual gas price on Ethereum. Means if the gas price grow. Chi token price also grow. If gas price in Ethereum drops, the same would also happen with Chi.

Though the grammar on that quote begs forgiveness, the point is clear. Buy CHI Gastokens cheap and sell them when gas fees are soaring! Be sure to invest in enough CHI Gastokens to cover the high cost of gas when it comes time to dump them.

To provide some perspective on the value of the CHI Gastoken, it has traded as high as $5.01. It's dropped as low as $.021 and currently trades around $.25 USD.

1INCH Governance Token

The 1inch DEX Aggregator appears to draw upon liquidity from the Mooniswap DEX Protocol. As such, they are rewarding the 1INCH governance token to liquidity miners in one of four different Mooniswap pools.

Join The 1inch Affiliate Program

You read correctly! 1inch offers an Affiliate Program to reward people for referrals. Please use my link if you decide to check out the DEX Aggregator.

To get your affilate link, simply connect your wallet to 1inch and it shows at the bottom of the page. 1inch isn't clear about the rewards. Read more about the program here.

Not Financial Or DeFinancial Advice

Do you have any thoughts on 1inch or the CHI Gastoken? Start the conversation in the comments below.

Thanks for reading and as always...

Images Captured As Screenshots

Bottom Image Courtesy Of Hive.io Brand Assets

LeoFinance Illustrations Courtesy Of @mariosfame

Want To Join The HIVE Community? Use My Referral Link To HiveOnboard.com

Posted Using LeoFinance Beta