Decentralized Finance (DeFi) has emerged as one of the most promising applications of blockchain technology, offering a range of financial services that are accessible to anyone with an internet connection. At the heart of DeFi lies the concept of decentralized currencies or tokens that can be used to buy, sell, and lend without the need for intermediaries like banks.

One of the key challenges facing DeFi is the volatility of cryptocurrencies, which can fluctuate wildly in value. Stablecoins, which are cryptocurrencies that are designed to maintain a stable value, have emerged as a solution to this problem. In this post, let's explore the role of stablecoins in DeFi, their benefits and drawbacks, and their potential impact on the broader financial system.

Benefits and Drawbacks of Stablecoins as a Store of Value in DeFi Protocols

Stablecoins offer several benefits in DeFi protocols, including stability, accessibility, and speed. Unlike traditional cryptocurrencies like Bitcoin, which can experience significant price fluctuations, stablecoins are designed to maintain a stable value. This stability makes them ideal for use as a store of value in DeFi lending and borrowing protocols, where borrowers can use stablecoins as collateral for loans without the risk of price fluctuations. Stablecoins are also accessible to anyone with an internet connection, making them an attractive option for users who are looking for a more transparent and decentralized alternative to traditional banking. Additionally, stablecoins can be transferred quickly and securely, making them ideal for cross-border payments.

However, stablecoins also have some drawbacks. One of the main concerns is the risk of centralization, as stablecoins are often backed by fiat currency or other assets that are controlled by a centralized authority. This centralization can create a single point of failure that could threaten the stability of the entire system. Additionally, the lack of transparency and regulation surrounding stablecoins can make them vulnerable to fraud and market manipulation.

Enabling DeFi Applications: The Role of Stablecoins in Automated Market Makers and Decentralized Exchanges

Stablecoins are also playing a critical role in enabling several DeFi applications, including automated market makers (AMMs) and decentralized exchanges (DEXs). AMMs are decentralized protocols that use algorithms to set prices for tokens based on supply and demand, and stablecoins are often used as the base currency for these protocols. This is because stablecoins offer the stability and predictability needed to create a stable trading environment.

Similarly, stablecoins are also used as the base currency for DEXs, which are decentralized exchanges that allow users to buy and sell cryptocurrencies without the need for intermediaries. Stablecoins are used as the base currency for these exchanges because they offer stability and ease of use, allowing users to trade cryptocurrencies without the risk of price fluctuations.

Token Wrapping and Interchain Bridges: The Evolution of Stablecoins in DeFi

Token wrapping is the process of converting a cryptocurrency into an equivalent token that can be used on a different blockchain. This process allows users to access the features and benefits of different blockchains, enabling them to take advantage of DeFi protocols on multiple platforms. Interchain bridges are the tools that make this process possible, allowing users to transfer tokens between different blockchains. This technology has led to the creation of several wrapped stablecoins, which are stablecoins that are issued on one blockchain but can be used on another. For example, the first wrapped token, Wrapped Bitcoin (WBTC), was created in 2019 as a way to bring Bitcoin onto the Ethereum blockchain. Today, there are several other wrapped stablecoins, including Wrapped HBD and Wrapped Hive, which are issued on the cubfinance.io platform giving investors a wide range of investment avenues

Facilitating Cross-Border Payments and the Potential Impact on the Global Financial System

Stablecoins have the potential to revolutionize cross-border payments, which are traditionally slow, expensive, and subject to multiple intermediaries. By using stablecoins, users can send funds instantly and cheaply across borders without the need for intermediaries. This could significantly reduce the cost of remittances, increase financial inclusion, and promote economic growth in developing countries. Furthermore, stablecoins could help mitigate currency risks for businesses operating internationally and reduce dependence on the US dollar as a global reserve currency.

The Hive block chain is apt for this with our free transactions and 3 seconds per transaction. Usually with Banks it can take days especially when intermediary banks are involved which also piles up the transaction costs.

Differences between Algorithmic and Collateral-Backed Stablecoins

There are two types of stablecoins - algorithmic and collateral-backed. Algorithmic stablecoins, also known as seigniorage-style stablecoins, maintain their value through a supply and demand mechanism that adjusts the token supply based on market demand. Collateral-backed stablecoins, on the other hand, are pegged to a specific asset or basket of assets, such as fiat currencies, commodities, or cryptocurrencies. Collateral-backed stablecoins use smart contracts to maintain the peg and are backed by reserves held in a secure vault or custodial account.

Legal and Regulatory Challenges of Using Stablecoins in DeFi

One of the biggest challenges facing the adoption of stablecoins in DeFi is the legal and regulatory environment. As stablecoins have the potential to undermine the traditional financial system, governments and regulators are taking a cautious approach to their use. Stablecoins may be subject to a range of regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Additionally, stablecoins may be classified as securities, which would subject them to securities regulations.

Regulatory Landscape for Stablecoins in DeFi

The regulatory landscape for stablecoins in DeFi is evolving rapidly, with regulators around the world grappling with the challenges of regulating these new digital assets. In the US, stablecoins are subject to oversight by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). In Canada, the Canadian Securities Administrators (CSA) recently issued a report outlining their approach to stablecoins, which includes subjecting them to securities regulations.

In other words, unless a stablecoin is asset backed, it is out. This means trading HBD in Canada is going to be make illegal.

[Source: Canada Showing Us The Future Of HBD by @taskmaster4450]

As the adoption of stablecoins in DeFi continues to grow, it is likely that regulators will continue to issue guidance and regulations to ensure their safe use.

The Future of Stablecoins in DeFi

Stablecoins have seen significant growth in recent years, with total market capitalization increasing from less than $3 billion in 2019 to over $100 billion in 2021. [Source: CoinMarketCap] This growth is expected to continue in the future, driven by the increasing adoption of DeFi applications and the need for stable and predictable cryptocurrencies.

One of the key advantages of stablecoins is that they offer a stable store of value that is not subject to the volatility of traditional cryptocurrencies such as Bitcoin or Ethereum. This makes them an attractive option for investors and traders looking to hedge against market volatility.

In addition, stablecoins can be used as a medium of exchange in DeFi applications, such as decentralized exchanges and lending platforms. They enable users to transact in a stable currency without the need to convert back to a traditional currency, thereby reducing transaction costs and improving efficiency.

As stablecoins become more widely adopted, they could potentially become a mainstream form of payment, particularly for cross-border transactions. This would provide a low-cost, fast, and secure alternative to traditional payment methods, such as wire transfers or international money orders.

Stablecoins and Financial Inclusion in DeFi

One of the most promising applications of stablecoins in DeFi is to improve financial inclusion. Many people around the world are unbanked or underbanked, meaning they lack access to traditional financial services. Stablecoins have the potential to provide these individuals with a low-cost and accessible way to transact, borrow, and save money.

Stablecoins can be used to facilitate microfinance, which involves providing small loans to individuals who lack collateral or credit history. Microfinance is a powerful tool for poverty alleviation, as it can help people start businesses, invest in education, or pay for medical expenses.

In addition, stablecoins can enable remittances, which are the transfer of money from migrant workers to their families in their home countries. Remittances are a critical source of income for many people in developing countries and can help alleviate poverty and promote economic growth.

However, for stablecoins to be effective in promoting financial inclusion, they need to be accessible and easy to use. This requires addressing technical barriers, such as the need for a stable internet connection and a smartphone, as well as addressing regulatory barriers that can limit the adoption of new financial technologies.

Empowering people in countries with volatile currencies, high Forex rates and Forex shortages

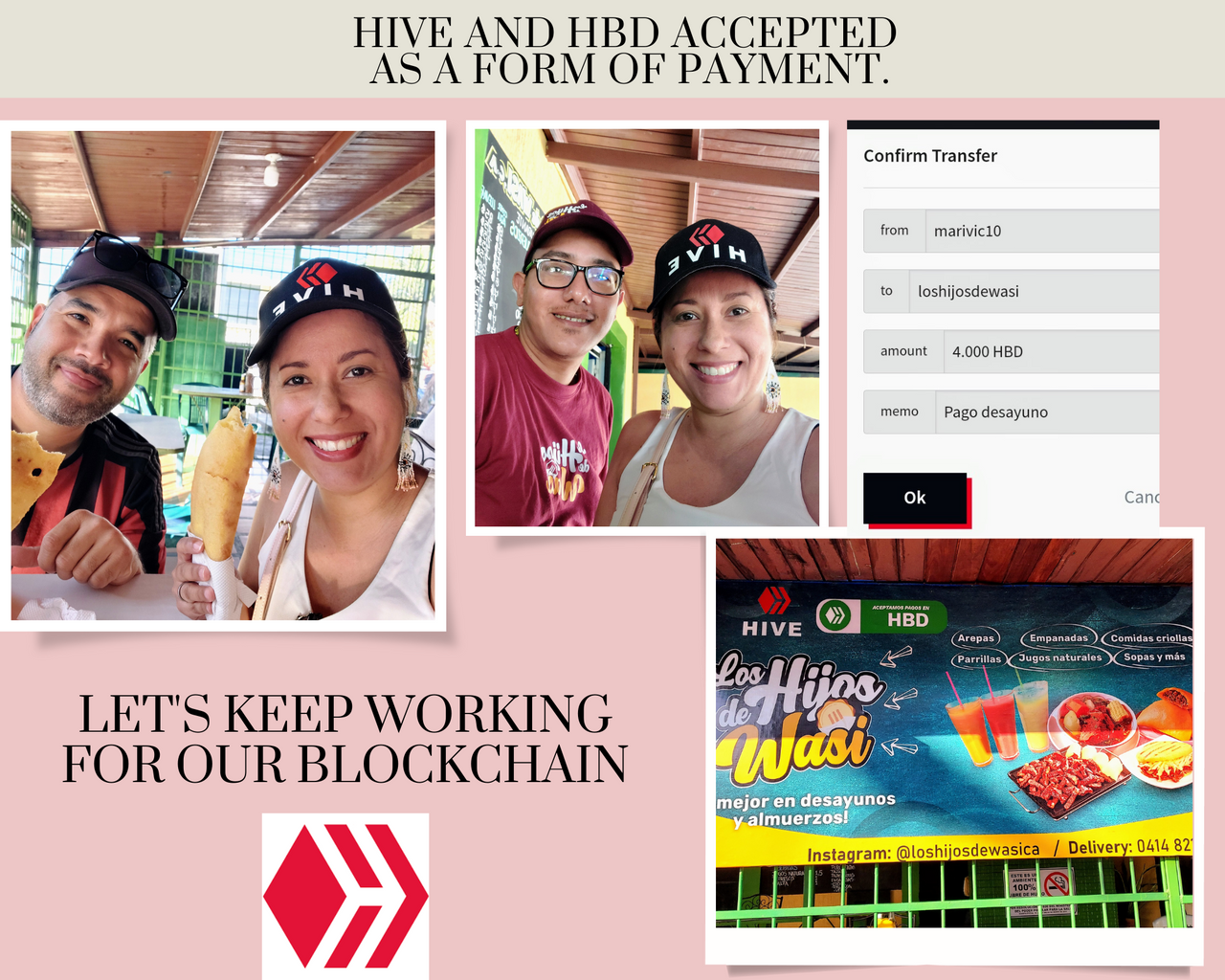

Hive making waves in Venzvuela as a payment method!

Look at countries like Venezuela. Hive is solving the problem of the instability of their local currency Bolivar and lack of access to US dollars. HBD payments are being accepted by business now making

[Source : HIVE and HBD are accepted as payment methods. Today I paid for my breakfast with HBD.. by @marivic10

The dual exchange rate in Argentina

There are two official exchange rates for the Argentine peso. I was shocked when I had to google this after a client in Argentina couldn't make a downpayment for a service I had offered him as his bank outright refused him and asked him to get the invoice changed to say something completely different! At first I thought he was laundering money until I got to the bottom of it.

This system was implemented in 2011 as a response to a shortage of foreign currency reserves and to try to control capital flight out of the country.

The first official exchange rate, known as the "official" or "commercial" rate, is the rate at which businesses and individuals can purchase foreign currency from authorized dealers such as banks and exchange houses. This rate is set by the Central Bank of Argentina and is typically lower than the market exchange rate.

The second official exchange rate, known as the "parallel" or "blue" rate, is the rate at which foreign currency is traded on the informal market. This rate is determined by supply and demand and is typically higher than the official rate.

The dual exchange rate system has been controversial, as it has led to a significant discrepancy between the two exchange rates and has made it difficult for businesses to plan and budget effectively. The system has also been criticized for encouraging the use of the informal market, which can lead to money laundering and other illegal activities.

In recent years, the Argentine government has taken steps to unify the exchange rate and eliminate the dual exchange rate system. However, this has proven difficult due to the country's economic challenges and ongoing inflation.

Conclusion

Stablecoins have a promising future in the DeFi ecosystem, and they have the potential to become a mainstream form of payment and investment. They offer a stable and predictable alternative to traditional cryptocurrencies, making them an attractive option for investors and traders.

Moreover, stablecoins have the potential to improve financial inclusion in DeFi. They can provide low-cost and accessible financial services to unbanked and underbanked individuals, enabling them to transact, borrow, and save money.

However, realizing the potential of stablecoins requires addressing technical and regulatory barriers that can limit their adoption. As the DeFi ecosystem continues to grow and mature, it will be important to work towards making stablecoins more accessible and user-friendly for everyone.

I hope you guys enjoyed reading this post. If you did, please give it an upvote and re-hive it.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @islandboi ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

https://leofinance.io/threads/@islandboi/re-leothreads-52jnsy

The rewards earned on this comment will go directly to the people ( @islandboi ) sharing the post on LeoThreads,LikeTu,dBuzz.