Every perpetual derivatives exchange needs a great deal of liquidity in order to offer traders the best trading experience possible. The greater the liquidity, the greater the utilization, the greater the rewards. GMX.io has been one of the oldest and most popular perpetual derivatives exchanges out there, and since its launch last year, has been able to sustain itself as a Goliath no matter how many times it gets forked.

With so many different protocols building on top of GMX and with over $400 million in TVL, the only issue with GMX is that liquidity providers now have a smaller piece of the pie when it comes to earning rewards and fees. Now barely 7%, this is likely a significant reason why we’ve seen pretty big drops in returns for their liquidity providers ($GLP), and until we see trading activity outpace its growth in liquidity, this may not change.

Whether it be due to size, tech, or the respective chain they’re on, what I’m going to be listing in today’s article are some of the best APR-yield-earning alternatives where you can get the most bang for your buck.

Let’s dive in shall we?

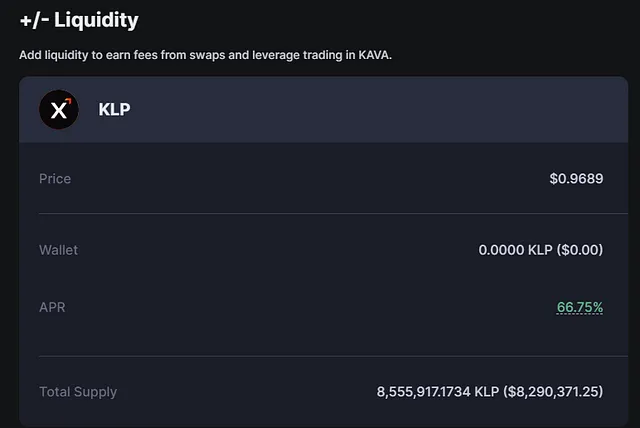

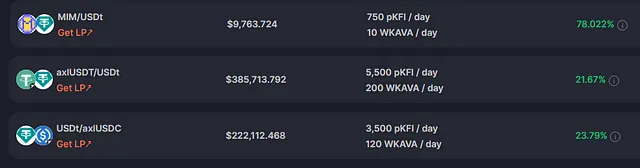

Kinetix —66% APR

Kinetix Finance is a perp DEX on Kava that launched a couple of months ago, and already in that short span of time they’ve amassed more than $8 million in TVL. Going into the $KLP pool will give you significant exposure to both $KAVA and $PKFI, which constitute almost 98% of the yield. It’s also probably worth mentioning that in addition to their perp DEX, they also have some pretty significantly high APR LPs with stables, including:

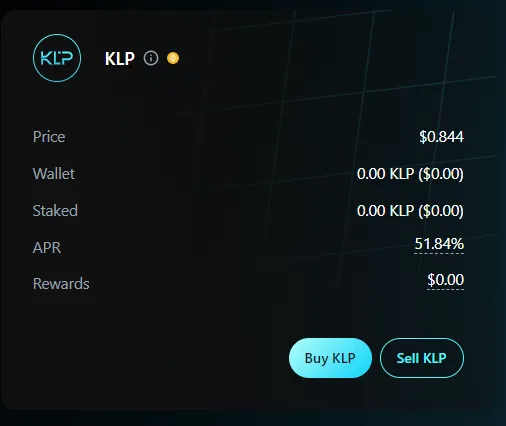

KTX Finance — 51.84% APR

KTX Finance which was originally launched on BNB, earns a solid 51.83% APR and is roughly 5 months old with approximately $5 million dollars in TVL. $KLP holders earn 70% in platform fees in $BNB, and the rest of in escrowed $KTC ($esKTC) rewards — rewards that can earn an interest of currently 79.79% APR. Another detail worth noting is that KTX Finance was the first perp DEX to launch onto Mantle, one of Ethereum’s newest Layer 2’s. Currently the APRs on Mantle are significantly lower at around 20% APR, but I would expect that to change if we see a lot more in-flows into Mantle in the future.

Metavault.trade — 32.67% APR

Metavault is perhaps the oldest protocol on this list, and the only one that I have that’s listed on the polygon/matic network. Their liquidity pool token $MVLP is significantly different from many other perpetual DEXes in the fact that the majority of the allocation (more than 70%) is in $MATIC rather than stablecoins or bluechips:

This $MATIC-heavy approach is also why the current $MVLP price is closer to $MATIC’s current price (roughly $0.55 cents) rather than a dollar.

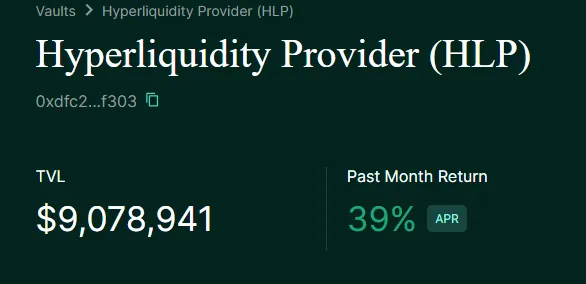

Hyperliquidity — 39% APR

Besides Kinetix, Hyperliquidity is the only one on this list that doesn’t have its own token (*hint hint), and in my opinion is by far one of the best GMX competitors on Arbitrum with its one dedicated L1 network. If you’re interested in learning more about Hyperliquidity, I recommend you check my deep dive I did earlier this month.

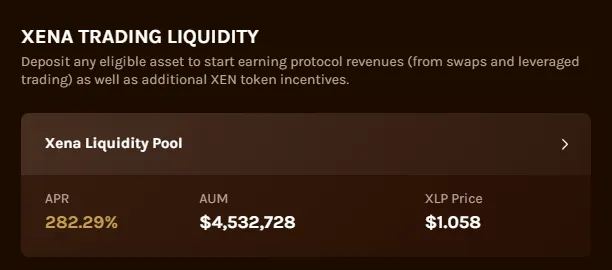

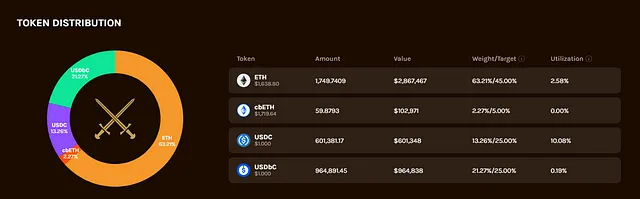

Xena Finance — 282.29% APR

Xena Finance is a Level Finance fork that’s newly arrived on Base, but in less than 2 weeks has already captured more than $5 million in TVL, with a quickly growing community. One thing to note is that $XLP is backed heavily by $ETH, which will give you significant price exposure to it:

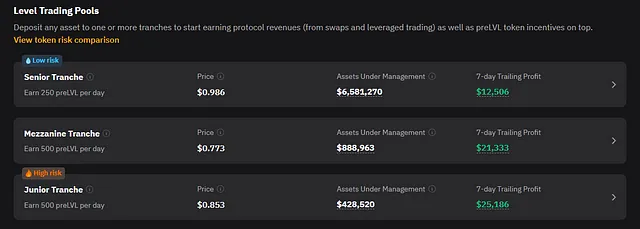

Level Finance — up to 1800% APY

Level Finance is one the biggest derivatives exchanges on BSC, and they’ve made a pivot last summer of also going onto Arbitrum. As you can see in the graphic above, Level has 3 different tranches all with varying risk, and all with varying returns. The Senior Tranche for instance is currently averaging around a 10% APY for the past week yet the riskiest Junior Tranche has made more than 1800% APY.

A couple things to note before you start aping in:

✓ These returns are based on a 7-day rolling figure so I imagine that the returns can significantly vary depending on what window of time you’re looking at.

✓ All of these pools accrue the platform’s native $LVL token in yield, which honestly has seen much better days:

Conclusion

As you can see from this list, apart from difference in APY, there’s also significant differences in how the liquidity pools are structured. For instance, GMX has its own $GMX token that accrues platform fees, but other platforms, such as Hyperliquidity’s $HLP, accrues everything including PNL and platform fees.

That being said, no matter how well it’s structured, with all counter-party vaults there is always the risk of traders winning, or in otherwords, there will always be the chance of the gambler beating the casino. Overall the odds might be in the casino’s favor, but it can’t prevent from one massive whale winning big.

And lastly, before entering into any type of high yield vault, please read my PSA.

And as always, thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. If you want to get access to all my draft links or get an idea about what’s next on my docket before I publish, find me on Friend.tech (and now New Bitcoin City), where if you’re a keyholder, I share all that information in my chatroom. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: And as a final reminder, this is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!