I shared my thoughts recently on why I think Metis Marathon is the best kept secret in crypto right now and with the current market conditions, I would like to double down on that statement using Hermes Protocol as an example.

What Is Hermes?

Hermes can be looked at as just another DEX but with a lot of added features. If you are familiar with Solidly or the Ve tokenomics model in general, you can think of Hermes as one more itteration of that idea.

Hermes allows all parties involved to benefit from the exchange itself. Liquidity providers earn fees and an added layer of incentives while token holders control token emissions. Locking your tokens up for a certain time period allows you to have a say in token distribution.

Your locked tokens are turned into a Ve NFT that allows you to vote on token emissions in what is called "the Gauge".

Your vote value will depend on the number of tokens you locked up and the time period you chose. The longer the time period, the higher the multiplier which increases your voting power even more.

For a detailed explanation be sure to check the official documentation

What Is Metis Marathon?

Metis organized an event called Metis Marathon where projects in the Metis ecosystem get additional $Metis tokens to distribute to their users. This is where Hermes comes into play.

The way Hermes decided to distribute these rewards is simple. If you lock your Hermes tokens for 4 years, you get a portion of your locked value back next week. Depending on the total amount of tokens locked this number can vary, but based on my personal experience, the lowest ever return I got in one week was 50%. With the current price increases in crypto markets, the numbers look even better.

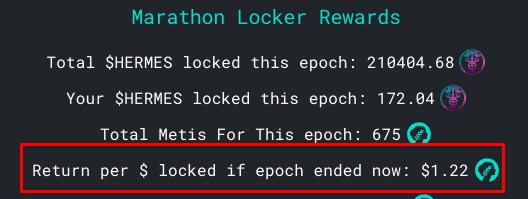

At the time of writing, there are about 11 hours left until the end of this week's epoch. As you can see, if things stayed the way they are now, locking up $100 worth of Hermes would yield a return of $122 in Metis tokens in about 7 days from now.

I am sure that this number will go down as the end comes near but this should give you a good idea on what you may be missing out on. Those that consider investing in the Metis ecosystem in the long term could consider adding small amounts of disposable capital to Hermes every week.

Yes, your investment is locked for 4 years but you are essentially buying $Hermes at 50-80% discount every week. Most of your investment is returned next week and you get to keep your Hermes tokens, plus, weekly emissions from the gauge. These rewards accumulate for the next 4 years.

This is what is called a no-brainer in my book.

How To Buy Hermes?

- Go to Chainlist and add Metis to your wallet

- Go to Synapse protocol and bridge tokens from almost any chain

- Don't worry about Metis for gas fees, Synapse converts some of the funds into Metis automatically

- Go to Hermes and swap your tokens for $Hermes

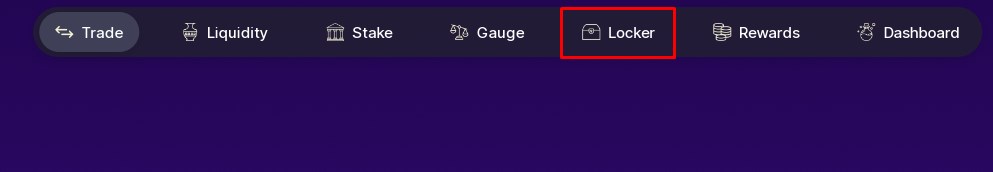

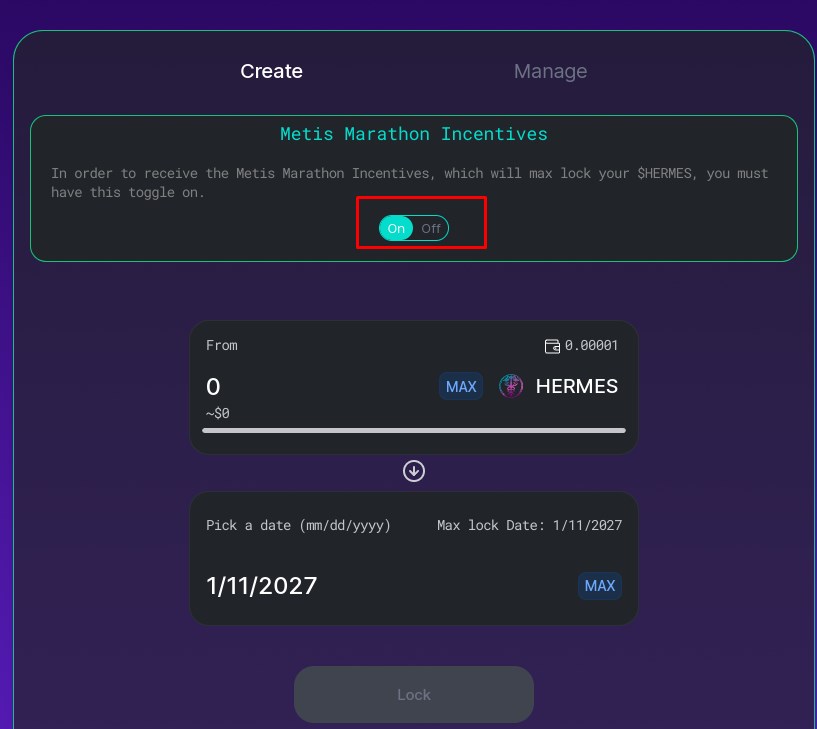

- Select "Locker" and follow the instructions on the screen

Make sure that your "Marathon incentives" are turned on

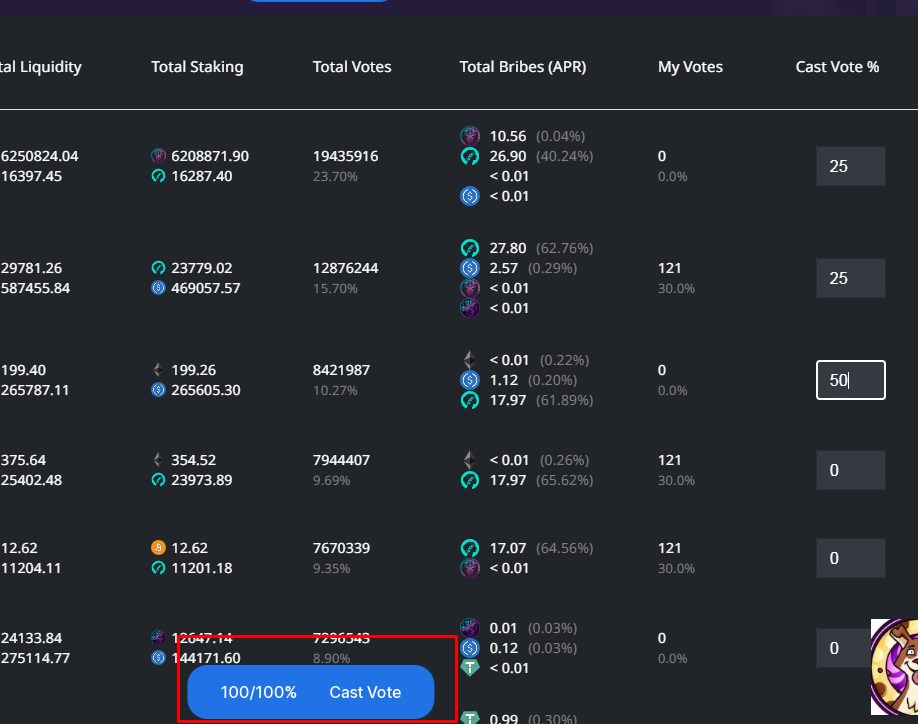

After locking your tokens go to the gauge and vote on any of the Metis pools:

HERMES/Metis

Metis/m.USDC

WETH/Metis

m.WBTC/Metis

All of these qualify for Marathon rewards. You can vote for one or multiple pools by entering the percentage of your vote that you want to spend on that pool. When you are satisfied with your vote distribution click on "Cast Vote"

After that, you are all set.

Sit back, relax, and wait for next week when your Metis rewards will start rolling in.

If you want to get more alpha like this daily consider following me on Twitter or joining the Leo Airdrop Hunters Discord server.

Posted Using LeoFinance Beta

I dig it- I’m just curious about METIS as a whole… I was into different chains and their opportunities, sure, but I felt like diversifying only splits your attention. HIVE is getting all my attention for virtue of being familiar.

I agree, don't spread yourself too thin, but this is an exception in my book.

Btw, I wrote about Metis a while ago, if you are looking for reading material. It's still very relevant.

Posted Using LeoFinance Beta