I have been trying to find some good words for the current situation with the ETH network and the Twitter cultists that praise it consistently but I just can't see the same value they are seeing. Most of the people I know have a few hundred dollars to invest, sometimes even a few thousand but that is a stretch. If they decided to go with ETH that would be a really bad experience.

The False DeFi Narrative

If you ask the internet it will tell you that DeFi started on Ethereum and everything else is just a bland copy of this amazing network. How many of us are actually able to pay the costs of decentralization and innovation at this point in time? Simple transactions can cost up to $50 while more complex ones will require a few hundred dollars in ETH. The best part is that if those transactions fail, you aren't getting that money back.

I learned all of this the hard way earlier this year. ETH was picking up the pace but you could still transact for a few bucks. I started providing liquidity on Uniswap, started depositing coins in DeFi protocols, and forgot about them for a while.

Right now, if I wanted to take my liquidity out of Uniswap I would need more money in ETH fees than what I would get out of them. In other words, my capital is trapped on ETH and it will stay that way for a while I guess.

The cost of True DeFi

Ideally you want decentralized finance to run smoothly on decentralized chains but that is simply impossible. If you were a new investor that wanted to put $2k in DeFi protocols on ETH here is some simple math:

Step 1 - Obtain ETH on a CEX

Step 2 - Move ETH from CEX and pay ~$40 in transaction fees

Step 3 - Swap ETH for desired currency on Uniswap - ~$100 in transaction fees

Step 4 - Deposit said currency in a protocol - Approve spending ~$20, execute deposit contract ~$100

Best case scenario, your $2k ended up being worth almost $1700 but this is not all. You have to remove those tokens and swap them back if you want to cash out so prepare at least $500 to move your cash in both directions.

It is more than clear that investors with a few hundred dollars have no business in DeFi on ETH but they are constantly told that this is the place to be... No wonder they end up getting rugged by scammers on BSC or whatever centralized chain they chose as an alternative.

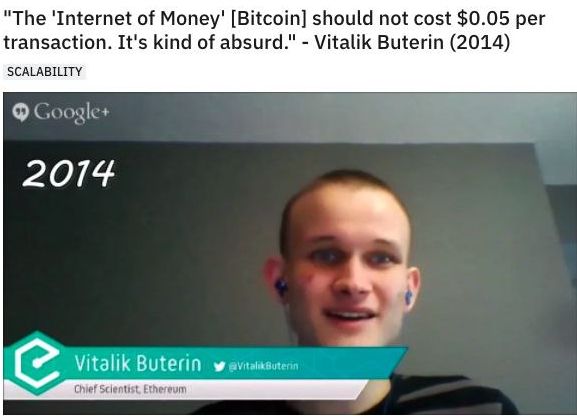

The Internet Of Money Should Not Cost $0.05 Per Transaction

These are the famous words of Vitalik Buterin while he was criticizing BTC for expensive transactions back in 2014. We have come a long way.

Instead of fixing the problem we now have a network that is exclusively being used by billionaires, NFT flippers, and those that didn't figure out the alternatives yet. Knowing what I know about ETH 2.0 there is no fix in sight and this may be the new normal for ETH. At least for the next year or so.

How long will it last, no one knows but even billionaires will be sick of paying $500 for simple transactions. I fear that this is the point where things will go south for quite some time.

Conclusion

Poor people are completely thrown out of the window in the ETH kingdom and they will not be welcomed back in the foreseeable future. If you don't own millions before getting into crypto, you have no business using the ETH network because it is not for you.

I'm sorry this rant turned into shitting on Ethereum but with the current state of things, it is hard to draw one positive conclusion. The vast majority needs decentralized banking services for small sums, not millions and billions. If we want to bank the unbanked we need to provide cheap services. Instead, we are asking for an arm and a leg during the onboarding process.

Posted Using LeoFinance Beta

So which chain is doing this the best?

Maybe ranked by true decentralisation?

Posted Using LeoFinance Beta

Still remains to be seen imo. POW seems to have an edge for now but PoS and DPOS will probably be the more accepted options for logical reasons.

That is why I'm placing my bets on Hive but there is still a long way to go. So many possible flaws in all of the consensus systems we use right now and so many unpredictable issues that may come up in the future.

It is a very hard thing to predict from this perspective I guess.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.