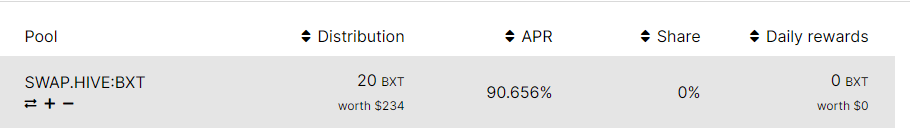

The BXT/Hive pool pays 90% APR and while it may come with a bit more risk I have a simple logic why I'm putting my earned BXT in this one from now on.

If you convert half of the earned BXT and pool it with Hive in this one you will double your initial BXT earnings in a very short period of time. Depending on the starting stack you could catch up with those earnings in about a month or two.

The ideal scenario would be that both Hive and BXT keep pumping and rewards keep increasing but crypto is anything but predictable.

The bad scenario is that BXT price keeps falling and you end up with more BXT in the pool but thanks to the very low supply you can simply stake it and earn much higher Hive rewards than what you can get now.

Something to think about at least imo. 90% APR is too large to ignore.

Posted Using LeoFinance Beta

I looked at this hive/BXT pool as well. The % is very good indeed but i fear the risk of the BXT token dropping in value massively as it's basically a farm token. Well, it's better than a standard farm token because it pays out HIVE rewards.

For me personally account, i might take the risk and put a small amount into that but for LBI, less risk is better plus the BXT has to be converted to LEO for weekly div's

Posted Using LeoFinance Beta

You are right. A fund (LBI) should be more conservative than a one man show.

Posted Using LeoFinance Beta