This post will specifically reference the WLEO token, but the information could be relevant to other projects looking for information on Liquidity Pools and BAL token mining.

The Balancer DEX and Liquidity Pool platform is an interesting one. Liquidity providing is incentivized by emissions of the BAL token, which is earned on a vast array of tokens and pools, unlike Uniswap where the UNI token is only earned on a few.

The way BAL is distributed is fairly complex, and there is much more customization options with a Balancer Pool. Here is what I have learnt so far:

Pools with BAL earn higher rewards. Obviously the platform wants to encourage a highly liquid market for its own native token, so pools containing it will earn higher BAL payouts.

Balanced pools earn better than unbalanced. Pools can be set up with a very one-sided structure - up to 98% one token and 2% the other. This is great for minimizing Impermanent Loss, but not necessarily great for thew platform. Also, a pool like this could be used as an attack vector, setting up a pool, massively inflating the value of the token, leading to a huge "on paper" liquidity and higher rewards. To counter this, balanced pools are rated higher.

Pools with highly correlated pegged assets earn lower BAL. For example, a WETH/sETH pool will receive lower BAL than others.

Pools need at least 2 whitelist tokens to earn rewards.

Lower fee pools earn better than higher fee. Pools can be set up for different purposes. Some target high swap fee income, others lower fees, higher transaction volume and higher BAL payouts. With a token like WLEO, I think swap fee income shouldn't be the high priority, higher BAL return would be preferable.

How do tokens get whitelisted?

The process is pretty straight forward. All that is required is to submit the Token symbol, address, Etherscan link and Coingecko link to the dedicated Discord channel. Each week tokens get added to the whitelist, provided they meet some basic eligibility checks.

Ok, so what would an optimal pool look like for maximising BAL payout for a WLEO pool.

- 60% BAL

- 40% WLEO

- minimal fee - 0.3% or less.

What sort of ROI could be earned?

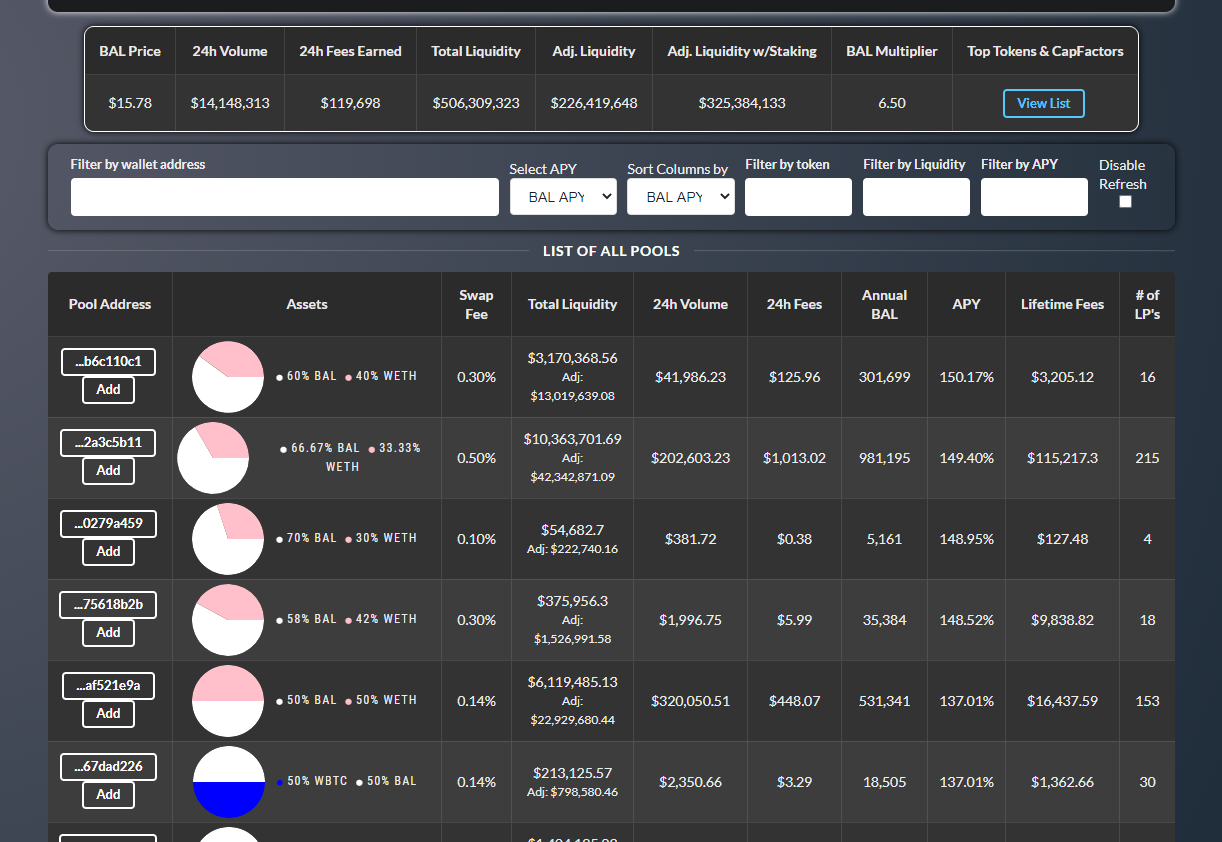

The most profitable pool in terms of BAL mining, according to [Pools Vision](https://pools.vision/ - a website set up to track performance of the different pools) is a 60% BAL, 40% WETH pool with a 0.3% swap fee, generating an APY of 150%. Here are the top pools, sourced from the pool vision site linked above, and sorted by BAL APY:

These returns will vary depending on how much liquidity Balancer has, and could vary greatly over time.

Setting a pool like this up is permissionless. We don't need to apply to anyone for listing. Being added to the Balancer swap platform is a different story. This is up to the discretion of the devs there. Swaps are available of course using the contract, but a simple token ticker would be nice and easy.

Whitelisting for BAL rewards would be a formality I think, the WLEO eth contract is pretty straightforward I think, and the token is gaining volume, price and liquidity on Uniswap.

Why mine BAL?

I think a pool on Balancer for WLEO, optimized to maximize BAL income, could bring new investment in to the WLEO token. Liquidity Providers will find the high BAL APY and add to the pool, maybe even doing some research first to find out what we are all about.

The other reason I like it is that a pool could be set up, and @khaleelkazi and the LeoFinance team would not have to offer a bounty to encourage liquidity. More listings and more availability could add to the marketing campaign to push the big CEX's to list WLEO. Growing pools on 2 platforms is a stronger narrative than one pool on one platform. Also, the addition of a BAL/WLEO pool opens up a whole new arbitrage channel for the smart WLEO traders.

The Uniswap pool is going fantastically well, opening up another option could take WLEO onwards and upwards. I know more options are in the plans for down the track, but momentum is a powerful force and I think there is plenty behind WLEO at the moment.

I don't know if Balancer is the best option, it is just the one I have been playing with a bit and have done some research on.

Links for further reading:

Lastly, the cost to set the pool up would simply be a gas fee charge. It is quite expensive in terms of gas. In the LEO discord a couple of days ago, I did a background check of the cost to set up a pool, and the amount of Gas required was around $250. This could be higher or lower depending on the ETH network activity and current Gas levels.

Thanks for reading,

JK.

Post dividers and banner courtesy of @barge - 5% beneficiary set.

Posted Using LeoFinance Beta

I need to have a look at this one. Now... I just need to find the time for it.

Posted Using LeoFinance Beta

So many options, so little time. Everyone is rushing to Uniswap, but I actually prefer the options, customization and the overall UX of Balancer - but Uniswap is still the dominant player in this space for now.

Posted Using LeoFinance Beta

I am still reluctant to use these kind of things with ETH... after ETH upgrade, maybe I will feel more comfortable... if it would be EOS, I might have been already deeply involved.

It could help with the LEO sell off I'm expecting as the current bonus period comes to an end, if there's an alternative place to stake these tokens!

I'm not sure if there will be a sell off. I see more options being opened up over time, and tokens being moved around a bit chasing yield, rather than a sell off. Lots will come back on to hive once the bounty ends, and go back to being staked and used for curation I think. We will see I guess.

Posted Using LeoFinance Beta

Well that doesn't sound too bad, if all it is $250 to set up the pool, beatss the fees you need to pay to get listed on a CEX. Would be interesting to see how a BAL pool would affect UNI would traders jump to the one with less competition and better yield and how that would draw even more tokens out of HIVE, hmmmm

Posted Using LeoFinance Beta

I think it would introduce an interesting dynamic and an alternative to the Uniswap pool. As the WLEO market cap steadily grows, more options become viable. Who would have thought that $350,000 market liquidity would be achieved after only a week.

Posted Using LeoFinance Beta

Very nice article here, with well researched information!!

Thank you, glad you liked it.

Posted Using LeoFinance Beta

@tipu curate :)

Upvoted 👌 (Mana: 0/7) Liquid rewards.

Thanks @cardboard appreciate it.

Posted Using LeoFinance Beta

Balancer looks like a second best after uni and I think its a nice idea what are you propsing here.

An alternative option, optimized for farming BAL is appealing I think.

Having a second market, could increase awareness and arbitrage opportunities, without needing another bounty program.

Avoiding cannibalising the Uni pool would be an important consideration.

Posted Using LeoFinance Beta

That's some valuable research as I know Balancer is making waves in the DeFi sector. What really blows me away is how much you guys accomplish as far as outreach working together as a team. Exciting times ahead. 👍

Posted Using LeoFinance Beta

I really like it as a portfolio management tool, if only I had a proper portfolio to manage.

LEO is great because there is some smart people here, all motivated by mutual self-interest. A bunch of people on the same page, with a common goal can work wonders.

Posted Using LeoFinance Beta

My portfolio is small but growing. Lately, it's started to feel like it's all over the place. I'll have to spend some time checking out these different protocols. Dexter just came out for Tezos today. Add another to the list of DEX'es to research. 😁

Posted Using LeoFinance Beta

@tipu curate :)