As has been the case in the past, macroeconomic news is an important aspect to consider in the price development of Bitcoin and other cryptocurrencies such as Hive and the Leo token. The focus this week is on the Fed's interest rate decision, which will directly influence the equity and risk markets, which for now includes Bitcoin and alticoins, so it is a piece of information to watch out for this week.

CPI, Interest Rates

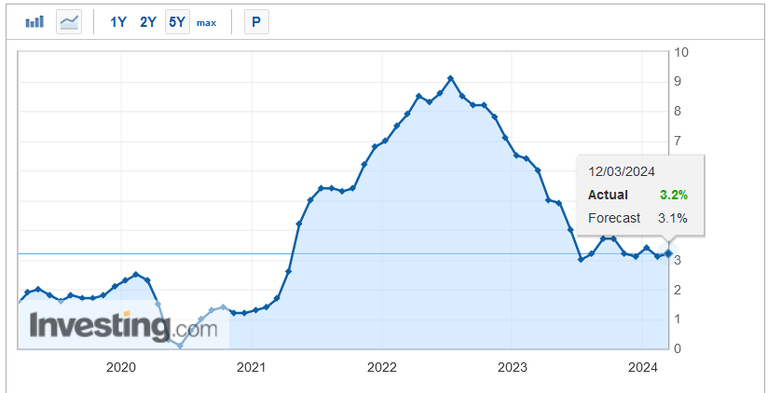

Due to the release of the CPI in the US, we can speculate a bit on the decision to raise, lower or keep interest rates the same, as I explained a week ago my article on the US CPI, this is the main piece of information to keep in mind to speculate on market movements for this week.

Despite the fact that there was a decrease in employment in the US which is a sign of a decrease in liquidity, the CIP went up one basis point from 3.1% to 3.2%, so it shows that despite the efforts to keep interest rates high inflation is still ravaging the economy, even going up one basis point which may trigger a more aggressive discourse from the FED on its economic policy to control inflation, all this to attack and not let the inflation monster grow.

Prediction: Interest Rates Stay the Same

My prediction for interest rates is that they stay the same at 5.50%. I think it will not move for two reasons. The first is that you cannot lower the interest rate because of the CPI data, which has increased, even though it is little, it is a sign that it can continue to increase. I think that they will not go up because it would put too much pressure on the banking sector, which could create a more pronounced banking crisis than expected. In addition, there is also the risk of going into recession and the FED has to keep the balance so that inflation gradually decreases.

How will it affect Bitcoin and Cryptocurrencies?

The markets have already reacted to the possibility of maintaining interest rates by ruling out the reduction altogether, that would explain why all markets (both traditional and crypto) pulled back and marked red numbers these last few days, so the market is betting on maintaining or in extreme that interest rates will rise, however, there is another important issue to take into account for that day.

Powell's Aggressive Inflation Speech

Fed Chairman Jerome Hayden Powell is due to appear before the media and give details on the economic policy adopted by the Fed to curb inflation, which is the priority for the US economy, so I would expect a speech with an aggressive tone to reduce inflation by mentioning for example that interest rates are likely to remain on hold for longer than expected.

This speech will give volatility to the market, possibly with an aggressive anti inflation speech, which may mean that markets will have significant volatility and several may have corrections and red numbers for the day. Although the market has already reacted in advance, it is Powell's speech that may provide the most volatility for March 20th.

In the event that the speech signals the possibility of interest rate hikes, volatility will be higher.

Opportunities in Bitcoin Cryptocurrencies

I think the possible pullback may mark some entry opportunities in the markets, however, there is news affecting the fundamental analysis of BTC that suggests it is possible that the price could recover much better than other assets, one such news is that MicroStrategy is still acquiring debt and selling shares to accumulate more Bitcoin, so Saylor could be waiting for the right time to make purchases possibly days after the interest rate announcement trying to make the transaction at a favourable price.

Another point in favour of Bitcoin and cryptocurrencies is the gradual loss of confidence in the dollar and the economic policies carried out in recent years, taking into account that this monetary policy has its beginnings in the massive injection of liquidity in the pandemic and has greatly affected the U.S. economy. If we add to all this the distrust in the banking sector to assume the interest rates, many investors may turn to buy cryptocurrencies, especially Bitcoin in the near future through ETFs already approved.

Bitcoin and Cryptocurrencies Will Continue to Grow

Perhaps at the moment macroeconomic policies are not feeling entirely favourable, however, BTC has managed to break its previous all-time high even before Halving, so it is possible that much of that news could be absorbed into the market and come back very quickly as it continues to break all-time highs, so seeing any pullback in the price of BTC would be a new opportunity as we are in a bullish cycle.

Posted Using InLeo Alpha

Thanks for the update friend, Inflation on fiat has always proven an opportunity for other assets. At first it was rare metals like gold and silver. Very glad that big investors are also seeing btc as a store of value and safe haven against inflation.

Thus, institutional investors now see in Bitcoin the solution to the problems of the current financial system and the risks it has. Although it is still observed as a risky market BTC will be seen as a refuge of value. This will benefit the entire crypto ecosystem.

Crypto will gain attention with time

The USA has a problem with debt and interest rates, both FED and private households.

All that can cause or collapse the economy starting with generating mistrust in the dollar, is a very serious problem.