Bitcoin miners are leaving China as the CCP clamps down yet again. Many are going to Texas due to the crypto-friendly government and some of the cheapest electricity in the world. Add to that the possibility of mining via renewables or eco-friendly power sources and you have a winning formula that will take bitcoin to the next level.

Personally I imagine that some miners will also move to El Salvador, the world’s first nation to now use bitcoin as legal tender. When your own sovereign currency dies and all you have left is the dollar, it makes sense to jump at the bitcoin alternative. It’s not out of fondness for the tech that El Salvador accepted bitcoin but out of necessity. And they may become the world leader overnight in the cryptocurrency field.

But Texas will give them a run for their bitcoin. The “great mining migration” caravan is heading to the Lone Star state, which happens to be America’s leading wind-powered energy producer, with almost 30% of the US wind power supply. That is a sure way to change the global cryptocurrency playing field.

This is all it takes to push bitcoin to the next level – mainstream government adoption. We’ve had institutional investment arriving in a big way this particular bitcoin bull cycle, and now government adoption has arrived. “This time it’s different” has never been truer for the bitcoin halving cycles. Greg Abbott, the governor of Texas, is actively promoting bitcoin mining, aiming to turn it into a full fledged mainstream industry for the biggest state in the USA.

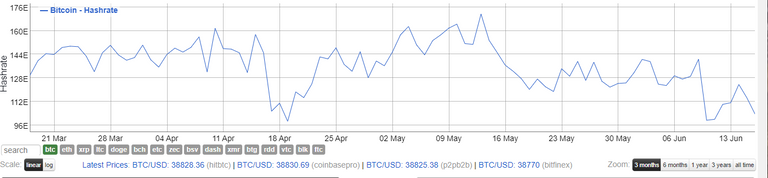

As miners switch off their rigs and farms in China, naturally the hash rate has dropped and is currently down about 30% from its peak in mid May. Ultimately at least half the mining hash rate will probably leave China under their clampdown, all to the benefit of decentralization overall. The earlier dominance of Chinese mining farms was always a slight concern, but those days are over. This is proving to be yet another revolutionary year for bitcoin.

As president Nayib Bukele suddenly becomes the darling of bitcoin community, accepting them with open arms, his dream of creating a bitcoin-powered economy for El Salvador is becoming a reality. Who would have thought that one of the smallest nations on earth would be the smartest and first mover to fully embrace bitcoin? Even if out of desperation.

All that volcano power is finally being put to the correct use – powering the mining rigs. The theory that bitcoin is dirty and uses masses of carbon fossil fuels to mine is a smear campaign. There is so much renewable energy going untapped all over the world. In fact Canada alone could power all the bitcoin mining in the world from its geothermal power. Well El Salvador has beaten them to it. Volcanoes it is.

Already leading members of the bitcoin community have met with Senor Presidente in El Salvador and big moves are being made. Do you want salsa with that? The delegation included bitcoin podcaster Peter McCormack and Paxful exchange CEO Ray Youssef. Not only that but the ripple effect is occurring (pun intended). As El Salvador strides ahead in bitcoin adoption, USA is obliged to increase their curiosity and take it more seriously.

The argument that bitcoin is too volatile to be a legal tender can work both ways. Your store of value may drop for a while, but it may and does also rise just as dramatically. In fact more dramatically because the long term overall trend is definitely up and to the right. Add to that the fact that with time the curve or trajectory of bitcoin’s price climb will flatten. The price will stabilize as the years go by – theoretically. In fact it has already been evident that with each halving the price climb is proportionally slightly less than the last.

It’s only a matter of time before the bitcoin price levels out around $1 million per bitcoin. This bull run should take us to the hundreds of thousands of dollars and the next halving cycle in 2024-28 will take price to the $1 million level. The volatility is dropping over time, only making bitcoin more attractive by the year, and more scarce, and thus more sought after and stable in its use case for store of value and means of exchange.

El Salvador is merely the first mover, thanks to being a small nation and a desperate one. Texas will pull the USA into the mix and other nations will follow in time. This is truly a momentously bullish time for bitcoin, despite price showing only slight moves to the upside just now. This next leg of the bull run this year will stun onlookers and give us a spectacular show like we haven’t seen since 2013. I hope you have your popcorn ready.

Refs and image: https://cryptonews.com/news/el-salvador-gov-t-mulls-btc-pay-as-int-l-bitcoin-players-rol-10708.htm

https://cryptopotato.com/exodus-chinese-bitcoin-miners-set-their-sights-on-texas/

https://bitinfocharts.com/comparison/bitcoin-hashrate.html#3m

volcano image: pixabay

Posted Using LeoFinance Beta

Less mining coming from China can be good for decentralization as well.

Posted Using LeoFinance Beta

Yes indeed, this is for the best and will remove that uncertainty regarding China's influence over bitcoin that has always been there.

Posted Using LeoFinance Beta