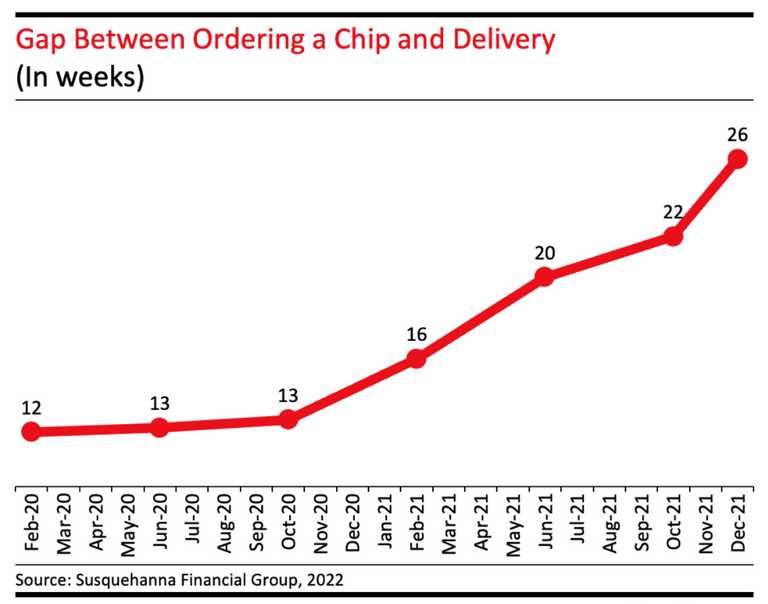

If COVID-19 wasn't enough to put global supply chains in disarray, we have another conflict to make matters worse. I have long believed that any central bank action targeted at inflation is misplaced. The situation we currently face is a result of the imbalance created by normal demand and a broken supply. Adding fuel to that fire was easy monetary policy, and helicopter money in developed nations. Supply Chains haven't been restored. For example, most industries are still facing chip shortages.

Just as the world was about to declare victory on COVID-19 by removing almost all restrictions, Russia hit Ukraine with a Special Military Operation. In my previous post on the topic, I had argued why Russia has the financial wherewithal to fight a prolonged war. At least, it will be less impacted by sanctions this time. The West is still debating whether to ban Russian banks from the SWIFT ecosystem, btw. I also mentioned why lends to Russia's confidence. It is one of the largest suppliers of Natural Gas, Crude Oil, Fertilizers, Wheat, and many many Metals. Who will ensure the supply of these products post-sanctions?

The first problem that arises is in logistics - cargo and passenger. What about cancellations and re-routing of ships, trains, and planes?

Shipping ports around the Black Sea have closed, halting dozens of cargo vessels. But the more immediate effects are likely to be felt in air shipments between Asia and Europe, which now have to divert around Russian airspace,

I still think this is a smaller problem that the world will be able to solve. It does lead to expensive transport, delays but it can be sorted. Let's look at the bigger problems - Supplies of essential goods.

Ukraine and Russia are both substantial sources for palladium and platinum, used in catalytic converters, as well as aluminum, steel, and chrome.

While the absence of important raw materials will lead to higher inflation, it also means that plants have to be shut down. That is a straight hit to growth and incomes. I think Elon Musk sent a Starlink satellite to restore internet in Ukraine, but what happens when trade is stopped with the 3rd largest supplier of Ni for his cars' battery packs?

Russia and Ukraine are also important suppliers of Sunflower Oil. What happens to the price of fried snacks that we all enjoy?

The biggest agricultural commodity to come out of Russia is Wheat. The two countries embroiled in war account for one-third of the wheat market. They account for 20% of the corn market. Will France run out of Bread or Italy out of Pasta? Probably not but food inflation will be a problem. If essentials are about to get expensive, then what happens to discretionary spending? GDP growth is also about to take a hit worldwide.

The problem is inflation is going to rise and growth is going to falter. So what happens to the 4 rate hikes by the US Fed?

Still happening according to the market I guess

Aggressive rate-hike bets priced in by markets from the likes of the U.S. Federal Reserve, Bank of England and European Central Bank had already come off in the past week.

The market is still expecting that the Fed will go for a 25 bps rate hike as opposed to an aggressive 50 bps. The central bankers are in a soup. They have to target inflation but also support growth. Inflation is about to skyrocket and growth about to take a hit - a double whammy for them and they need to act. Also, will their slightly dovish stance further add fuel to the fire of inflation? Interesting times ahead, for sure!

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.