You are not lazy, you work hard so as to have enough to sustain yourself and save as well. But you just don't understand, after allocating money for monthly expenses there seems to be nothing left to save. What could possibly be wrong?

The answer is not far-fetched, you might think. Insufficient income is the problem.

Or is it?

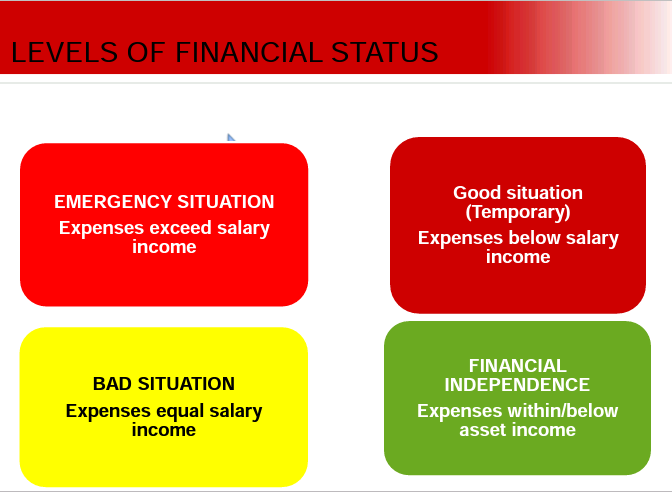

Being on a payday to payday treadmill basically means your expenses is equal to your income. This is not an ideal situation. Let us consider the classes of financial status.

Classes of Financial Status

- Vicious cycle of poverty. Here, there is low income level compared to available and recurring expenses. This leads to:

- low/no savings

- low standards of living

- no tangible investment

- limited opportunities for next of kin... among others.

- Financially Unstable. One of two things can bring about financial instability. It can either be 'low earnings' or 'living beyond one's means'. And sometimes both. Lack of goals and uncontrolled purchasing habits leads to poor management of personal finances. Hence, this leads to:

- low savings

- low asset accumulation

- cash flow crisis

- Financially Stable. This class' income is reasonably above it's expenses. The financially stable has a plan for obtaining financial resources and and manage them well. They:

- make budgets before spending

- have controlled purchasing habits

- save for long term stability

- invest earned resources

The illustration above shows 4 levels of financial status. Now ask yourself: 'What level do I fall into?' You do know the answer.

When it comes to financial matters you can lie to everyone, but you can't lie to yourself.

Analyse your status.

Know your financial level and net worth. Find out if there are any spending leaks and rectify them immediately. Make a budget and use it to guide your expenditure. Set up financial goals and work towards achieving them.

A person's financial stability is defined by his decisions, not really by his income. That is why you will see a man earning 5 figures has more achievements than one earning strong 6 figured. This is largely due to their actions and orientation. Therefore, don't think because you have low income you can't achieve much. Put into use the points above and see whether you are improving in your finances.

Continue putting in your best and elevate your game. Carefully make plans for your finances and see how you can climb the ladder of financial status.

Thanks for visiting my blog.

Posted Using LeoFinance Beta

Congratulations @kennysplash! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 100 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!