The contrast in the headline I chose for today's post is intentional: the U.S. is conducting a coordinated attack against Crypto through regulation meanwhile, China and other jurisdictions are becoming more crypto friendly. This is not a drill!

I'm not one for politics but when it comes to Crypto and jurisdictions, I think there is a fascinating and highly relevant discussion to be had.

Security or Commodity?

The news is dropping hot on this Monday morning and there is a lot to unpack.

Firstly, it looks like the CFTC and SEC don't have their stories straight. Is Bitcoin a security or commodity?

In the lawsuit today, the CFTC called BTC, ETH, etc. "commodities" while the SEC has been claiming they are securities.

A commodity is any basic good that can be bought traded or exchanged. The key word is basic - things that are almost like natural items in the world like Lumber, Oil, Grain or Gold.

Securities are defined in a few different ways. The most common is the idea that there is a common enterprise and ways to benefit from that common enterprise via buying some sort of stock issued and sold by a corporation and not participating in any of the work.

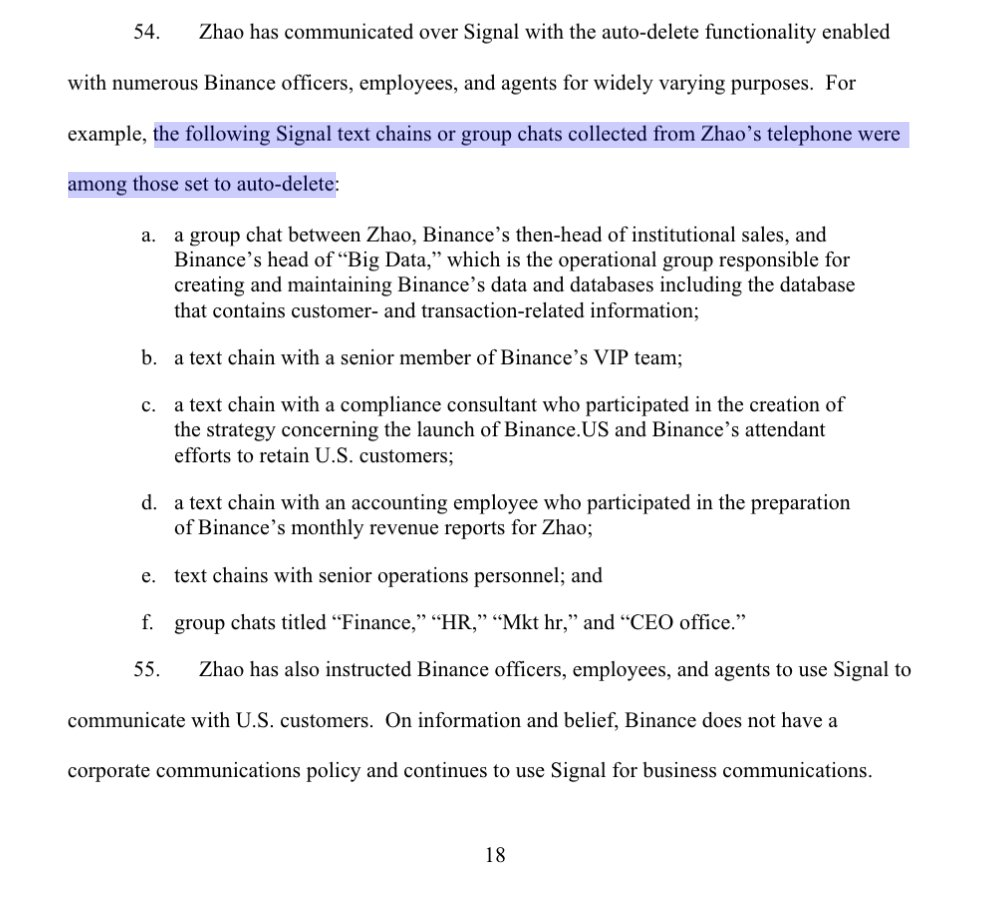

CFTC Sues CZ and Binance

The CFTC is essentially claiming that CZ is insider trading on the Binance platform. They have a claim in their suit that over 300 Binance accounts are owned or can be linked to Binance / CZ directly and that they are trading with those accounts.

There are also other items in the doc that point to him sharing data with people who are trading on Binance. Potentially looking like some kind of frontrunning / taking advantage of users type of situation.

Billionaires and big corporations get sued all the time. To me this is mostly FUD. At the end of the day, the majority of what CZ does is all overseas.

China Gets More Crypto Friendly

If you've been in crypto long enough, then you've seen China go through so many periods of FUD and FOMO.

Ironically, as the U.S. is cracking down on Crypto, China is now loosening on crypto. We're seeing a coordinated move on that side of the world to get deeper ties into crypto and adopt the innovative technologies that it provides.

I see this as a huge war frontier. I think nations are going to battle over crypto and adopting blockchain technology.

While a lot of jurisdictions are anti-crypto, there are a lot who are pro-crypto.

My Take

I wanted to quickly share all of the above news stories because I see a lot of ties into each other. I think we're seeing a global shift as the tides turn in terms of the way exchanges, governments and corporations view crypto.

In my opinion, I think this is a new war frontier. Just like how we used to fight on the battlefield straight up but then moved to vehicular warfare and now fight digital wars 24/7/365 on the internet, we're going to see another frontier open up in the blockchain/crypto/currency arena.

Some jurisdictions will ban crypto and try to keep it out of their states. Others will become pro-crypto as a result and try to gain an upper-hand by encouraging innovation and entrepreneurs to build amazing technologies that improve society.

You're reading this post, so you likely have some pro-crypto leanings. To me, the technology is irrefutably one of the most innovative technologies that humanity has ever created.

Exchanging goods and services, trading, communicating with money and other "tokens" that represent assets... This has been a part of human nature since the dawn of existence.

Money has gotten more and more sophisticated over time but we finally reached a breaking point with the typical "gov-backed and issued" currencies. We've seen a growing need (and desire) for an alterantive currency. A form of immutable, untouchable, decentralized and hard money. Bitcoin offers us that.

Crypto as an extension of that offers a far greater opportunity. A world of innovation exists on this end of the spectrum.

Some people always fight innovation.

Newspapers fought the internet.

Radio fought the television.

Horse & Carriage fought the motor vehicle.

... so on and so forth. Innovation is denied until it is undeniable.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

LeoMobile (IOS)

LeoMobile (Android)

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://testflight.apple.com/join/cskYPK1a: https://play.google.com/store/apps/details?id=io.leofi.mobile: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @shiftrox ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Atleast they would have something to pin on CZ if they review his involvement in the steel hostile takeover.

That aside, America's continuous probing of the crypto industry isn't doing them any good. They are losing the battle on almost every front, whilst other continues capitalise on existing opportunities to alienate themseleves from America and it's influence.

Posted Using LeoFinance Beta

Interesting take, especially the contrast. Even if I don’t believe a single minute that China will ever be pro Crypto or should I say « pro-decentralized cryptocurrencies ».

Europe, Singapore or other liberal economies have a card to play.

I also believe that a new war frontier is emerging and crypto and all emerging tech will be the battlefield. The fact that China is loosening its grip on crypto while USA is over there tightening it will ring a bell to many nations.

I’ve said it before, any Binance fud that brings a Bnb dip Is a buy signal. Maybe the regulators can catch CZ slipping after a break of not inciting him so much but not like this when everyweek it’s one sue or the other, he will undoubtedly ensure to operate by the books for this period of regulatory scrutiny.

Posted Using LeoFinance Beta

This is something I mentioned in a few of my posts a couple of years ago. The whole banking situation is only going to push crypto into adoption.

No doubt that crypto is a real financial alternative to fiat, especially during these times.

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

the SEC don't even know what it is, they just want to **** everything up, the problem are CEX, but they take advantage of the situation to blame all crypto.

US government is afraid of losing its dollar Dominance over the world, they know that crypto is challenging that power.

Posted Using LeoFinance Beta

Given the latest development in geopolitics, I am totally not surprised that China is taking a favorable stance on crypto.

For the first time, Blockchain is shifting the Balance of power(sovereign power) from the state to the people in the true sense. This will only consolidate from here on.

The next bull cycle will be much more interesting, it again shifts to the very question of the decentralized asset more than the sophisticated use case of that asset. And that will give credence to Bitcoin.

It can be overwhelming to see conflicting information coming from different jurisdictions and regulators, but your ability to unpack and analyze the news shows that you are informed and engaged. It's also inspiring to hear your positive outlook on the potential of blockchain and crypto to improve society and create new opportunities for innovation.

I have seen some heavy interest in cryptocurrency from Middle East (mainly Dubai) and I have a feeling that they will play a major part in the future. El Salvador has proven to be much better than what I initially expected it to be.

!PIZZA

!LUV

!CTP

Posted Using LeoFinance Beta

(1/1) sent you LUV. | tools | discord | community | HiveWiki |

HiveWiki |  NFT | <>< daily

NFT | <>< daily

$PIZZA slices delivered:

(1/5) @vimukthi tipped @khaleelkazi (x1)