High transaction fees are kryptonite to the Bitcoin and Ethereum blockchains. One of the primary factors holding mass adoption back are rising fees and slower tx times.

Ethereum has been growing incredibly fast in terms of usage and transactions over the past year. I talked about it in my last post when I discussed the flippening of BTC and ETH in terms of value being settled on a daily basis.

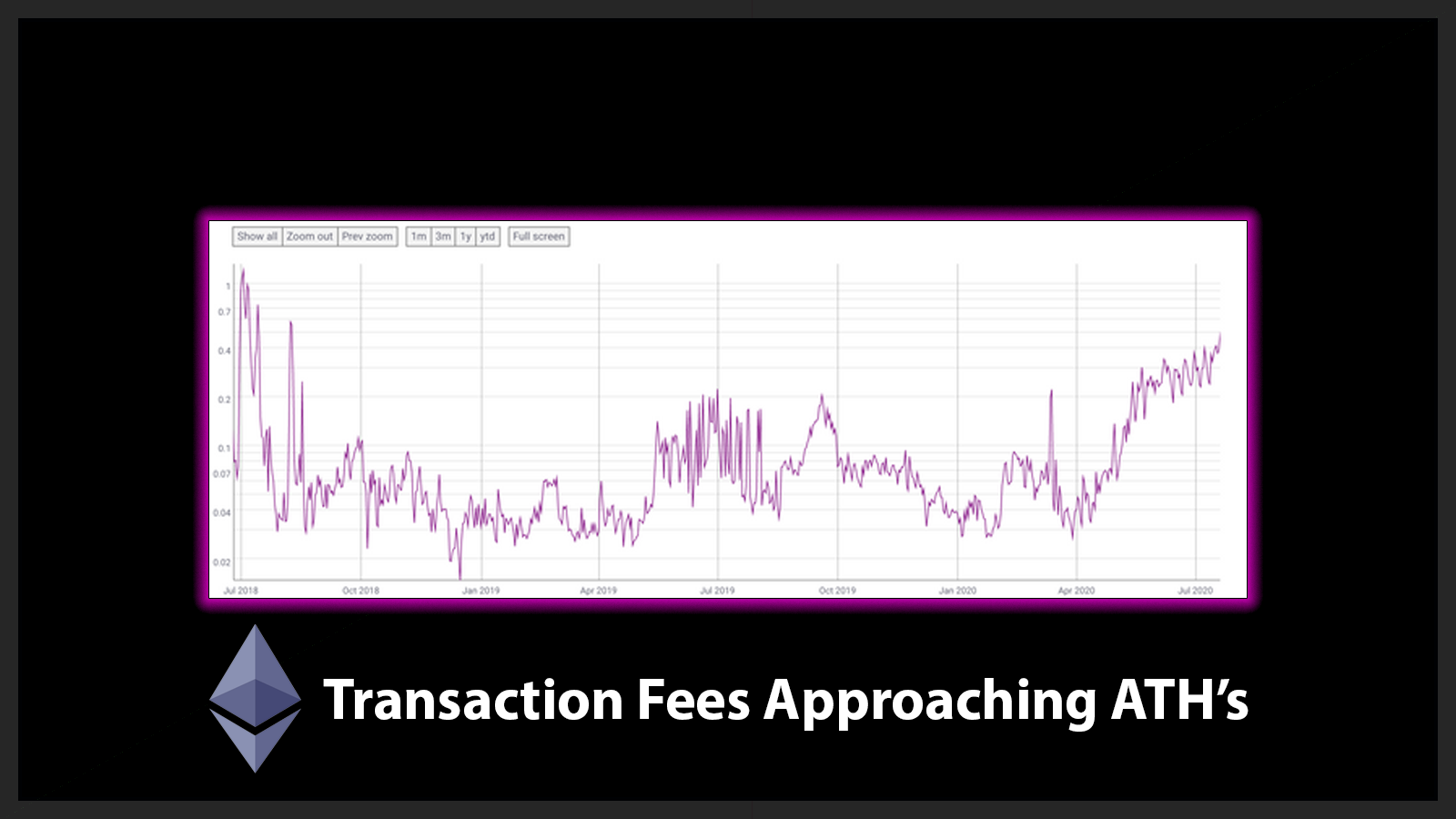

Below is a chart of ETH transaction fees from June 2018 to present day:

Fees are rising and this incredible spike in fees are coinciding with the rise of DeFi products and stablecoin usage.

While adoption is something that we all want and continually talk about getting, we are still far away from being able to handle that adoption. Blockchains like Hive are equipped with a more scalable tech stack, but they are still not the forefront of crypto.

With chains like Ethereum being the base layer to many innovations (i.e. DeFi & Stablecoins), we're seeing a lot of people get turned off by high tx fees and long wait times. Crypto is supposed to be better value transfer.. not the slow transfers accompanied by high fees that the banking industry purports.

Dangers and Solutions

Vitalik recently tweeted about the dangers of this rise in fees. It's not just creating a poor user experience, it's also creating a security flaw for the entire ETH network itself:

In the tweet (as well as in previous conversations/blogs about tx fees), Vitalik references an article written years ago about a potential flaw in the future security of the Bitcoin network. The claim is essentially stating that a rise in miner reliance on earning fees creates a security risk as miners have a growing incentive to manipulate blocks rather than produce them as intended.

Game theory comes into play here and we all know that Vitalik is well-versed in that arena. You might think that when Vitalik proposes a solution for Ethereum, it is quickly adopted. That is not the case.

Vitalik co-authored and has been pushing for the adoption of EIP 1559 (Ethereum Improvement Proposal 1559). I mentioned it in a blog post I wrote last month when we were starting to see this trend of rising ETH fees.

In a simple sense, the proposal just adds two new dynamics to transaction fees on the Ethereum blockchain:

- A BASEFEE for all transactions on the network

- An optional "tip" for miners (allowing you to tap into a "fast-pass lane")

By making these changes to the fee structure, prominent figures in the Ethereum dev community believe that the network will be more secure and tx fees/time would be more reliable from a UX perspective.

It's worth noting that many other prominent figures in crypto/Ethereum (including the founder of ENS - Ethereum Naming Service) disagree with the proposal.. or at least believe that the proposal needs more thorough testing before implementation.

Where Do You Stand on ETH Fees?

I'm curious to hear where you stand on ETH fees. If you're a regular user of the Ethereum blockchain, I'd like to know if you're still transacting on-chain.

My personal approach has not changed much since my last post about ETH fees from 1 month ago. I'm still transacting on ETH as needed, but I'm avoiding them as much as possible -- only making transactions when it is absolutely necessary.

One of the fun things about using Hive and Ethereum simultaneously is that I experience the fees on ETH and then contrast it with my activities on Hive - where between my personal account and LeoFinance accounts, make thousands of transactions per day and pay 0 fees.

There is never a dull day in blockchain.

LeoFinance is an online community for crypto & finance. We run several projects that are powered by Hive and the LEO token economy:

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

Posted Using LeoFinance

Hopefully it won't stop the eth 2.0 bulls

Posted Using LeoFinance

Agreed. I have been avoiding ETH transactions due to high fees. Only if it is absolutely necessary such as selling few ETH during last night's bump in price. As you said, i would normally never think about transactions on hive. Imagine if we have to pay fees on hive, how tough would that be for new users onboarding?

Posted Using LeoFinance

I used to promote posts over on Minds. I got a bunch of on-chain tokens. The fees can get ridiculous given the amounts of the promotions.

Before I discovered Dash, I was using ETH to buy HIVE. Now that I've been around the block, I try to avoid ETH when possible. For that matter, I don't do any business on BTC either, other than hodling.

In some respects, I suppose I should be grateful that ETH forced me to explore other cryptos. Long-term, I think Dash and Monero may be the way to go in terms of fees. XRP is another good one in terms of fees, except I can't use it on Blocktrades.

Posted Using LeoFinance

I don't use the ethereuky blockchain yet, however I won't lie to you transaction fees and slow transaction period is something I feel crypto in general needs to resolve, it honestly puts people off big time and I've seen someone shy away from transaction eth because it took a lot of time and he needed the transaction to pull off quick

Im not using Eth either but fees are something I'm worried about in Bitcoin, since as we hope it to go to new highs, fees will too in terms of its value, rather than on more or less BTC per transaction

This 100% needs to hold steady at least and not rise. Increase in fees is not good nor what anyone wants.

Posted Using LeoFinance