Hey everyone. wHIVE is one of the latest projects to come to the Hive blockchain. Developed by @fbslo, Wrapped Hive offers a bridge from Hive to the Ethereum blockchain.

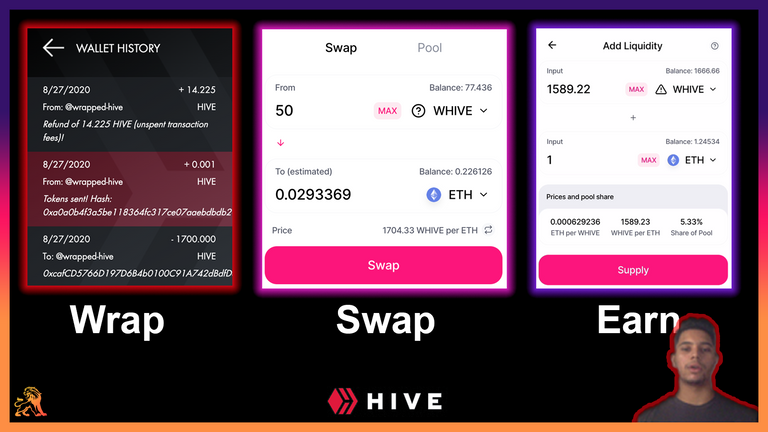

I’ve been seeing tons of questions about wHIVE and @jk6276 recommended that I put together a video about it for LeoPedia. I recorded this one as I went and then chopped it up in post-editing to make it shorter. In this video, I run through the entire process of wrapping Hive on the Hive blockchain, receiving it on Ethereum. Swapping wHIVE for ETH on Uniswap and also adding liquidity to the pool on Uniswap.

Adding liquidity is a fascinating idea. It essentially gives you tokenized ownership in the swapping of Wrapped Hive. By adding liquidity, you’re adding both wHIVE and ETH to the swapping pool and then you collect a fractionalized share of all the fees that are incurred by Uniswap users of wHIVE.

Right now, the pool is incredibly small which means that you can own a large share of the swapping fees. The fees are also quite small at the moment, so you shouldn’t expect to get rich from this.

Using Hive on the Ethereum blockchain in the form of wHIVE has always been a dream of mine. This video focuses heavily on Uniswap and how we can now utilize HIVE on one of the largest DEXes in the world, but the real excitement comes with the addition of more protocols that adopt wHIVE in the future. This is the first step in an exciting journey of connecting Hive to other blockchains.

I also have a long-form written guide for wHIVE if you prefer written over video. That written guide will be released on LeoPedia tomorrow.

In This Episode:

- What is Wrapped Hive? (0:00:51)

- How Do Wrapped Tokens Work? (0:02:35)

- Example: Wrapping HIVE to receive wHIVE (0:05:17)

- Example: Swap wHIVE into ETH (0:07:00)

- Example: How to Add Liquidity to Uniswap and Earn Fees on wHIVE Swaps (0:09:45)

- Other Use Cases and the Future of wHIVE (0:14:54)

Resources:

- Official Website: https://www.whive.network/

- Official Announcement Post: https://peakd.com/hive/@fbslo/introducing-wrapped-hive-hive-on-ethereum

- Uniswap wHIVE-ETH Trading Dashboard: https://uniswap.info/pair/0x50702c216ca6906a18ff105d5dfb1602e8bf0d03

- Remove Liquidity Page for wHIVE: https://app.uniswap.org/#/remove/0x11d147e8d39f59af00e159c4b1fe3a31d58a2c66/ETH

- Liquidity Provider Guide by @jk6276: https://leofinance.io/hive-167922/@jk6276/my-new-life-as-a-liquidity-provider-first-look-at-uniswap-and-whive

- Wrapped Hive Account + Provable HIVE Backing: https://hiveblocks.com/@wrapped-hive

- Verify the Circulating Supply of wHIVE: https://www.whive.network/verify.html

Listen & Subscribe to the LeoFinance Podcast!

Join Our Hive Community & Earn LEO Rewards!

Earn LEO + HIVE rewards by creating crypto/finance-related content in our PeakD community or directly from our hive-based interface at https://leofinance.io.

| Track Hive Data | Blog & Earn LEO | LEO FAQ |

|---|---|---|

| Hivestats | LeoFinance | Learn More |

|  |  |

▶️ 3Speak

Posted Using LeoFinance

Thanks been waiting for this, now if only I could figure out what to do with 4 transactions that been stuck for 2 weeks on metamask first.

Speed them up :)

...Pay more for gas

I've tried ;( just errors out or won't let me.

You're just talking about the default "speed up"/"cancel" buttons, right? Those fail sometimes for some reasons. But going Settings -> Advanced -> Customize Transaction Nonce and fix it that way.

Thanks will have to try that!

Np. Obviously that was a super simplified explanation, so if you are still lost let me know. Go help that liquidity!

I'll try soon, right now @ocdb is needing most of my liquids. :p

^ yep exactly. Mo’ money faster transfers 🤷🏽♂️

Using ETH always makes me appreciate Hive’s fast and free tx’s

Posted Using LeoFinance

Thank you for this and I bought some wHIVE today:)

I have been considering helping to build liquidity for whive. When I tried to use it the other day the liquidity was pretty terrible, but I understand it's very new and we need to build up liquidity. Is it necessary to provide both ETH and WHIVE liquidity?

You can also use Balancer and build new pool there for WHIVE.

The reason why I suggest Balancer is that you can choose your WHIVE:ETH ratio there (it doesn't have to be 1:1). Cheers!

Interesting. I’ve never used balancer, I’ll give it a shot

Posted Using LeoFinance

Let us know if you set this up, I'd like to join in - digging around to learn about Balancer now.

Cool I've been stacking up some liquid funds and researching how to do all this, so I'll check it out too.

Yes, the liquidity is very low. For example, I provided 1 ETH and 1600 wHive in this video, and as of today I own about 10% of the entire liquidity pool and thus, collect 10% of the fees with a pretty small investment.

It is necessary to provide both sides in equivalent amounts - I.e. 1 ETH + 1 ETH worth of wHIVE

Posted Using LeoFinance

Balancer actually allows users to fund liquidity pools with only one token; no need for 2 tokens of equal weight.

@khaleelkazi Something like 10% Hive/ 90% wETH or 10% Hive/ 90% wBTC would attract others not too familiar with Hive to take some exposure and offer liquidity on Balancer.

Also, you can reach out the the YFV Finance devs (https://bit.ly/DeFiArbitrage) and see if they are interested in adding a 98% wHive/ 2% YFV liquidity pool to their website. This way, we would get two birds with one stone; extra liquidity for Hive and a huge DeFi community becoming more aware of what Hive has to offer.

That's how it works, yes.

detailed written manual for wHIVE, I like it better.

We’ll have the written guide up on Leopedia tomorrow

Posted Using LeoFinance

@khaleelkazi, Sounds Promising. Let's hope that soon this will expand in something really big.

Good to see that now Cryptocurrency Space is evolving very seamlessly.

Have a blessed time ahead.

I think it will grow into something big. This is the first step in a greater mission to connect hive to other chains

Posted Using LeoFinance

Good wishes from my side and stay blessed.

Thank you for making this, it helped me!

Always happy to help!

Posted Using LeoFinance Beta

Great content. Get the detailed text based version up on LeoPedia asap.

Posted Using LeoFinance

Oke

ETH is killing it with the fees!!!! Jeez! Every single permission and transaction costs ETH. I really have been taking the 0 fees on Hive for granted.

What's the difference between a custom token like WHIVE and a fully listed token? What needs to be done for it to be fully listed and easily viewable/searchable in Meta Mask?