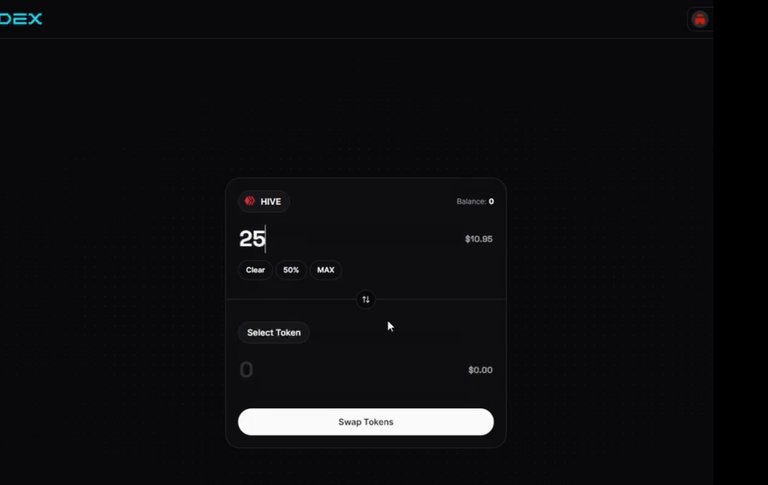

Let me be clear: every single $HIVE swap on LeoDex to any L1 asset (BTC, ETH, etc.) is routed through LEO’s pools

Each of these trades collects fee revenue in 2 forms for the LEO token:

- Wrap fee

- Affiliate fee from Maya swap

Are you sure this is priced in to $LEO?

Doesn't the fee revenue just go to the liquidity providers? Me simply holding staked LEO wouldn't matter in this case right?

no.

fee revenue comes from 2 places & will buy LEO & CACAO for permanent liquidity.

1 - affiliate fee charged by Inleo for each swap via Maya

2 - wrap/unwrap fees from using LEO as the bridge from Hive to other chains

Ah good stuff thank you. Been missing some of the AMAs here lately and trying to keep up. Appreciate the deets!

no worries fren

oooof i need moar

Me too, honestly

Moar LEO then?

I mean, I really am starting to feel underexposed

ha ha ha same here ser!