frens, I know that all the focus lately has been around PolyCUB and that's for good reason. The LeoTeam is really changing the game for sustainable DeFi. We can't forget about the others though!

Aave V3

Aave has solidified itself as one of the largest decentralized finance applications built on Ethereum. With over $12.6 Billion in total value locked, the only protocol ahead is Anchor. No only is it one of the largest, but it has been around longer than most that haven't died or lost most of their value. Aave acts almost like a decentralized bank (even though I hate that word) that allows users to deposit ETH or other assets and take out collateralized loans in various cryptocurrencies.

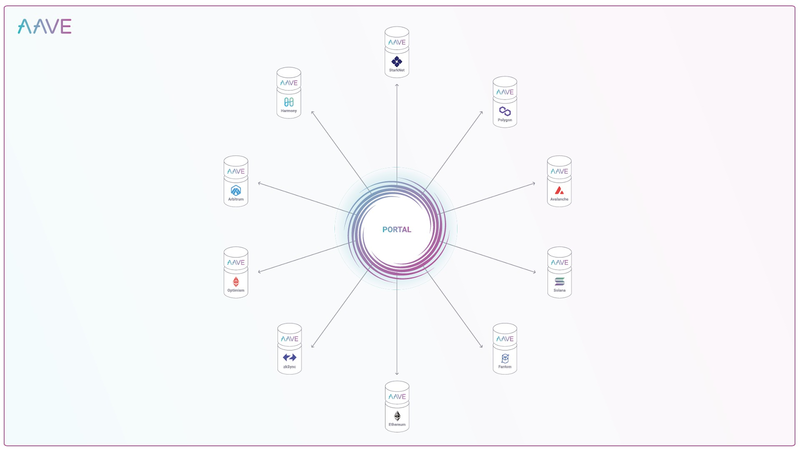

With the launch of Aave V3, the protocol now supports a plethora of different chains including Polygon, Avalanche, Fanton, Harmony, Arbitrum, and many more. Multi-chain support is of extreme importance, especially now when there's hundreds of different blockchains out there.

Portals have been added which allow users to easily move assets between Aave on the different chains. This is made possible by Aave's aTokens which serve as a receipt that can be redeemed on the Aave platform on different chains. For example, a user can deposit ETH from Polygon chain and aETH is minted. That aETH can be redeemed for ETH on say Harmony chain by burning. These aTokens are technically unbacked because they are burned on one chain and minted on another. The underlying assets exist in Aave's lending pools though, so I guess that is kinda backing.

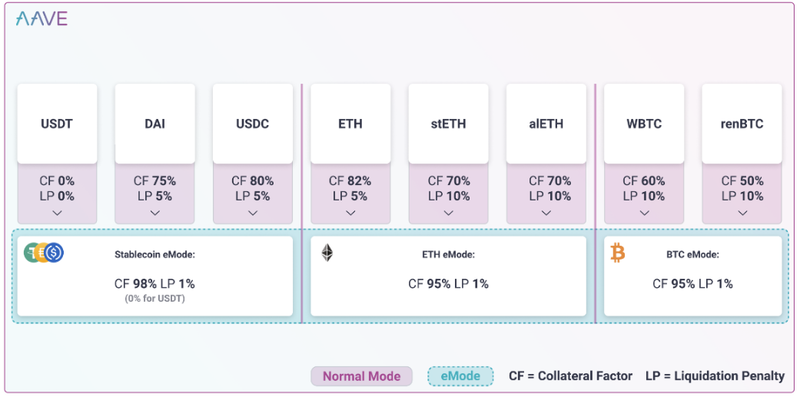

E-Mode is another awesome feature that has been added with the V3 upgrade. It allows users to take collateralized loans in certain cryptocurrencies up to 98% of the value of their collateral! This is something I've never see honestly, and it's a game changer. Typically you are going to get somewhere around 60-80% of whatever your collateral is as a maximum.

E-Mode is not enabled by default, and when it is enabled you are limited to the assets you can deposit and borrow. These E-Mode categories will be determined by Aave governance, with the highest loan to value ratio being stablecoins. This enables users to take full advantage of liquidity between different cryptocurrencies on different chains.

Isolation Mode is yet another amazing feature that has been included with this update. It allows users to deposit newly listed assets voted on by Aave governance to earn yield from users borrowing those assets. By providing these assets as collateral, users will only be able to borrow stablecoins which are also determined by Aave's governance. This will add liquidity for a ton of new tokens I imagine.

These are the major features that I think are going to bring a ton of new value into the protocol. There's a ton of new features, some small, some large, and I highly encourage you to check out the docs I linked above. I also highly advise doing your own research on this platform as I'm just a dude on the internet that likes crypto. I'm no expert nor am I a financial advisor. I could see PolyCUB adopting some of these features down the road as well.

Have you ever used Aave? What are your thoughts on V3?

Thanks for reading! Much love.

Links 'n Shit

| Play to Earn | Read emails, Earn Crypto | Get free crypto every day | Get a WAX wallet |

|---|---|---|---|

| Gods Unchained | ListNerds | PipeFlare | WAX.io |

| Splinterlands | GoodDollar | ||

| Rising Star | FoldApp |

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Cool!

Posted Using LeoFinance Beta

Right?

Posted Using LeoFinance Beta