I found staking as a great opportunity especially if you prefer HODLing your assets instead of trading which is riskier if you bought in the high price then the price suddenly drop.

I had a great experience for being chef in making and staking my $BAKE in beefyfinance even though I only had a small and few amount of capital, I still have a great ride in rollercoaster that going to the moon. As of now, my $BAKE is still waiting for the future, who knows that it will be the next $CAKE, right? I believe on my $BAKE, I staked it and having a cute daily interest (0.04% daily) not bad.

On the other hand, I think $CAKE was mad at be because after buying it, it suddenly dropped and wait for more than a month to sell it. Well, I am blaming myself to buy in $20 before, it dropped into $9-$11 a month ago then this bull run reached its new ATH—≈$28. Unfortunately, I sold it on March 29, 2021 and buy a $CUBas it was a cheaper than $CAKE, they said that “Don't buy the trend” and $CAKE was already hyped and I think buying it for a high price is not a good idea.

However, even though I sold my $CAKE earlier, I don't have any regrets because I bought a $CUB before it goes to the trend, I bought an approximately 13 CUBS and it is worth of ≈$38 with a price of $2.80. As of now, I'm holding it tightly and being optimistic that it will grow sooner or later, the community of Leofinance is really good in bringing $CUB to the moon.

How to stake your $CUB using Trustwallet?

Disclaimer: This is not a financial advice, always Do your own research and invest at your own risk.

First of all, make sure that you have some BNB on your wallet, we will use a few amount of BNB for the transactions.

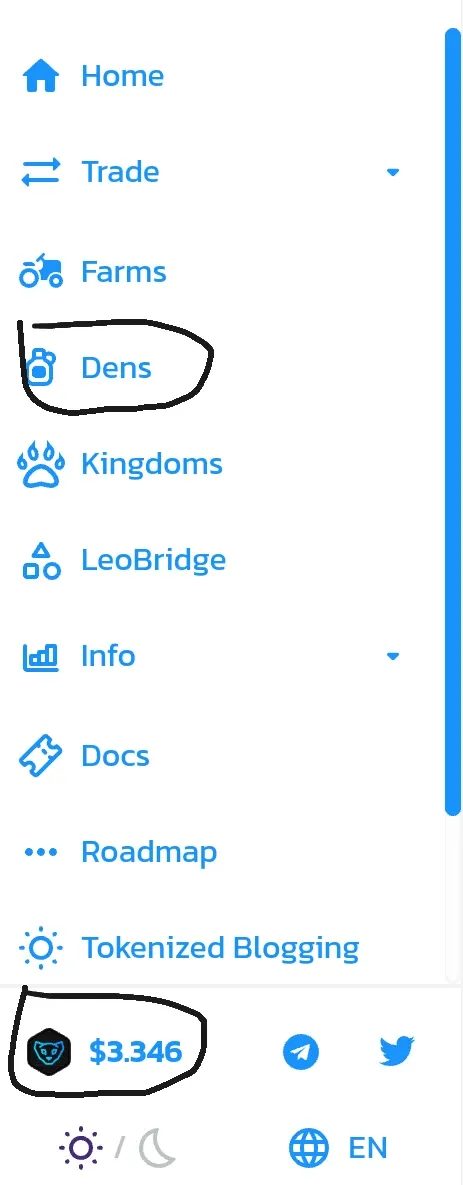

Go to the Dapps tab and search cubdefi.com, make sure that you change the network into BSC.

Next step is go to the Dens so you can stake your $CUB. As you can see, the price of the $CUB (as of writing) is an approximately $3.346.

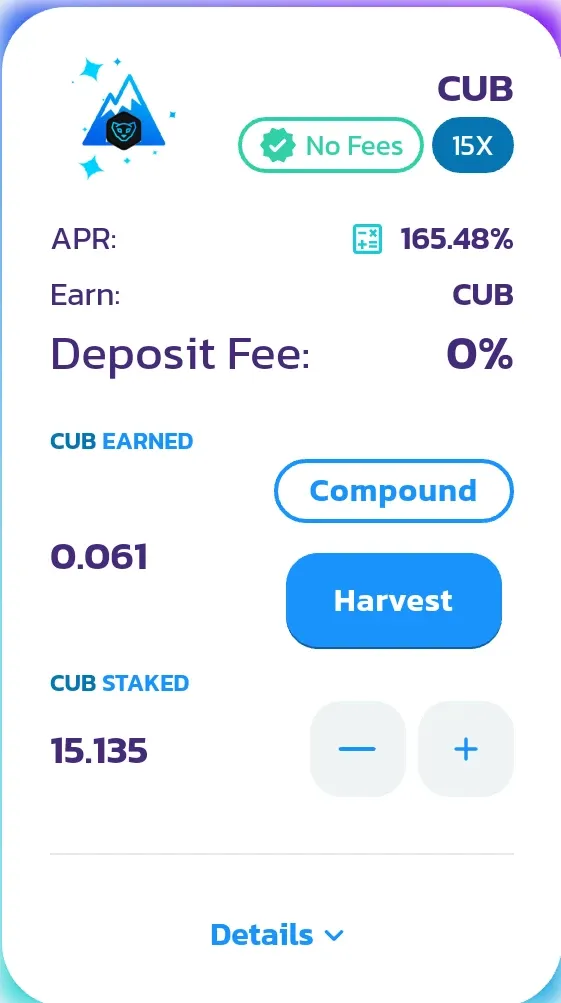

Then this will happen, as you can see, it has 165.48% APR and has no fees, it's good compared to other defi platforms.

If you want to stake, you can click the plus (+) button to add more stake. After putting your investment, you need to Approve the transaction and it will cost more or less a dollar for the network fee.

Compund your interest

What is compounding?

According to FinancialDictionary, Compounding occurs when your investment earnings or savings account interest is added to your principal, forming a larger base on which future earnings may accumulate. As your investment base gets larger, it has the potential to grow faster.

Compounding your interest is a great way to accumulate more interest, this will makes your interest grow faster.

In staking your $CUB, you can also compound your interest so you will gain more interest.

How to compound your interest?

This is easy as what you think, at the homepage of cubdefi.com, you will see your current interest.

This is the interest that I got after an almost 16 days of staking. I decided to compound it so I will gain more interest.

Take note that you still need some BNB for the network fee.

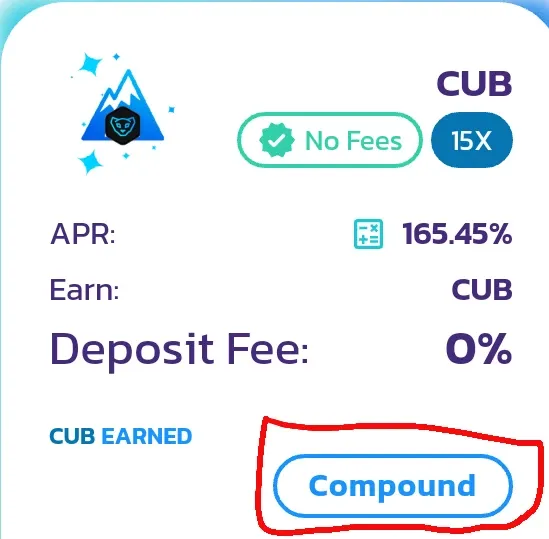

First step, go to the Dens, your current stake will show. This time, click the Compound button.

After clicking the Compound button, you need to Approve it and pay for the Network fee to make it successful. It will instantly added to your stake and gain more profit.

In my opinion, compounding your interest is a great decision because you will gain more interest by doing it but always remember that it's also depends on your opinion.

Terminologies that can help you

In case that you are confused between APR and APY, this can help you.

According to Investopedia, APR does not take into account the compounding of interest within a specific year. It is calculated by multiplying the periodic interest rate by the number of periods in a year in which the periodic rate is applied. It does not indicate how many times the rate is applied to the balance.

APR = Periodic Rate x Number of Periods in a Year

APY does take into account the frequency with which the interest is applied—the effects of intra-year compounding.

APY is calculated by adding 1+ the periodic rate as a decimal and multiplying it by the number of times equal to the number of periods that the rate is applied, then subtracting 1.4

APY = (1 + Periodic Rate)Number of periods – 1

Invest at your own risk and do your own research!