Authored by @silverstackeruk

Hello, LBIer's and CLer's. Welcome to this weeks CUBLIFE (CL) token update. We are going to look at this week's CUB harvests, reinvestment and weekly dividend APY. This update post is released weekly, dividends are paid in LEO every Friday at 9 pm UTC and new CUBLIFE (CL) tokens are issued once per month every 21st.

What is CUBLIFE?

CUBLIFE (CL) in a nutshell is a hive-engine token dedicated to investing in CUBfinance that pays out weekly dividends in the form of LEO. All LEO/HIVE raised from monthly token issues is invested in CUBfinance. 50% of weekly harvests are converted to LEO and issued to CL token holders, 40% is reinvested back into the platform and 10% goes to LBI as an operators fee for maintaining and actively managing the wallet.

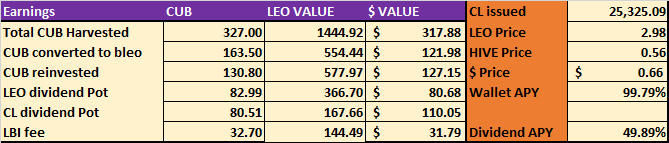

Weekly Income

Well, polycub's high APY's did not last long and we are back down to a 50% APY. This is still great of course as the dividend is paid in either LEO or CL tokens depending on if you are staked are not. Earning were still good overall but compared to the past 2 weeks, they are way down, almost half of last week. Converting our harvests to DAI during the week has also helped. This week i included both BSC and POLY CUB harvests to get back to normal. Not a bad week, just had hoped the great times would have lasted longer.

- Blue = BSC

- Orange = POLY

- Black = Gas tokens

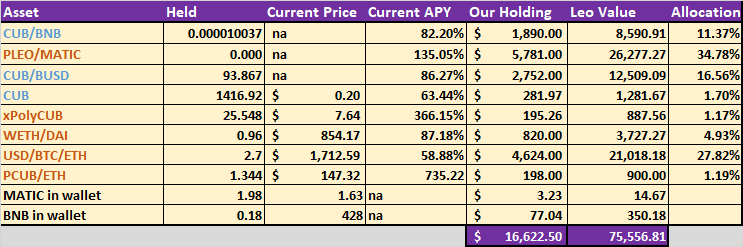

Holdings this week or around the same as last week, little bit down as both CUB's dropped in price. Our BTC/ETH/BNB holdings through LP's all increased so the lose was minimal at around $150. Im seeing that the APY for bLEO/BNB is now higher than the pLEO/MATIC LP so i might swap that over if the price of polyCUB does not improve. Not rush, i'll monitor it for a few weeks and wait until we hit monthly reduced polyCUB mined per block mintage. In fact, there are few LP's in teh BSC kingdom that are starting to look really good in my eyes plus POLY is a terrible chain to use. It's slow, laggy with transactions failing or just not showing up in matamask. BSC is much more clean and works as you'd expect it to work.

I have converted BSC CUB's into BNB this week until i decide what to do with it. Im on the fence between BSC and POLY CUB. This weeks reinvestment money on polyCUB went into the ETH/DAI LP as it's grows closer to $1000.

This month's CL token issue

Every 21st of each month, new CL tokens are issued to those that have sent either HIVE or LEO to the @cublife before the end of the 20th. The month goes 21st-20th. If you send in funds on the 21st, you'll be waiting till next month. Conversions take place once per month on the 21st with new CL tokens being minted to the same value as the existing ones in circulation. There are 12 CL token issues per year.

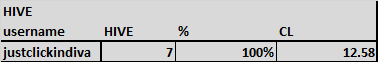

You can transfer LEO/HIVE or HIVEp from hive-engine. If you send both LEO and HIVE, you will receive 2 token issues, 1 for each. You can confirm your funds have been received in the table below which are posted weekly and updated 2-3 times per week.

Leo

xx

Hive

Roundup

Not a bad week but not great either. I work out the numbers just before i put this post and im feeling a little deflated from the 50% APY. I knew it would be less but it dropped almost 50% in a week. I remember it taking 3-4 months for BSC CUB to see it's price drop to $1. I know about the hardcap and stuff, i guess time will tell if it works are not.

Not many people buying into CL anymore but we are issuing more from offering compounding through staking on hive-engine so we're still issuing a decent amount each month. On a normal month, we'd issue maybe 200-300 CL tokens from the monthly minting but we issue over 500-700 per month from stakers which is really cool. 50% of CL token holders stake and 50% keep theirs liquid for LEO dividends. 50/50 is perfect.

Going forward, we follow CUB finance should it be on luna, avax, dot, whatever and CUBlife will have holdings in them all so it's never to late to buy up a few hundred dollars worth to let them sit, pay you out a dividend in ether more CL tokens, LEO or a mix of both, you can always hold some liquid and stake the rest. Many airdrops are coming, many kingdoms containing BTC/ETH will be grown.

Think back to when we the APY was 25% around 1 month back. Our APY might drop back more but we have gained $820 of ETH/DAI and 25 XpolyCUB tokens. Might not sound like a lot but that represents 6% of our currently holdings and increasing holdings by 6% in 3-4 weeks is pretty good. This means we could if we wanted to, convert everything back over to BSC CUB and earn a 25% APY again and farm with $820 of ETH on top increasing our earnings by 6% roughly. Now the min APY is around 31% APY.

I see something I missed out on. Next time CUB will release a farm, I will push to sell CL tokens 3-4 weeks before the planned launch. If i sell lots of them while they are cheap, i mean lots like 5000 plus then there would be lots of new funds ready to take advantage to (nfm)™ new farm massive APY's. I just coined the phase myself. But lots of new money plus NTM equals huge gains all round and maximum growth.

Anyways, dividends will go out this evening as always. I love overthinking all this stuff and running sims in my head. Have a good one everyone, see ya'll next week.

CUB LIFE!!

Posted Using LeoFinance Beta

Is this similar to Polycub?

If I have helped you in the past, please consider dropping a few words of support.

Oh ok, no. Polycub and Cublife are different. I guess my question is, do they work similarly?

Didn't actually remember CUB LIFE since I didn't receive a good chunk of it during the airdrop. I think its an asset to put in the radar with the present value that CUB is trying to gain.

Posted Using LeoFinance Beta

Splitting between staked and liquid is a cool idea, I didn't really consider doing that.

Do you get a better deal buying CL through the group purchase or is it just a convenience thing? Or should I try my luck at Swapping into it on Hive Engine?

Posted Using LeoFinance Beta

so the hype for polyCub is dying down huh? wen next Cub project then ? :P so we can enjoy the some nice killer APYs again

I have noticed that transactions fail more often on Polygon and I also noted that BSC APR isn't that much lower than PolyCUB last week. With the emissions dropping, the 50% penalty would cut it lower now.

Posted Using LeoFinance Beta