Welcome to this weeks LBI token earnings and holding post

What is LBI?

The LeoBacked Investment (LBI) token is the first of its kind, the 1st token to be valued completely in LEO. Each LBI token represents a percentage ownership in the overall fund including all LEO, HIVE, off-chain and wallets operated by @lbi-token. The goal is to provide a community based and ran investment vehicle focused primarily on the LeoFinance community and LEO token. We provide a weekly LEO dividend payment to all token holders whilst also increasing the value of the LBI token slowly but consistently over the long term by only investing into things that will stand the test of time.

LBI is a long term HODL token based on SPI's model. Because these tokens are backed and valued in their primary assets, the value only increases. Think of it as putting $1000 in the bank and earning interest. In theory, you should never have fewer dollars. The $1000 is the LEO you give us to buy your LBI token and the interest is the earnings we produce with that LEO.

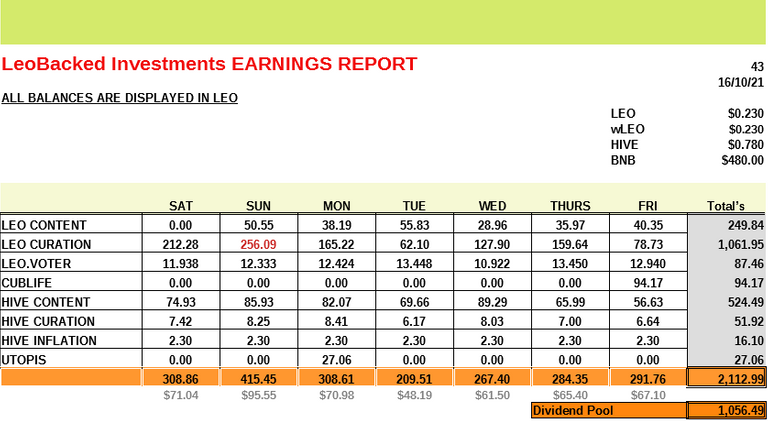

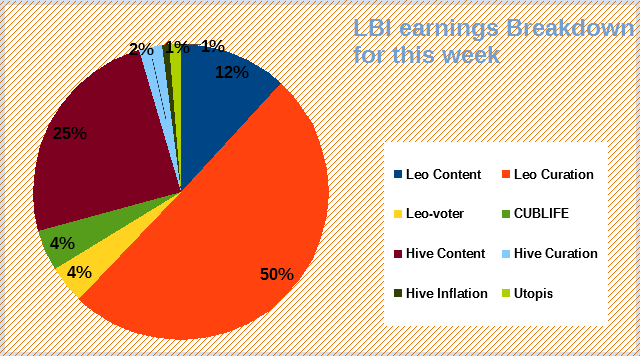

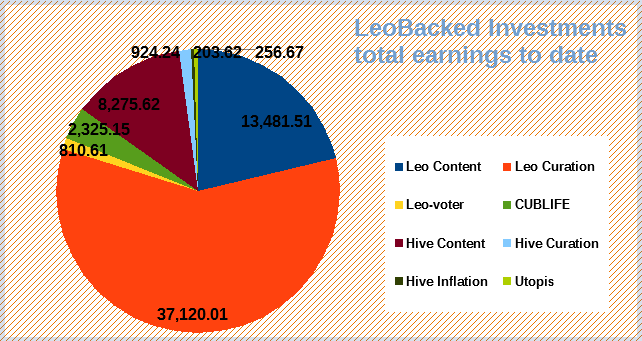

This weeks earnings were very good at over 2100 LEO making it our 2nd best week ever. We had a double payout day and we might have scrapped 2000 LEO without it so very good week. Seeing curation at over 1000 is amazing and we see around 25% of earnings came from HIVE content. I staked our UTOPIS tokens and notice the % of return has increased a little so that's cool and leo.voter & Cublife look to be consistent. If every week was like this and it can be, we'd be earning 110k LEO per year.

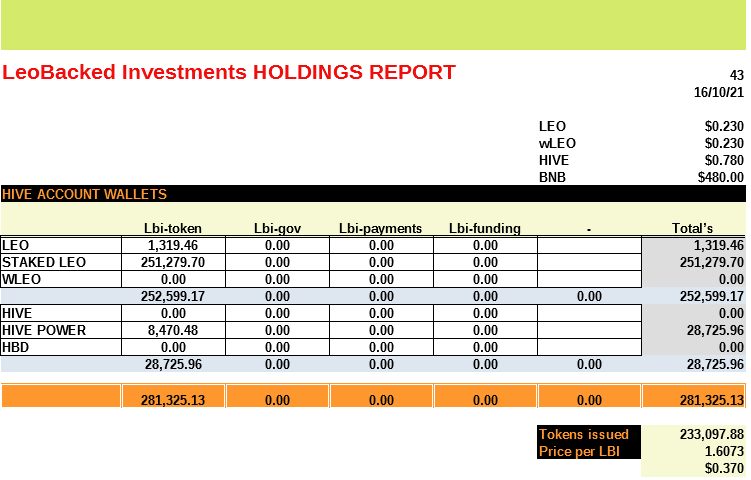

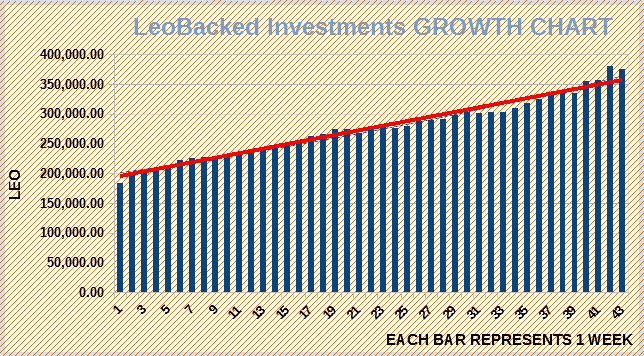

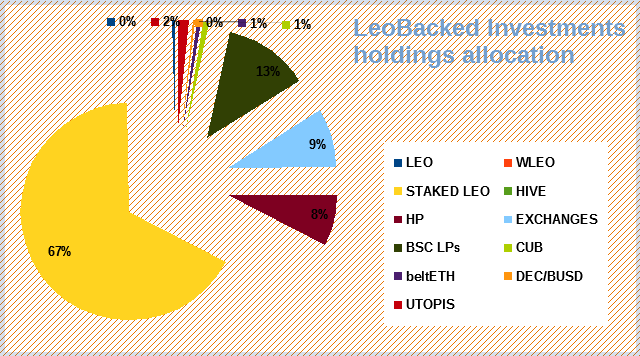

The top chart is this week, the bottom chart is a total of over 43 weeks.

If we are able to maintain around 2000 LEO per week, i would be very happy with that. I think however if the price of LEO were to increase back to 50cent + we would see a big decline in weekly earnings based on our HIVE earning being worth less LEO. Our HP delegation earnings from leo.voter remain consistently at 16% by design so no worries there, but our content and Utopis incomes would be worth less LEO.

Around 300 LEO was added to the wallet this week all everything was paid out. No that much the play with. I have been thinking about converting some HIVE earnings to either LEO or some sort of passive income token to increase our earnings further. I was thinking about using whatever liquid amount of HIVE we have at the end of each week for this. With HIVE becoming a large % of our earnings, the plan to power up 100% might have to change as we need to react to the market and in particular the LEO > HIVE conversion rate or even the fact that as everything has been mooning, LEO has been falling. No idea why but it's to have flatlined down here at 20ish cent.

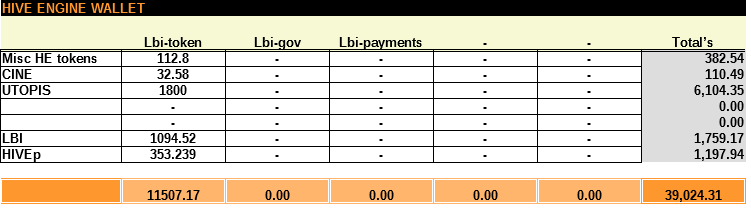

Not much change here. We got 18 SPS from our DEC/BUSD LP, earned a few POB and converted those into HIVEp. I like that we dont have too much investment in Hive-engine, the liquidity is poor and many projects become abandoned. Liquidity is king and we can cash out all our BSC holdings in a flash.

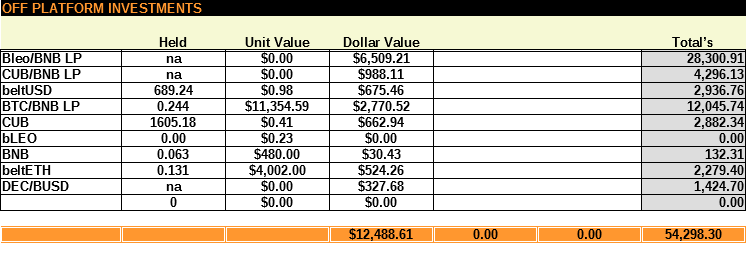

The bLEO/BNB LP has increased by over $1000 this week thanks to BNB's 10%+ day a few days back. This has boasted basically all of the LP tokens we have. The BTC/BNB kingdom is still growing as I add harvested CUB's into it each week. If BTC hits a new all-time high of $65k, im fairly contain that it would not stop there and would moon to $80-100k. When BTC hits a new all-time high, it does fall back down, it'll normally moon much further. When BTC broke $20k last December, it's never been below that price since it went on to moon for 5 months to peak out at $64.8k. It BTC pass $65k, we are in for 1 hell of a good time for the next few months 🤑

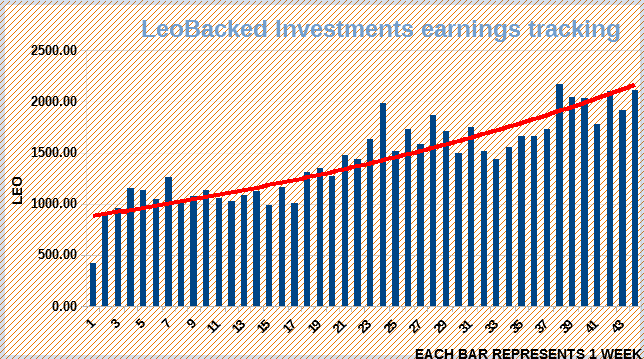

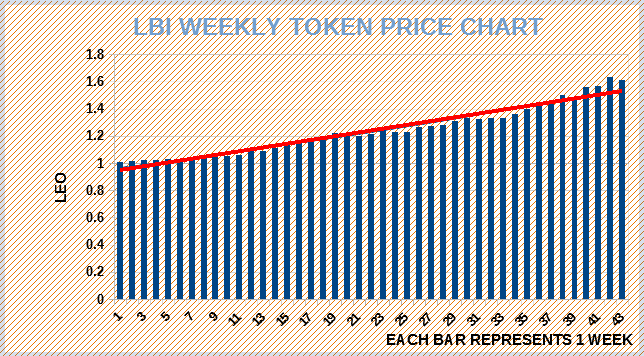

Still above the trending line so very happy with that. We get a small dip because the price of LEO increased a few cents from around 21 cents last week to 23 this week.

LBI token price

Total assets worth in LEO

374,647 LEO

Total LBI tokens circulating

227,481

LBI token price - 1.61 LEO

The LBI price took a small dip this week due to the same reasoning above in the Growth Chart. Still performing well as we close in on our first year of operation. 61% plus whatever dividends you've received.

Get LBI on LeoDex - https://leodex.io/market/LBI

Get LBI on Hive-engine - https://hive-engine.com/?p=market&t=LBI

Posted Using LeoFinance Beta

A decent performance all round and growing nicely. 61% is a decent return already and still have 9 weeks to try and cap of a great 1st year. can't believe the time has flown by so quickly. Thanks once again to you and the team for the work that you put into making it a success.

Posted Using LeoFinance Beta

So the HIVE and BSC holdings are making the underlying value fluctuate a lot? Maybe you should power up HIVE when LEO price is high and buy LEO when it's price is low. At least it makes sense to me.

Posted Using LeoFinance Beta

Great seeing the week yield get over 2k. It's amazing how the project have grown so far. Far better times ahead. Hopefully BTC crosses 65k and end the year in a much exciting time

"Get rich slowly...fast!" Indeed!!! I absolutely love this fund. With no plans to sell, I just enjoy watching it grow every single week. Plus, I get dividends! How great is that?!?

Yes, right now it's a pretty interesting (for lack of a better word) balancing act between our outside investments and LEO. On the one hand, the outside investments are performing and building up the overall value. On the other hand, LEO is trading at 20-25 cents.

So, the question is, will the other investments keep going up by more than what LEO is going to go up? I mean, we've got 374k in Leo value, but we've only got 252k LEO staked. It seems to me we should be taking that staked number higher. Like substantially higher. We may have 120k worth of LEO in outside investments, but if LEO doubles we now only have 60k worth of LEO in outside investments (obviously assuming those assets stay where they are price-wise).

We're trying to build each LBI to be worth as many LEO as possible, regardless of price, because we believe that eventually the price is going to go much higher. So we should be locking in as much cheap LEO as possible while it's down here.

With the massive amount of income our curators are generating, any and all LEO locked in is paying a great return. It stands to reason that if we staked another 50% to our LP, our curation earnings would go up 50% as well. That would take those earning from 1000 to 1500 every week. That would basically be worst-case scenario; we own nothing but LEO but we're getting 1500 more LEO a week from curation plus the CubLife payment.

I'm just worried that at some point LEO is going to pop and all of our good outside investments are going to be worth the same or LESS than they would have been had we just owned the LEO outright.

We are LEO-BACKED with the only goal to grow each LBI token to as many LEO as possible. That means we need to start locking in LEO at these cheap prices. The dollars we have in outside investments should be converting their profits to LEO while it's this cheap, and we should probably even sell some of this stuff off and convert it to LEO as well.

The other thing to consider is #ProjectBlank. Last time it was "announced" back in January, it caused over 90% of all LEO to become staked. It created a huge supply crunch and LEO went over $1. We should be ahead of the curve buying LEO now so we can benefit the most from that airdrop and the possible price appreciation.

Just my opinion....

Posted Using LeoFinance Beta

Cant complain with how this is shaping up for the first year. A lot of work going into it but the numbers are shaping up nicely.

This is what it means to be involved in a community project. Those who put forth some money are receiving some very solid returns.

Wait until LBI is 5 years old.

Posted Using LeoFinance Beta

Those are some neat numbers. I don't think I properly understood what LBI was about until now.

Posted Using LeoFinance Beta

Great!

Posted Using LeoFinance Beta