Hello, LBIer's. If LBI were a company, how much would it be worth? Of course, this is a pointless question but it's something worth exploring just for the fun of it. I dont think that LBI could ever be sold off as its model doe not support it but still...what if?

There are alot of different ways to value a company using different values such as shares price, incomes, equities, current and future cashflows, etc. We only have the option of using a few ways because alot of these methods are not applicable to us plus we've only been up and running for just over 1 year. Let's took a quick look and see what we are worth based on figures from the end of year 1.

Using number's from LBI's first year

1/ Book Value

That's start with book value because this is what LBI uses to determine it's token price. Working out the book value is fairly simple. You add up all your assets excluding intangible assets and then remove any debts.

HIVE wallets - 315,727 LEO

Hive-engine wallets - 10,958 LEO

Non-HIVE wallets - 52,800 LEO

Debts - 0 LEO

LBI's Value - 378,980 LEO

Each LBI token - 1.63 LEO

2/ Market Capitalization

This is another simple method and one that is used by most companies that feature on a public stock exchange. You take the number of shares that are issued and multiply it by the current price of a single share. The answer you get is the market cap.

If we look at LBI and use Hive-engine trading prices, we can work it out. Right now, there are 233,097.88 LBI tokens in circulation. The last sold LBI token sold for $0.328. Ok, we need the LEO price and the last LEO sold for $0.216 so that would mean the last LBI sold on hive-engine was sold or bought whatever way you look at it for 1.518 LEO.

LBI's market cap is currently 353,963 LEO

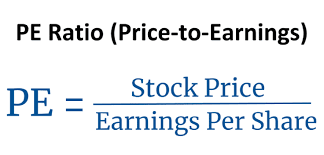

3/ Price to earning ratio (P/E)

Companies can value themselves based on their stock price to earnings ratio using pre-tax profits and a multiple of years. Eg, If a company had a PE ratio of 5 this would mean if they produced pre-tax profits of $100,000 per year, they would be valued at $500,000. In most cases, this ratio is used to decide if a company is under or overvalued but in other cases, it can be used by reversing the formula to get a valuation. So instead of stock price divided by earnings per share to get the PE ratio, we guess the P/E based on incomes and potential future growth and then multiply the number by our yearly earnings to get our value. Companies that have a consistent track record of profitable yearly results, an excellent plan for growth or being a start will often have high PE ratios. Companies that would have smaller PE ratios would likely be mature with growth excused or local high street businesses like hairdressers are cafes. I have no idea what the average bank P/E ratio is but

LBI is somewhere in the middle I feel. We have plenty of room for growth but it requires man/women/other hours so im going to work out and show the values of 5 which is low, 15 which is normal and 40 which is high. To give you an idea, currently, Tesla has a PE ratio of 322. This means if you bought all of Telsa, it would take you 322 years to get your money back. I dont think those green Tax credits will last forever Elon!! and of course, we should expect Tesla to turn a real profit soon as they do better each year.

LBI's Earnings last year were 82,476 LEO giving us an average of 1,586 LEO per week. We dont need the average, I just thought you'd like to know 😉. So we take our yearly earnings and multiply it by whatever we decide.

P/E of 5 - 412,380 LEO = 1.77 per LBI

P/E of 15 - 1,237,140 LEO = 5.31 per LBI

P/E of 40 - 3,299,040 LEO = 14.15 per LBI

Based on LBI's recent weekly earnings of around 2100, we can guess we'll pull in at least 109,000 LEO this year which is a growth of 32.8% on year 1. I guess you could say we have a projected 33% growth in earnings this year. That's a decent number and would give us a good PE ratio in investors eyes. In my mind, LBI would have a PE ratio of 4-5, i know this is a low number.

There you have it, there are 3 simple ways to work out LBI's value and you can see that each way will end on a different valuation. In order from the lowest, we have the market cap, book value and then P/E ratio. Using the book value obviously works best for LBI because... well just because.

How would you value LBI?

Posted Using LeoFinance Beta

so as an investor one must ask themselves can I get a better return using 1.63 LEO (cost of 1 LBI) on my own through curation + factoring in the future value of of what LBI will be in the future. Since you receive $LEO interest back on a weekly basis, I'm thinking $LBI is a great Hedge especially if you end up becoming inactive on $LEO for whatever reason. You'll still always have a stream of income flowing/dripping in.

Posted Using LeoFinance Beta

A future post idea for you guys, @lbi-token:

"LEO vs LBI - ROI comparison"

"Will I receive a better return on investment via buying LEO or by investing in LBI?"

This is all anyone really wants to know and clearly laying out the details would be a great evergreen post that you could use to market the fund.

Posted Using LeoFinance Beta

yes, that would be interesting but difficult. It would need to factor in how the $LEO will used and also how active the holder will be + also predict the future price of both $LEO and $LBI which is impossible. Still a discussion of the pros and cons of investing in $LBI instead of just powering up or investing $LEO yourself. A good exercise in

Posted Using LeoFinance Beta

I think that LBI will always produce a higher yield compared to LEO. It would depend on what way you view ROI? With LEO, you'd get liquid LEO as rewards for curation at 16-18% but with LBI, you'd get a weekly LEO dividend worth around 8% but the tokens price in LEO increases as well. LBI increased by around 60% in year 1 and paid out div's worth roughly 8% on top, plus its 100% passive for token holders.

It's a good idea for a post to show off some numbers. We're already hard-capped so im not as motivated to promote as I used to be. More interested in trying to increase what we got but with that said that's deffo a doozy of a post to upload. Would be a good way to show token holders where everything comes from.

Thanks

I think it would be a really great post and I'm sure it would be worth the effort. I'm even more sold on $LBI now!

Posted Using LeoFinance Beta

It's on my whiteboard 😁

Posted Using LeoFinance Beta

Just getting to know about this LBI token of recent and Definitely it seems so surprising now.

Have heard about this yesterday and definitely it is another project that looks so good right now,who say will can't even have it as a community self.

I completely agree that it is going to strive if it stands as a company

Cool, thank you. It's still a youngish project and its future depends on the token holders, we're trying to make it decentralized but it's not easy.

Definitely with time it will be much more better too.

Will be checking leodex to see if I can buy some and hold too,I will love to be part of this great project

Looks good to me,

but we'll see how it goes in the long run! 👀

We'll find out :)

Not going to put a number on it but it's definitely worth to invest on it !

And there are intangible assets which are extremely important, the 3 of you breathing life into this project.

Posted Using LeoFinance Beta

I think the bare minimum you would have to value LBI is 1 times the book value. But with as fast as it's growing it's assets, it should probably be some sort of multiple of that. 2 times, 3 times, whatever. Consider if it grows at 60% again next year, 1 times book would be 2.60 LEO. I think it's a pretty safe valuation to say it should be worth 1.5 times book value, which would mean it should trade at about double the LEO price right now. That, of course, doesn't factor in dividends but...we'll just take those as a bonus.

On the other hand, companies with high growth rates tend to have much higher PE ratios as they are obviously projected to make a lot more money in future years to justify it. If LBI continues to grow its asset base at 60%/yr, this could easily have a 15-20 PE ratio without batting an eye. Of course, trading based on the PE ratio would probably require a much larger and more active market.

The biggest drawback to LBI is the liquidity, or lack thereof. We did see just recently that there is definitely an appetite for it when it's cheap, but there isn't much in the way of big buyers looking out into the future. So, these exercises, while fun, really don't apply much. YET. Which you knew, of course.

But, if and when LEO becomes mainstream and more active on the markets, the value of LBI skyrockets, in my opinion. At that point it could certainly trade at that 15-20 PE. As the name of the fund states, it all comes down to how LEO performs.

Posted Using LeoFinance Beta

Cool comment and great feedback.

On your point about liquidity. Im with you and I'd prefer LBI was able to do a better job than it is. The main problem I have is a lack of liquid holdings that im able to convert to LEO to use to buy back LBI's.

An option could be to add a diesel pool at the cost of 1000 BEE and then we'd need to pay 200 BEE to enable rewards for people that provide liquidity. When the content team receives their LBI rewards, there are extra leftover and these can be added to an LP reward pool.

Another option could be to host week long cash out's every 3 or 6 months. We'd need to power down some LEO in advance which would cut into curation income. It's an option anyways.

Thanks

What a really interesting way to look at it! Thanks for breaking this down for us! It seems like a lower number is better for the P/E portion. Or maybe I am just understanding it wrong.

Posted Using LeoFinance Beta

Yeah for sure because we'd dependent on Leofinance and if something happens to it, we're fucked. If real world companies were doing 60% growth in year, they'd have P/E ratio of 50 plus probally. lol

I think the book value makes the most sense and it's easy for us to calculate in terms of LEO.

Posted Using LeoFinance Beta

Yeah, it's the easiest way for us. When i set up SPI, i used book value as well even when i had never heard of "Book value", haha. I guess it's my mind's default.

This is the first I've heard of LBI, but I appreciate how you've laid out your valuation process. I may have to do some similar calculations when trying to establish ideal entry prices for stocks/crypto I'd like to invest in.

!1UP

The P/E ratio is an easy one to follow. It'll normally be displayed somewhere on the stock's charting page. It blows my mind that we have comapany's that have ratio's of over 100.

You have received a 1UP from @entrepidus!

@leo-curator, @ctp-curator, @pob-curator, @vyb-curatorAnd look, they brought !PIZZA 🍕

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

This is a great concept. I treat my Hive account like a business as it produces more money than a part-time job which is great. Getting paid to create content and engage with great people has been an amazing experience.