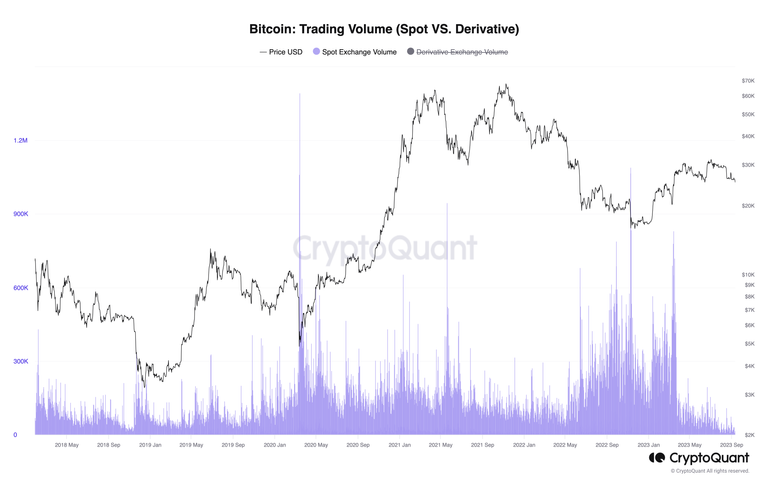

Not only did Bitcoin price action decline since yesterday, and that's probably not the concern being felt around the cryptocurrency market but the true fact related to the decline in Bitcoin spot trading volumes.

It has been reported that "Bitcoin exchanges have seen their trading volumes plummet as traders grapple with ongoing macroeconomic uncertainty," hence the current negative scenario experienced by cryptocurrency projects.

While "Bitcoin's price action has remained in a familiar range for several months, and as time passes, interest in trading seems to be fading," this is likely to continue for the remainder of the year.

Now, there is a belief that "Instead of seeking quick profits through short-term trading, more and more people are looking at Bitcoin and other cryptocurrencies as a long-term investment."

It is known that "Short-term holders - entities that hold BTC for 155 days at most - almost have their funds at an unrealized loss: their cost basis is higher than the current spot price"

I would like to know your appreciation on what is discussed here.

SOURCES CONSULTED

Cointelegraph. Bitcoin exchange volume tracks 5-year lows as Fed inspires BTC hodling. Link

OBSERVATION:

The cover image does not belong to the author: @lupafilotaxia, the image was taken from: Cointelegraph

There is always a negative impact on the market. If you do this, the price of altcoins will drop drastically.

I understand your point, October may bring more favorable scenarios for the health of the Bitcoin price.