Algorithmic trading, also known as algo trading or automated trading, is the use of computer programs and algorithms to execute trades in financial markets. Traditionally, this method has been the domain of institutional investors and hedge funds, but advancements in technology have made it increasingly accessible to retail traders. If approached correctly, algorithmic trading can offer significant advantages, including improved efficiency, better execution, and the ability to capitalize on market opportunities that manual trading might miss.

Why Algorithmic Trading is Profitable

Emotion-Free Trading:

Retail traders often succumb to emotional biases like fear and greed. Algorithmic trading eliminates human emotions by following predefined rules and strategies, ensuring consistency in execution.

Speed and Efficiency:

Algorithms can analyze vast amounts of data and execute trades within milliseconds, capitalizing on opportunities that might disappear before a human can react.

Backtesting and Optimization:

Algorithms can be tested on historical data to evaluate their effectiveness before being deployed in live markets. This process helps traders refine strategies and avoid costly mistakes.

Diverse Market Participation:

Algo trading allows retail traders to participate in multiple markets simultaneously, diversifying risk and increasing the potential for profits.

24/7 Market Coverage:

Cryptocurrencies and other global markets operate around the clock. Algorithms ensure that trading continues even when the trader is asleep.

How Retail Traders Can Start Algorithmic Trading

1. Understand the Basics

Before diving into algorithmic trading, it is crucial to understand the fundamentals of financial markets, trading strategies, and technical indicators. Knowledge of programming languages like Python or platforms that support algo trading is also essential.

2. Choose a Trading Platform

For crypto trading, platforms like Binance, KuCoin, and Coinbase Pro provide APIs for building trading bots.

3. Develop a Strategy

The profitability of algorithmic trading depends on the strategy. Some popular strategies include:

Trend Following:

Algorithms trade based on indicators like moving averages and MACD.

Mean Reversion:

Exploiting price reversals after overbought or oversold conditions.

Arbitrage:

Profiting from price differences across exchanges or markets.

Market Making:

Placing both buy and sell orders to profit from bid-ask spreads.

4. Backtest and Optimize

Use historical market data to test your algorithm's performance. Platforms like QuantConnect, and TradingView offer backtesting tools. Optimize parameters to ensure the algorithm performs well under various market conditions.

5. Monitor and Adjust

Even the best algorithms require regular monitoring and adjustments. Market conditions evolve, and a profitable strategy today might lose its edge tomorrow. Stay informed and iterate your approach as needed.

Tools and Resources for Retail Traders

Coding Frameworks:

Python libraries like Pandas, NumPy are excellent for developing and backtesting trading algorithms.

APIs for Trading:

Most exchanges provide APIs for programmatically accessing market data and executing trades.

Educational Resources:

Platforms like Udemy, Coursera, and YouTube offer courses and tutorials on algorithmic trading.

Community Support:

Join forums and communities such as Reddit’s r/algotrading and QuantConnect’s forums to learn from experienced algo traders.

Challenges to Consider in Algorithmic Trading:

High Initial Learning Curve:

Retail traders must invest time in learning programming and understanding algorithmic strategies.

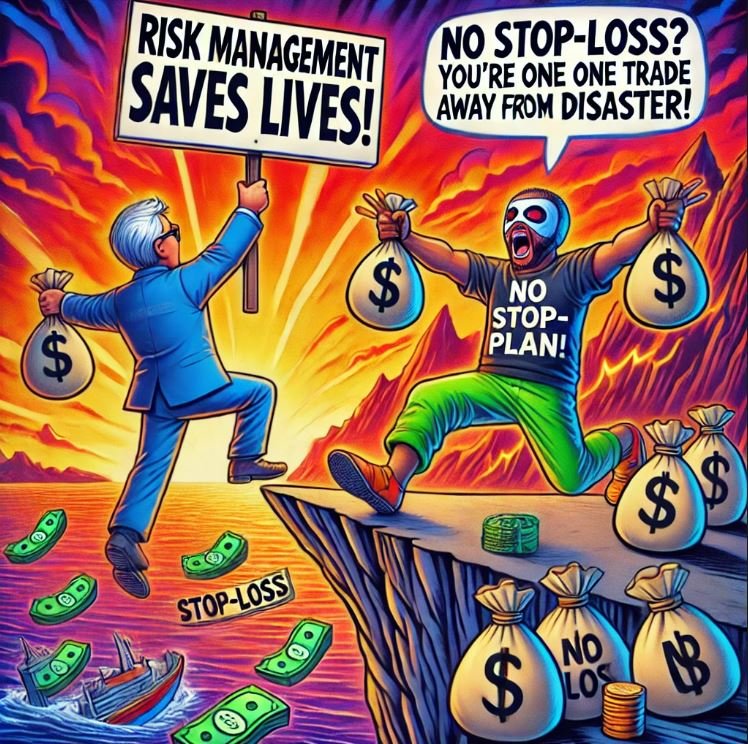

Risk Management:

Algo trading can amplify losses if not properly monitored. Use stop-loss orders and other risk management tools.

Cost of Infrastructure:

Quality data feeds, computational power, and reliable internet are essential for successful algo trading.

Market Risks:

Algorithms are only as good as the logic they’re based on. Unexpected market events can lead to losses.

Conclusion

Algorithmic trading can be a powerful tool for retail traders, offering the potential for consistent profits through disciplined and efficient trading strategies. While it requires an upfront investment of time and resources, the rewards can be substantial. By starting small, focusing on learning, and leveraging available tools and platforms, retail traders can harness the power of algorithmic trading to compete effectively in today’s financial markets.

Algorithmic trading opens the door to opportunities that were once reserved for institutional players. With the right approach and mindset, retail traders can turn algorithmic trading into a profitable venture.

Hello.

There is reasonable evidence that this article is machine-generated.

We would appreciate it if you could avoid publishing AI-generated content (full or partial texts, art, etc.).

Thank you.

Guide: AI-Generated Content = Not Original Content

Hive Guide: Hive 101

If you believe this comment is in error, please contact us in #appeals in Discord.