Anarchist Investor Weekly

Your weekly review of the Anarchist Investor Newsletter

Precious Metals Telegraphed the Iranian Attack

And there's potentially more to come.

THE ANARCHIST INVESTOR

APR 15, 2024

For weeks Gold, Silver and Oil have been rallying while the stock market (Casino) has been weakening. Many financial news pundits were chalking this up to hot inflation numbers and delayed rate cuts by the Federal Reserve. I wasn’t convinced. I still think we’re closer to deflation than inflation. Metals and Oil were telegraphing an escalation in conflict in the Middle East. Let’s look at that and then what may be to come.

Inflation Doesn’t Look Like This

Yes, during times of inflation, metals rise as a hedge (imperfect as they may be). You also see everything else rise with few exceptions. However, we’ve recently seen pockets of assets disinflate (slow down their increases) or even deflate (drop in price). Examples would be cars, some regional real estate prices, building materials like lumber, industrial metals like palladium, etc. Many of the extreme cases of inflation can actually be tied directly to supply shocks. The bull whip within the supply chain is continuing to play out in cocoa, wheat, corn, and many other agricultural commodities. Just today there was a story about how the projected Monsoon season in India will be wetter than usual which will help food inflation due to higher yielding harvests. India has banned exports to protect its citizens from even more food inflation. If the ban were to be lifted, the global prices of these goods should moderate as a result. Consumer spending continues to increase outside of food and energy prices. However, much of that is based on the expansion of consumer credit which is already beginning to crack. Delinquencies are rising while employers continue to cut staff. Just today Tesla announced a 10% workforce reduction. There is only so long the economy can withstand layoffs at higher paying jobs while folks sign up for gig work like Uber eats and Amazon Flex.

Gold, Silver & Oil’s Warning

Despite the above headwinds for inflation, metals and oil increased in price over the past few months. Outside of heading inflation, the primary reason for these commodities to rise in tandem is insurance against catastrophe such as geopolitical instability. Case in point, Iran and Israel are now engaged in conflict following the last few months of Israel’s fight against Hamas and other supporting groups in neighboring countries. Conflict in the Middle East has a habit of spilling over from country to country. This stems from the various tribes and organizations that span political borders and have ever evolving states of support or conflict with each other. A lesson that took Trillions to learn by the US during Gulf Wars 1, 2 and 3. If you want to learn more about the nature of the conflicts in the Middle East, I highly suggest you read Enough Already by Scott Horton.

Much of the news flow this morning has been targeted at attempting to sooth markets with the projection that these attacks may be isolated because no one in the region wants all out war between Iran and Israel. This may be true but remember the nature of conflict in the Middle East. Even if the country of Iran doesn’t necessarily want a formal war, the various tribes and groups within Iran could use this as an excuse to exacerbate the current situation.

Gold, silver, and oil are not selling off despite the stock markets rising. This is the recipe for additional conflict in the future; both in the markets as well as in the Middle East. Continued battles and contested shipping lanes will cause further supply disruptions for oil and other goods. This has the makings of the Global Financial Crisis (GFC) of 2006-2009 all over again. Oil’s dramatic rise is what ultimately broke the camel’s back in 2008. The same may happen all over again if geopolitical conflicts don’t abate.

Keep watching these three commodities. They will clue you in on the future of the economy.

The Coming Bankruptcy Tsunami

This is why the Federal Reserve Can't Wait to Cut

THE ANARCHIST INVESTOR

APR 16, 2024

We narrowly avoided a Great Financial Crisis 2.0 in 2019. Bankruptcy filings (both personal and commercial) topped 750,000 that year. This is well below the wave that coincided with the Great Financial Crisis topping out at over 1.6 million filings in 2010. The money printer and delayed debt payments in 2020 and 2021 helped to reverse that data series. However, it’s back with a vengeance. 2023 filings increased 18% to 419,000 in 2023 (up from 357,000 in 2022). And there’s more where that came from.

Health of the Consumer

Let’s begin with personal bankruptcies. 2023 saw a 16% rise year over year in personal bankruptcy filings. A debt.org report cited the following regarding the trends causing personal bankruptcies:

Medical bills are a significant factor in bankruptcy filings. The Kaiser Family Foundation showed that 41% of U.S. citizens carry some sort of medical debt, and 24% were considering bankruptcy to solve a medical debt issue.

However, while some bankruptcies were related to outstanding medical situations, other factors cause people to file. Among them: Loss of job, an unaffordable mortgage, overspending (including on credit cards), divorce, and helping other family members with financial assistance, which while noble can put the lender/gifter in a bad position if his or her financial house is not in order. 3

Medical debt continues to be the single largest reason for bankruptcy filings. While medical cost inflation typically leads overall inflation, it has remained tame throughout this inflation crisis with the past 12 months showing only a 2.2% rise. However, this is mainly due to Medicare and Medicaid spending shifts that have to do with a backlog of procedures and bills coming due following the lockdowns in 2020 and 2021. My assumption is that as those backlogs clear, healthcare inflation will return to it’s pre-2019 annual growth rate in the 4% range.

Job losses are on the horizon. This is partly to do with what I’ll discuss later about the corporate bankruptcy environment. However, we’re already seeing announcements of large labor force restructuring. Just recently Tesla announced a 10% reduction in workforce. A darling of the past few years, Tesla has seen rare reductions in vehicle deliveries and unit sales. If Tesla is tightening its’ belt, I find it hard to believe that less successful and more debt strapped companies won’t begin layoffs or filing for bankruptcy themselves. Unemployment numbers in the US have remained tame with only minor upticks recently. However, employment is a lagging statistic when it comes to economic cycles. The Unemployment rate has risen slightly and labor force participation is rising which is indicative of cash strapped households returning a member to the workforce to try and make ends meet. All of this at a time where US economic growth isn’t exactly robust.

Mortgage affordability is also an issue. The Federal Reserve’s tightening cycle has increased mortgage rates dramatically. New fixed rate and legacy variable rate mortgages are climbing in monthly cost by a lot. The new home sales data shows that the average monthly mortgage bill has jumped by about 50% since 2021 with the interest rate rising from 3.15% to 7.00%. Home prices are starting to decrease in certain regional markets to help homes sell faster. However, in high demand markets prices have maintained their levels or even advanced in some cases.

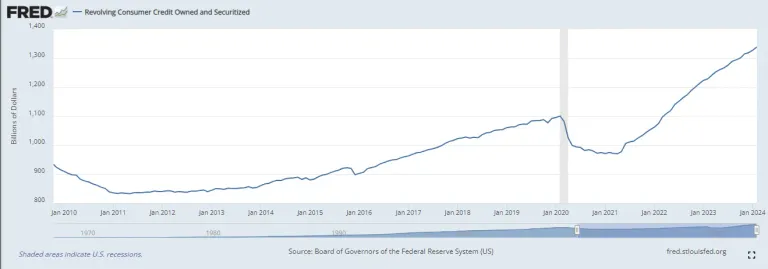

Credit card balances and auto loans are ballooning in the current environment. Many Americans splurged following the reopening of the economy after COVID and have refused to reduce their standard of living despite higher interest rates and eroding savings accounts. Hourly pay rates have only just begun to make up the stagger on inflation. As a result, credit card and auto loan balances/payments are rising very quickly. These trends are unsustainable and will require a period of greatly reduced spending and/or restructuring of these balances due. Credit card debt bottomed in 2021 at around $970 Billion. The total has since risen to over $1.3 Trillion at the end of 2023. That represents an approximate 34% increase over a period of 2 years. The average interest rate on this debt is also fueling the rise as it has increased along with the Federal Funds Rate. The Average APR for credit card debt is now at 22.63%. That is up from 14.6% in 2021. Auto loan payments and interest rates are rising as well. Recently, used car prices have begun to fall off a little bit. However, pent up demand remains following the supply chain disruption of autos during COVID. Both Auto and Credit Card delinquencies are on the rise.

Total Revolving Consumer Debt 2010-2024 from FRED

The statistics on divorce are precarious because many proceedings were interrupted in 2020 and 2021. The annual rate of divorces has been on the decline for several years. There has been a recent uptick in filings and that may or may not be related to the backlog of cases from 2020 and 2021. Of note is one of the main reasons for divorce…financial difficulties.

Health of Businesses

Commercial Bankruptcy filings increased by 22% in the first quarter of 2024. Small business filings beat that by increasing at a 30% rate. March’s numbers are up about 5% year over year and marks 20 straight months of increases. As rates and borrowing costs rise, businesses are finding it harder and harder to roll over new debt. Once this point happens, bankruptcy and/or dissolving the business are the only options. In addition, higher rates means businesses aren’t able to expand certain operations or venture into new ones because their return on debt might not result in profitability. This means less overall borrowing, expansion, and economic growth.

In line with the decrease in the health of commercial balance sheets is the rise in layoffs and labor restructuring to try and preserve capital or maintain profitability. Articles such as this one from nerd wallet don’t foresee widespread increases in firings. They have only observed isolated instances in certain industries. Keep in mind though that this is all things remaining equal. A spike in corporate bankruptcy filings would completely change this outlook and it is my position that it will. The proof? How investors are putting their money to work.

The HYG etf tracks the price of High Yield Corporate debt. These used to be referred to junk bonds. I guess we changed the name because it made them feel crappy about themselves. That aside, the HYG tracks companies that are looked at higher risk and their borrowing costs. Because yield moves inverse to price, as the HYG moves up, these companies are issuing debt at lower yield (or you can think of it as their interest rate). As the HYG drops, these companies now issue debt at higher yield to attempt to grow or roll over older debt. Investors will buy this if they think that the risk of default in the commercial world is dropping and sell it if they think it is increasing.

For the majority of 2022 as the Fed raised rates the HYG was sold off aggressively. Higher rates meant that companies that rely on debt might go bust. The etf bottomed and consolidated from October of 2022 until October of 2023. Following October of 2023, the broader market anticipated a halt to Fed rate hikes and thus the immediate risk of defaults was reduced. The overall market rallied vigorously and so did HYG. However, the HYG has stalled and consolidated starting in December of 2023. It has recently broken below this consolidation and looks to be rolling over again. The main culprit here is the rising risk of default due to a perceived delay in Federal Reserve rate cuts along with a darkening economic picture. Countries in Europe have fallen into recession and China is faltering. Commercial operations in the US are soon to follow. As such, big money investors are pulling their investments from these higher risk borrowers to recommit to lower risk ones or even hold cash.

The wave of bankruptcies will soon grow into a Tsunami. It’s not a matter of if, but when.

Sources:

https://www.reuters.com/markets/us/us-bankruptcies-surged-18-2023-seen-rising-again

https://www.kff.org/health-costs/issue-brief/the-burden-of-medical-debt-in-the-united-states/

https://www.bankrate.com/mortgages/average-monthly-mortgage-payment/

https://www.enterpriseappstoday.com/stats/divorce-statistics.html

Don’t Miss Your Chance At BITCOIN!!! 💰💰💰

I’m giving away $25 in Bitcoin to up to 4 free subscribers on May 1, 2024

💌 Get The Anarchist Investor automatically delivered to your inbox and get notified whenever a new post drops for free!

Subscribe to enter: anarchistinvestor.substack.com

Or better yet…Become a paid subscriber to get a chance at $100 IN BITCOIN and:

📚 Access to the full Anarchist Investor Archive

💰 My weekly portfolio update newsletter detailing allocations and performance

🎁 Incredible paid subscriber-only giveaways and promotions

US Treasuries About to Rally

And your investment options to take advantage

THE ANARCHIST INVESTOR

APR 17, 2024

I am by no means a fan of enabling Federal Government debt spending. I also can’t stand Federal Reserve debasement of the currency we’re expected to use in this economic system. However, the ebbs and flows of those two things greatly impact our lives still and create opportunity to invest. Here is what I see will happen with US Treasuries and how you can invest accordingly.

How We Got Here

To fight “inflation” the Federal Reserve raised interest rates through 2022 and into 2023. That process has now concluded with the Federal Reserve pausing its’ rate hiking cycle. This means all the while that interest rates across the board have risen and bond prices on investments such as US Treasuries have declined. Starting in October of 2023 when the pause became almost certain, bond prices began to rally and the inverse relationship with interest rates caused them to drop. However, recent “stubbornness” in inflation has caused the market place to rethink just how soon Federal Reserve rate cuts will happen. As I’ve discussed in many prior articles and livecasts, the market isn’t reading the tea leaves correctly. We are closer to deflation than we are reinflation. However, the recent moves have been toward lower bond prices and higher rates with the potential for a prolonged pause or even a resumption of rate hikes by the Fed. This won’t be the case for several reasons:

The US Federal Debt is unsustainable at higher borrowing rates. The annual interest payments alone are at $1 Trillion and will continue to rise as US Treasuries are issued to pay for maturing debt while also funding new deficit spending. The Federal Reserve will need to act to keep the Federal Budget from exploding.

Economic data is weakening. While oil rises and puts pressure on US consumers, overall business activity is slowing or even retreating in many key areas. Several commodities are selling off strongly due to future weakness in demand. The last 2 years of yield curve inversion is squeezing financial sector profits and causing a dramatic slow down in borrowing which in turn drops future prospects for ‘growth’ in our debt-dependent economy. The last shoe to drop is overall corporate profits and then employment.

Other global central banks are already planning rate cuts. Several European countries have been in actual recession for multiple financial quarters. The European Central Bank will cut in June. This forces the Federal Reserve’s hand. If the ECB cuts, the US Dollar will appreciate in value (god forbid) which will create further headwinds to economic growth in the US. The Federal Reserve can not tolerate much deflation in the economy as productivity will contract and a large wave of debt-laden companies will file for bankruptcy.

Geopolitics are straining the recovering supply chain. The damage done through the lockdowns in 2020 and 2021 has been hard fought to recover. Disruptions in the Middle East will continue to complicate this process. While some prices may rise as a result, the end result will be Global Economic weakness.

The end result is a Federal Reserve rate cut sooner rather than later.

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation

How To Invest Accordingly

I would never advocate for enabling US debt spending or lining the pockets of Wall Street bankers that profit through what amounts to theft. However, if you are less put off by these things, you can invest in US Treasuries rising in price. One of the most popular ways to do this would be through an ETF called the TLT. It tracks the price of the 20 year US Treasury. Keep in mind that the long end of the curve won’t increase nearly as much as the short-end. Therefore, a higher risk but also higher potential return play would be to purchase the SHY etf that tracks the prices of the 1-3 year US Treasuries.

The next area you should be looking at is your cash holdings. If you have a safety fund and/or portion of your portfolio in cash, now is the time to lock in rates you probably won’t see again for several years. That means CD rates for the most part. Anything you are rolling over or have been looking to put into some form of less liquid cash account would best be served locking in 3-5% yield right now. These won’t stick around for much longer. Keep in mind you may need access to this money so the CD should include at least one withdrawal without penalty. I recommend laddering CD’s such as 3 months, 6 months, 12 months and 24 months. Money market funds are an option here however their rates reset regularly so you may not be able to lock in rates.

Risk assets are weakening right now. There will be one last thrust higher when the Federal Reserve finally announces its’ first rate cut. Keep in mind that the worst losses in the Wall Street Casino typically happen after the first cut. This means there will be a short window to lock in profits. This will apply to stocks, gold & silver, oil, and crypto like Bitcoin. Until further notice, Bitcoin and the others move like Technology stocks. You can purchase a little right now as a trade in the event this plays out accordingly. I would recommend selling as the market pumps leading into and following the rate cut announcement. That cash can then be rolled into the investments I mentioned prior or you can sit on them to average into gold and silver and longer term investments. Gold and silver will drop off as folks raise cash during the downturn in the economy. This won’t last forever. Gold and Silver typically rally near the ‘recovery’ phase of the recession because the recovery is still fragile (which brings risk of falling back into recession) and the Federal Reserve loosens monetary policy which brings about currency debasement and inflation.

Longer term investments that you are averaging into will become cheaper. Think real estate, oil, uranium, gold & silver, crypto, etc. These you can continue to value average into or even pick up the magnitude of purchases if you are taking profit in other areas such as the stock markets. You should also be investing in yourself. Either through education or by building/expanding your side hustle that scales.

Biden & Trump Love Tariffs

And Tariffs continue to be an awful idea.

THE ANARCHIST INVESTOR

APR 18, 2024

Who pays for tariffs? In short, you do. Why are they an awful idea? Because they raise costs for domestic consumers and create supply shortages. The first tariffs in the United States were enacted as a result of The Tariff Act of 1789. The act was sold as protection for developing industries in the states and a revenue raiser for the Federal Government. In truth, it was the beginning of a disastrous precedent that eventually became a major reason The Great Depression was as severe as it was.

Tariffs and Protectionism

What is a Tariff?

A tariff is a type of tax levied by a country on an imported good at the border. Tariffs have historically been a tool for governments to collect revenues, but they are also a way for governments to try to protect domestic producers. As a protectionist tool, a tariff increases the prices of imports. As a result, consumers would choose to buy relatively less expensive domestic goods instead.

Investopedia

The most frequently cited political reasoning for trade restrictions, taxes, and tariffs is to protect domestic industries from “unfair” competitors abroad. Another way to refer to such policies is Protectionism (recently that falls under the umbrella of Nationalism). At face value this sounds like a good idea. However, the economics behind it make it an awful one that causes far more harm to far more people than it helps.

The Tariff Act of 1789 was the precursor to many such bills that culminated in the Smoot-Hawley Tariff Act of 1930. This protectionist legislation may very well be the worst trade regulation ever passed by Congress. This opinion is laid out in depth in this Marketplace podcast episode by Kai Ryssdal. The TLDR version was that economic weakness in the United States prompted Congress to ‘help’. The help came in the form of protectionist price regulations that place tariffs on over 20,000 goods that came from overseas. The result was higher prices for Americans (regardless of whether they bought imports or domestic products) as well as supply shortages. Some of the producers of these goods benefited domestically but as is the case with all protectionist measures, a higher cost was born by Americans whose household finances were already destroyed by high unemployment. This was just the first order affect. The second order affect was the trade war that ensued. Foreign nations increased their tariffs on American-made goods. This decreased the international demand for American products. It’s estimated during this time period that 66% of international trade stopped (at a time when millions needed lower prices and consumer demand to help them get a job).

**Note that the US Government enacted countless policies during this period that exacerbated the fallout. At one point they were burning grain and killing domestic livestock to increase farmers’ selling prices when many folks couldn’t afford to eat at is was.

Biden & Aluminum

President Trump began the descent down this ridiculous rabbit hole by increasing Chinese tariffs during his term as President. He also increased import taxes on goods from Canada, Mexico, and Europe. These have increased the impacts of inflation at present.

President Biden is campaigning for reelection by courting many of the same interest groups that Trump appealed to with protectionist policies to get elected in 2016. Recently, as detailed in this CNBC article, the President toured Pittsburgh steel mills and promised to increase the import tariffs on Chinese steel and aluminum by 3 fold. US manufacturing has been on the decline for a number of decades. It’s a direct result of economic cycles. However, politicians don’t get elected or re-elected by affirming their support for economic cycles. They get votes by ‘doing something’. In a period of time where the United States is coming out of inflation fueled by supply chain disruption and money printing on steroids, this is the last thing we need domestically. (It’s also incredibly ironic and disheartening that many of Trump’s protectionist policies are now seeping into the supposed opposition’s political platform)

Luckily, this saber rattling for protectionism isn’t having a major effect…oh wait. Aluminum has entered the chat:

Aluminum Futures

Wouldn’t you know that a tripling of the tariff would take it from 7.5% to roughly 22.5% and Aluminum futures have risen approximately 21% over the last 8 weeks? First of all, now you see how the Wall Street Casino works. Politically connected financial firms obviously got telegraphed that this was coming so they front-ran the trade. Secondly, the market is reacting by doing exactly what it should, adjusting for a higher price environment for Aluminum going forward. This means higher prices for everyone at a time when inflation is ‘sticky’ and causing the US economy to weaken.

Also notice how the pricing here had been headed lower over time and only recently it has begun to increase as a result of this policy position. In essence, the administration is introducing yet another supply disruption and the price is reacting accordingly. Meanwhile, the vast majority of other commodities are headed lower in price or at least disinflating (slower rise). Ultimately, this will harm the US economy more than it will help. Keep in mind that these actions will ultimately result in retaliation by China and other International producers if they feel they will be the next target. It will also slow international trade at a time when the global economy is in a slowdown with many industrialized countries in recession or on the verge.

Want a more complete primer on Tariffs and how they are absolutely awful Economic Policy? Download the Mises Institute pdf of The Tariff Idea by W.M. Curtiss here.

Sources:

https://www.investopedia.com/news/what-are-tariffs-and-how-do-they-affect-you/

https://www.marketplace.org/2017/08/24/what-was-one-worst-pieces-us-legislation/

https://www.cnbc.com/2024/04/17/biden-wants-to-triple-china-tariffs-on-steel-aluminum-imports.html

Arbitrage is Everywhere

This weekend I'm taking my son and his friend garage sale'ing.

THE ANARCHIST INVESTOR

APR 19, 2024

There are opportunities to hustle everywhere you look. You just need to be able to see them. Reselling or flipping things is a constant source of potential income. Years ago I started following Gary Vaynerchuk (Gary V) and watched him, a CEO of a $100 million advertising firm, go garage sale’ing and make $100 in a couple hours by identifying underpriced items like branded coffee mugs and then flipping them on Ebay for profit.

What Makes a Good Reseller

There are literally tons of skills you get to hone while garage sale’ing and subsequently flipping. Here are a few.

Researching

It takes a great deal of familiarity with certain types of items to be able to consistently turn a profit flipping. A big part of this is researching how much items sell for, where they sell, and how quickly they sell. Flipping is a lot about turnover. It’s not about building a collection of stuff that no one ever buys. Profit needs to be realized. Sell through rates are an important component here. What is a sell through rate? In simplest terms it’s what percentage of the overall number of the same item sell in a given period. For most items you’re looking for anywhere between 50% to 80% of the listed items turning over every month. This means you can price yours around the market price and it will be expected to sell within the month.

Bargaining

It’s basically the sale that you’re making at the same time the original seller is trying to sell you. Bundling items is a great way to increase your profitability on items while also making the garage sale operator happy that they’re getting more money and getting rid of more stuff. This is also a skill that pays dividends in many other aspects of life. Being able to quickly build report with someone else and get to a mutually beneficial agreement is huge.

Consistency

This is a side hustle that doesn’t scale as well as others. However, some folks have been able to build teams that help them source, list, and ship items in higher volumes than they could do by themselves. At the core of a single person or small team operation is the building block of consistency. Items need to be regularly sourced, listed, and shipped. Inventory also needs to be regularly monitored and managed. The most successful at this aspect as usually the most successful on the whole. Many things can go wrong in other areas of this hustle but if you can be consistent, you can overcome them easily.

A side note, there’s also a competitive aspect to this. Profitable items don’t just sit around forever. Many times there are other resellers looking for the same deals you are and the early bird gets the worm. I recently missed out on a stack of video games because the garage sale advertisement listed video games and someone showed up an hour prior to the start to purchase them.

Will This Make You Wealthy?

More than likely not. It can however provide a secondary source of income or a means to pay off debt. Both of these are huge. I like to stack cash flows. I currently have multiple sources of cash flow and I’m adding more as I master one and move on to the next. Flipping will be one of those moving forward. It will also serve as an incredible learning opportunity for my son and his best friend. A set of skills that will serve them well for the rest of their lives.

Updates will be forthcoming!

Affiliate Links

Get $10 in free Bitcoin and start stacking today with Swan Bitcoin: https://www.swanbitcoin.com/anarchistinvestor

Automate your Gold & Silver Purchases with Vaulted:https://vaulted.blbvux.net/g1EGKX

Save/Make Money on your Cell Phone Plan with Helium MOBILE:https://my.hellohelium.com/ref/2FN2CHL

Channel Links

Matt-Archy on X: https://twitter.com/Matt_Archy

Ungovernable on X: https://twitter.com/UngovernPod

Ungovernable on YouTube: https://www.youtube.com/channel/UCL0qwtU4SZhCgpz6f4EMgzw

Ungovernable on Facebook: https://www.facebook.com/UngovernablePod

Ungovernable on Twitch:

Ungovernable on Rumble: https://rumble.com/c/c-5871264

Ungovernable on Odysee: https://odysee.com/@WhyLibertarian:f

Keep in mind that investment and investment results are very much based on you as an individual. I am not an investment advisor. I’m a dude with an opinion. Do not rely solely on the discussion here to inform your investment decisions. Always make the investment decisions that are right for you and your situation