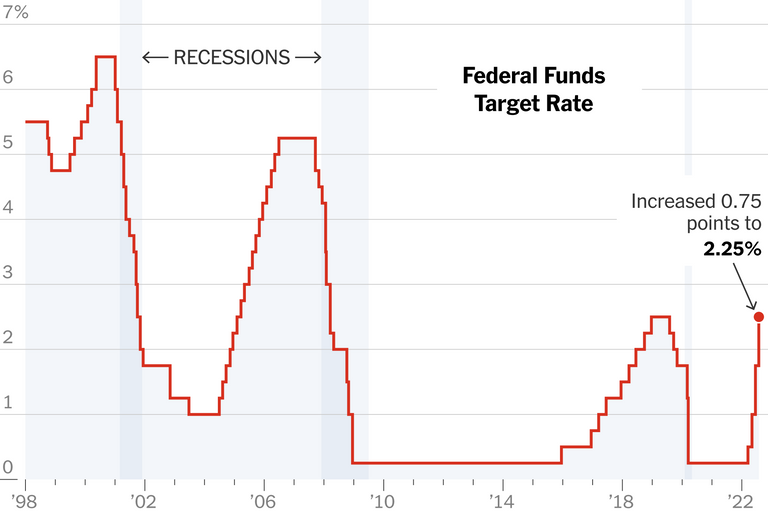

Image from New York Times illurstrates current interest rate hike by the FED compare to past rate hikes. Not how quickly rates were raised since the start of 2022 compared to previous rate hikes. Today's 0.75% increase is one of the largest in history.

For those not aware with higher interest rates it means borrowing cost are more expensive. Yet the stock market closed a lot higher after the news.

There is much more concern down the road to see how long these higher rates can last before it effects the economy. In all previous rate hikes it had resulted in a recession in the real economy. This is a major head wind down the road and not optimistic with the current buying spree in the stock indexes.

Conclusions

FED chairman Powell acknowledge the current economic conditions warrants higher rates but do not believe they were late in reacting to raising rates.

“Did it matter in the end? I really don’t think it did,” the Fed chair said. “I’m not sure it would have mattered if we’d been raising rates earlier. Lots of central banks were raising rates three months earlier and it didn’t matter.”

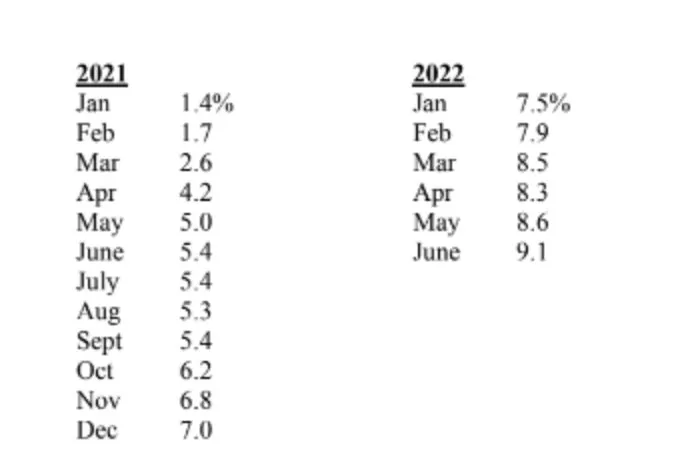

We on the other think otherwise as the CPI which is the real inflation rate people are facing had been on the rise of over 2.25% for over a year.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

Late to the party as always. Not sure why we have to pay these people with our tax dollars

Should note we pay them but we don’t elect them. The current president has the power to remove them but it will likely not change a thing as bank presidents think the same. Definitely frustrating.

I don't exactly trust Powell that much. He is good at re-assuring people with short-term moves. I think the market moved because Powell said that they might be done raising rates. I am wondering where things go.

Posted Using LeoFinance Beta

Powell came from investment banking world prior to being FED. This means he will protect and save his bank friends before all else fails. I too don’t trust what he is doing.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @mawit07, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Do you want to win SOME BEER together with your friends and draw the

BEERKING.So we back at pre-Covid levels regarding interest rates…

In my view they won’t have much influence on the reasons of inflation we are seeing not will the matter much in regards to loss of purchasing power (3% vs 9% inflation).

FED behind the curve. Printing 80% of all USD in two years is the key to soaring inflation. Interest rates at this level is a joke. Inflation is likely going to persist very many years to come.

Think so too, inflation is here to stay. Maybe not that high as now but definitely beyond 3-4%. We‘ll see.