The tech sector has taken a worse hit than SPY and initial assessment after the past two sessions is not looking so good for Nasdaq. NQ is near support line that had held during this recent uptrend that started in March, but the volatility in the index is rising. If VXN continues to rise it will likely spell more trouble for NQ. The fact that there has been massive rise in NQ above its 200 SMA it will likely find little to no supports if it breaks down. 11,100 is a crucial value for bulls to hold if it does get there. Friday's session it bounced right around 11,140ish but bulls need to take control sooner rather than later to maintain tech rally.

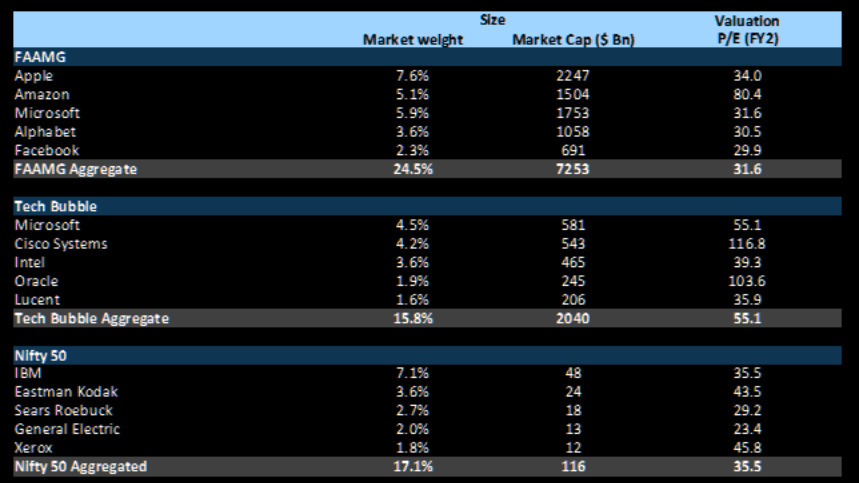

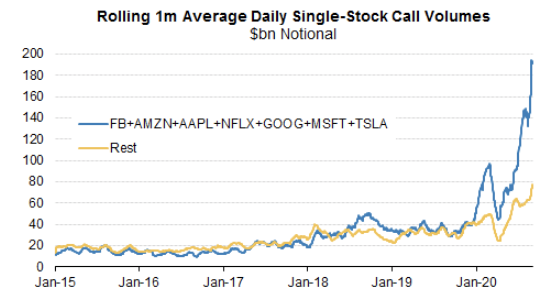

Evaluating current top tech companies market cap relative to past prior to crash leads me to believe a correction in tech is in store. However in today's period all the top tech companies are earning massive profits compared to other companies so hard to say that we are at a top now when it is valid where the FANG stocks should lead the market since they are the strongest in the real economy.

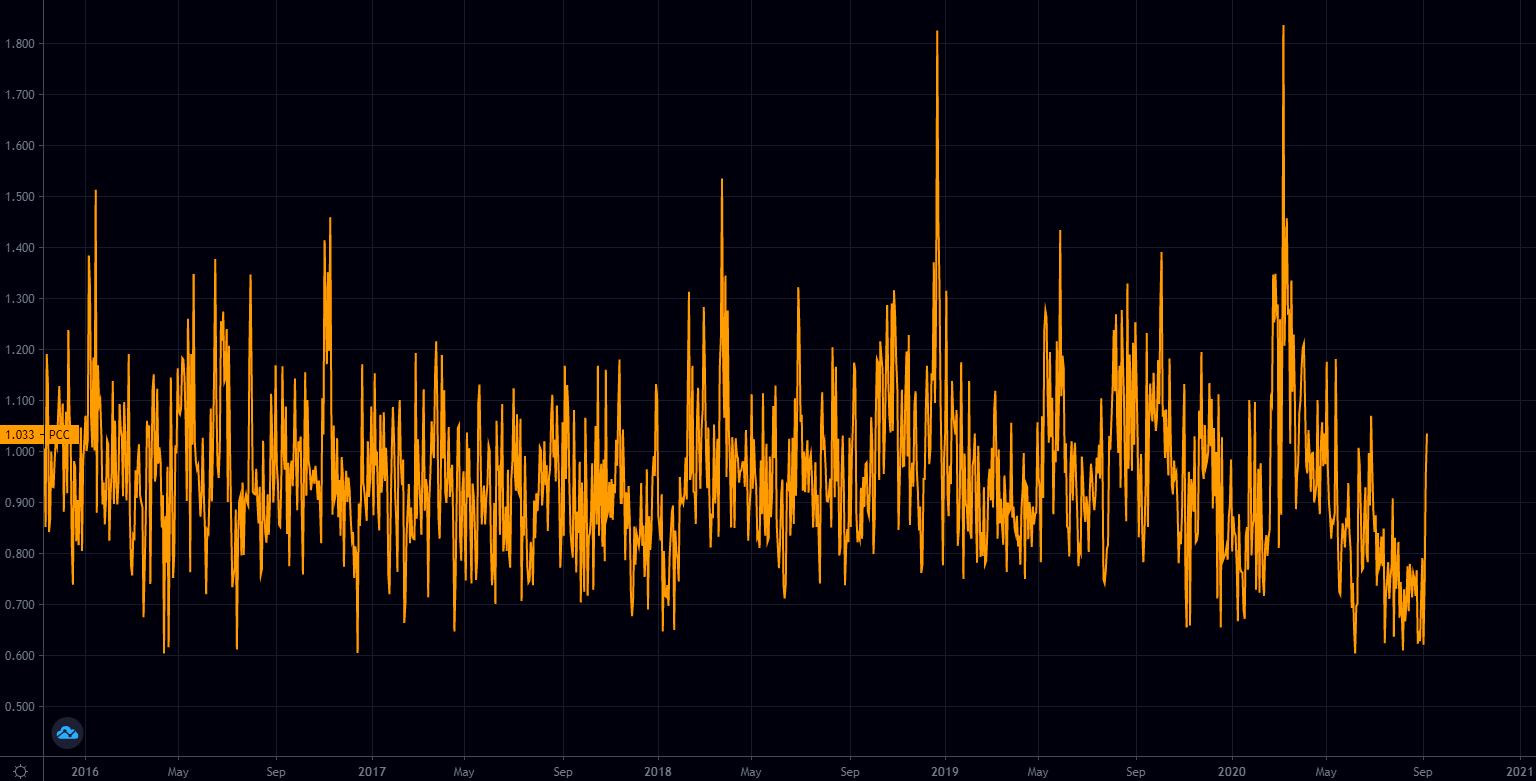

Equities put to call ratio rose back to an average value as of Friday at 1.033. There is more hedging going on so hopefully this will create a floor or support levels if stock prices drop.

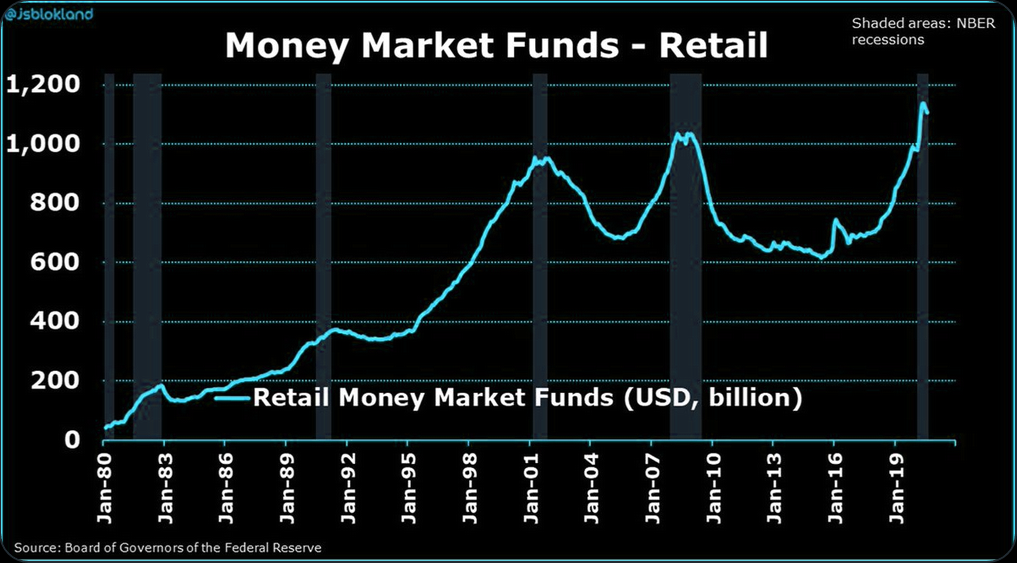

Cash on the sidelines have yet to really be put to work so another potential reason why tech has not topped out yet. As these next few trading sessions move forward it will be interesting to see if more money gets put into the markets and if so how much will go into tech since past few sessions it has appeared value stocks have gotten bid while tech sold off.

Posted Using LeoFinance

👍👍👍👍👍👍