Bitcoin's failure to hold the Uptober momentum brought widespread drawdowns this past week, and DeFi pools felt the drawdown badly as well. Despite market weakness and continual portfolio drawdown, we keep earning yields even through the drawdowns.

Week 35 TLDR:

- Weekly Fees Earned: $62.52 (down from $145.07)

- Positions Closed: 0

- New Positions: 0

- Total LPs Active: 5

While this week's earnings are roughly half of Week 34's, the broader context matters: the wider crypto market prices pulled back badly this past week, but yield performance stayed healthy relative to the risk profile. Bitcoin slipped nearly 13% from its October 6 high of $126080 to $109820, its weakest October since 2018. Jerome Powell's statement that rate cuts are "not a foregone conclusion" instantly tightened liquidity expectations. Nearly $1.1 billion in long positions were liquidated within 24 hours. This demonstrates how thin liquidity and leverage optimism can reverse sentiment overnight.

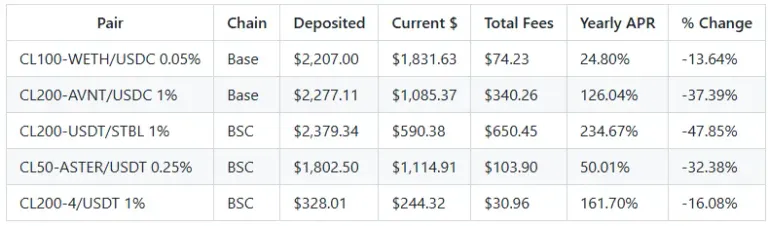

Week 35 Current Holdings

No positions were opened or closed this week. DeFi yields normalized to $62.52 after last week's surge. The data confirms that compounding through longer-held ranges produces stronger cumulative results than frequent repositioning. Most ranges still generate positive yield despite more price decreases this past week.

Impermanent loss in range positions is cyclical. Over 50-day horizons, what matters is net fee efficiency versus volatility exposure. The "growth versus dilution" race within projects like Avantis continues to play out. October defied its nickname. BTC's long-term holders began selling, consistent with a belief that the four-year cycle might be peaking. Still, the structural bull case remains intact. Institutional ETF approvals, on-chain revenue growth, and steady accumulation from whales suggest this pullback is a liquidity-driven reset, not a macro collapse. What will November bring?

- CL200-AVNT/USDC (Base). This week generated $28.61, nearly half the weekly yield. AVNT remains the most aggressive performer both in fee generation and volatility. Avantis continues to impress with $118M TVL, $47.7M annualized fees, and over $43B cumulative trading volume. The challenge remains tokenomics: only 26% of supply circulates, and major unlocks are due in 2026. If daily revenue sustains the $200K mark, buybacks will create a self-reinforcing value loop.

- CL200-USDT/STBL (BSC). This week yielded $6.45. Down 47.85% overall but still generating $650.45 in total fees at a 234.67% yearly APR. STBL has spent five weeks consolidating. With staking and buyback mechanisms being teased and $150M in USST mint capacity, the team is likely preparing for a catalyst.

- CL100-WETH/USDC (Base). This week generated $12.05. Down 13.64% with $74.23 in total fees at a 24.80% yearly APR. This range continues to struggle from Ethereum's sideways movement under macro pressure. Despite volatility, whale accumulation in ETH continues.

- CL50-ASTER/USDT (BSC). This week yielded $7.56. Down 32.38% with $103.90 in total fees at a 50.01% yearly APR. The ASTER pool remains in the accumulation phase. CZ disclosed a $2M personal purchase of ASTER tokens this week, triggering a 30% spike before retracing.

- CL200-4/USDT (BSC). This week contributed $7.86 in fees. The memecoin culture persists, with 4 remaining a top-performing community token on BNB, flirting with a Binance Spot listing. Liquidity remains highly speculative, but the flow shows how memetic capital migrates.

The Bottom Line

When markets move sideways or down, the instinct is to do more: tweak ranges, open new pools, chase APRs. But true performance emerges from doing nothing. If October was the market's stress test, November will reveal who stayed the course. I continue to be involved in DeFi and keep refining fee-to-drawdown ratios to improve capital efficiency. Even in red weeks, consistency and DeFi yields compound.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Substack

Posted Using INLEO