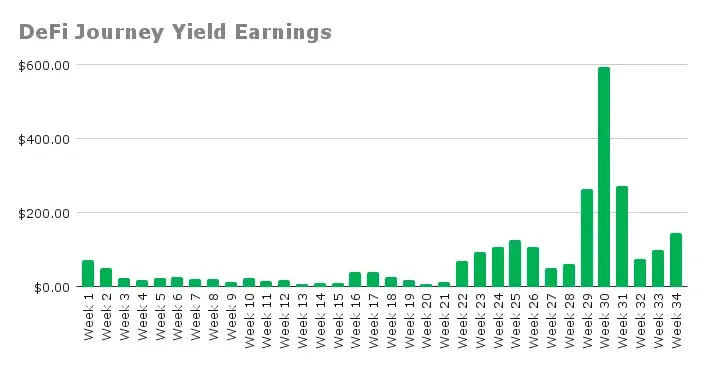

While portfolio value remains under pressure, DeFi yield continues to compound, with this week pulling in $145.07, up ~46% from last week. There were no new or closed positions, and I'm staying put across Base and BSC. With all positions having relatively wide ranges, the focus is on remaining patient and stacking the yields on a weekly basis.

Week 34 TLDR

- Weekly Fees Earned: $145.07 (+46%)

- Positions Closed: 0

- New Positions: 0

Despite a challenging market, yields remain healthy. The standout pool this week was AVNT/USDC, which contributed nearly 60% of the total yield, thanks to heightened Base volume and wide range volatility. October continues living up to its "Dumptober" label, but there have been some glimpses that the pace of decline has slowed.

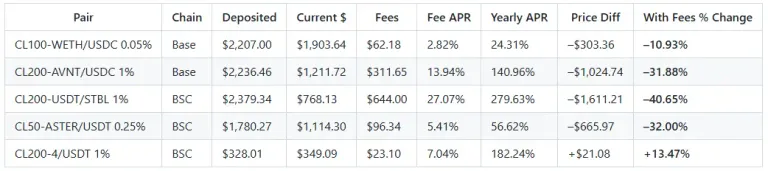

Week 34 Current Holdings

No changes to positions this week, with all five remaining active. The standout recovery came from 4/USDT, flipping green after the supposed "hack" turned out to be another episode of meme-chain drama. The overall DeFi portfolio is still down roughly 27% overall (after fees), but yield farming is holding strong. If markets even stabilize mildly or go on the slated Q4 run, then we may see the portfolio climb up and continue to generate fees.

- CL200-AVNT/USDC (Base). This week, this position alone generated $85.67, which is nearly 60% the weekly yield. AVNT's fundamentals remain strong: volume, TVL, and revenue are all at ATH even as price trades 70% below ATH. 22 RWA markets are live, and an $8M Series A is closed. The founder is ex-Pantera. AVNT is cooking, and if there is a Q4 bull run, this coin is primed and ready.

- CL200-USDT/STBL (BSC). This week, this position yielded $22.42. STBL co-founder Reeve Collins (also co-founder of Tether) spoke at GITEX about Stablecoin 2.0, a model that returns real yield to LPs. The ecosystem is expanding with minting, staking, and $1M/month premium buybacks beginning in November.

- CL200-4/USDT (BSC). My only green LP position. This week, this position contributed $15.97 in fees. The reported "hack" wasn't real, and the current FDV is ~$140M and 4 has become the cultural anchor of BSC and feels like a meme that may survive multiple cycles in the same vein as Doge. On that basis, I have taken all the yield generated this week and increased the LPs' deposit.

- CL50-ASTER/USDT (BSC). This week, this position yielded $7.02 in fees. ASTER finally broke out of its descending channel and held the key buy zone ($1.00--$1.05). RSI rebounded from oversold, and volume is increasing steadily. If ASTER continues its positive momentum, it may return to September highs.

- CL100-WETH/USDC (Base). This position generated $13.98 this week. This position is by far the most stable LP pool in my DeFi portfolio.

The Bottom Line

I am going to be happy to see the back of "Dumptober", but at least the fees continue to generate and compound. The overall DeFi portfolio is still down roughly 27% overall (after fees), but yield farming is holding strong with $145.07 earned this week, which is up 46% from last week. If markets even stabilize mildly or go on the slated Q4 run, then we may see the portfolio climb up and continue to generate fees. My playbook remains unchanged: have LPs position remain in range, compound through volatility, and stack yields on a weekly basis.

Thank you for reading, and hope you have a good rest of the day!

Follow me on these other platforms where I also post my content: Publish0x || Hive || Medium || Twitter || Substack

Posted Using INLEO