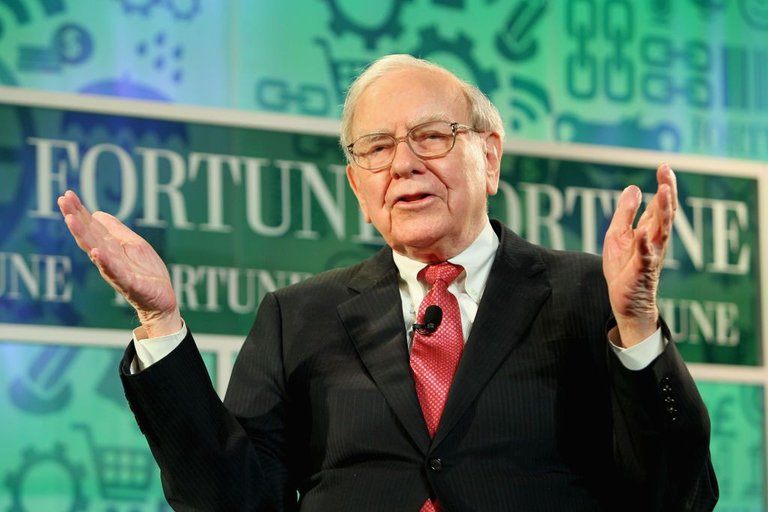

Another viewpoint that demonizes, for the umpteenth time Bitcoin. The main antagonist, par excellence, is Warren Buffet, as he asserts that since it does not represent the shares of a company, Bitcoin has no value.

The market, however, says the exact opposite!

Let us see in more detail why Schiff does not consider Bitcoin a digital currency.

Just three days have passed since Bitcoin's (BTC) halving, considered one of the most significant events in the cryptocurrency sector, yet American economist and gold enthusiast Peter Schiff continues to criticize the leading decentralized finance (DeFi) asset's ability to function as a digital currency. In his post on April 22, Peter Schiff stated, "The cost to complete a Bitcoin transaction is now $128, and it takes half an hour to process."

He further added that this period has increased to "over an hour," making the primary cryptocurrency unsuitable to serve as a digital currency, hence a "failure."

Schiff's Bitcoin vs. gold debate While some commentators pointed out that it would be much more expensive (not to mention longer) to ship "even just a liter" of Schiff's preferred precious metal "safely around the world," the economist dismissed the argument as "irrelevant" because "people aren't using gold as currency right now."

However, he added that tokenizing gold on a blockchain is possible, stating that, in such a case, "transaction time would be almost instantaneous and cost minimal," arguing that "gold works much better on a blockchain," to which the crypto community reacted with dismay.

Just to recall, Schiff also criticized Bitcoin's status as a "safe-haven asset" in an increasingly complicated geopolitical situation, comparing its performance to that of gold (which he considers superior) and declaring that "the Bitcoin craze is over."

Schiff's Bitcoin price prediction Additionally, the American commentator had also predicted that the most important asset in the cryptocurrency market would undergo a "catastrophic collapse" due to the large quantities of BTC entering exchange-traded funds (ETFs), making it more vulnerable as it is unlikely that Bitcoin ETF spot buyers are "true believers."

Conclusions Ultimately, while the idea of tokenizing gold may have interesting implications, Schiff's opinions and forecasts on Bitcoin seem to be based more on personal sentiment than objective reality. After touching the much-criticized $128 peak, Bitcoin's transaction fees have already dropped again, returning to the $8-10 range. As for the price, CoinMarketCap data (collected at the time of writing our article) widely demonstrate that Bitcoin has managed to rise above the $65,000 price level and is currently trading at $66,144. This means that the leading cryptocurrency has recorded a 0.08% increase in the last 24 hours and a reversal in losses on the 7-day chart, which now shows a 4.08% increase; meanwhile, even the 30-day chart reports a gain of 2.45%.

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.