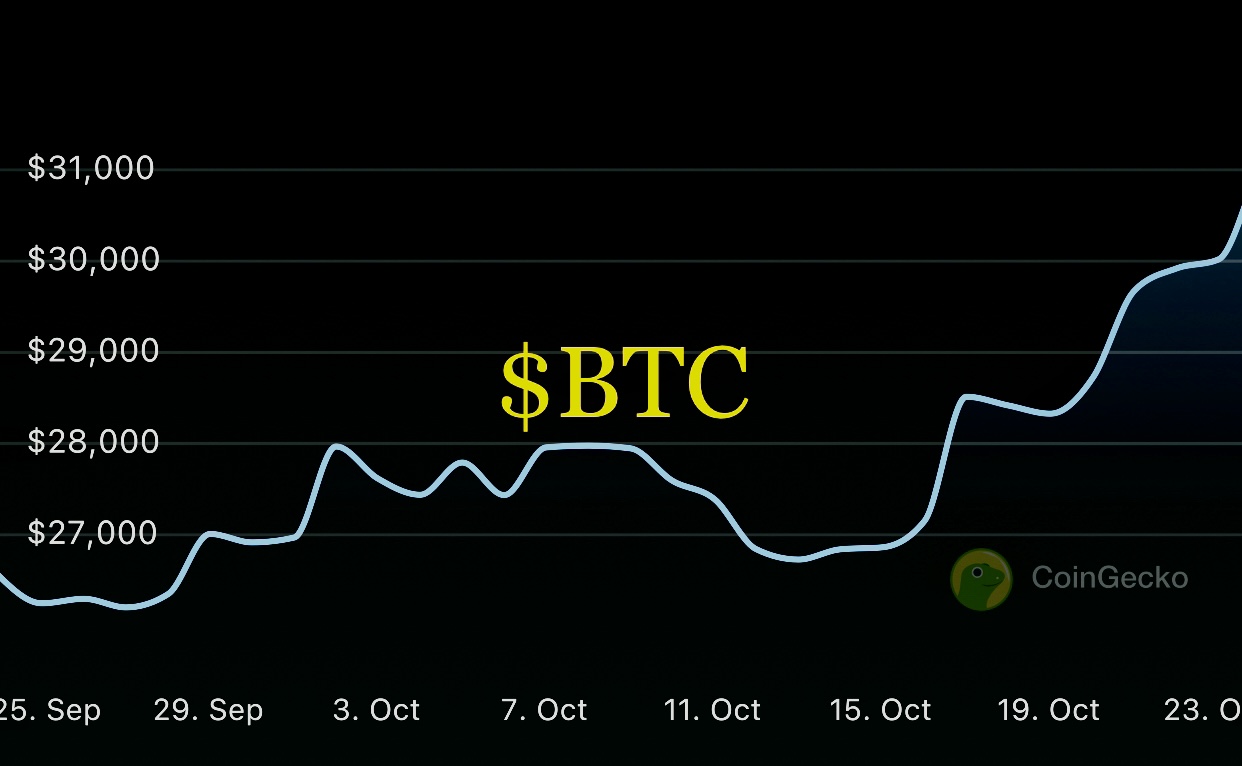

October ushered in an exciting wave in the crypto markets, overturning the bearish narrative that clung onto the previous months. The popular term "Uptober" wasn’t just a catchy phrase; it accurately painted the market's favorable turnaround. Here are some of my thoughts on the current dynamics of the crypto market as we navigate through this phase.

Currently, BTC is ranging towards the 32K mark, reflecting the pattern seen between May and June 2022 before the Federal Reserve's monetary loosening triggered a rally. We seem to be nestled in a pre-accumulation phase, encapsulating the market's mixed reactions to the prevailing economic cues.

The projection is that the core accumulation stage will unroll in the next 2-3 months, right on cue before the halving event. This phase is likely to be succeeded by a period of robust buying about 3-4 months down the line, potentially spurred by the Federal Reserve's tilt towards trimming down interest rates.

With global inflation rates soaring, the housing market is also experiencing a price surge. However, unlike the 2008 scenario, current lending protocols are notably more stringent, and the price uptick is primarily driven by a supply shortage.

The looming fear of a possible recession has arguably cast a significant shadow, instilling a layer of caution among investors.

Currently, Bitcoin is wrestling with resistance levels, and a retracement to the 27-28K zone wouldn't be startling, although that’s a trade I am opting to sidestep. A minor slump might lure the bears to fill more shorts, with the market maintaining a sideways trajectory, eventually liquidating the bears as prices recommence an upward trend.

The market is thirsty for a stimulus. While the ETF conversation has been relentless, it still harbors the potential to act as a catalyst, despite much of the anticipation possibly being baked into current prices. Other stimuli could emanate from Federal Reserve rate cuts or even geopolitical shifts like the cessation of ongoing conflicts.

Now, onto a notable observation: the market has shown signs of vitality even without the ETFs being approved. This point resonates with a previous post where I discussed the overemphasis on ETF approval and its perceived impact on the market. The reality is, the market has started to exhibit bullish tendencies regardless of the ETF scenario, a testament to Bitcoin's inherent strength and the growing recognition of its value proposition.

One aspect that keeps me pondering is the market's swift tendency to turn bullish. A mere trigger from the above-mentioned catalysts and we might witness jaw-dropping price actions. World asset managers have earmarked Bitcoin as a viable flight to safety. The traditional monetary moguls have played their cards, yet Bitcoin stood unflinched. It would be more than surprising if they aren’t quietly accumulating at this juncture.

It’s really interesting how one talks about these things and it just so happens in real life few days or weeks or months later, that’s how I feel about everything I’ve said in October. I’ve not been saying much about Hive though because I’ve stopped understanding it’s patterns for a while now. But it’s sure cool to see that it’s catching up some steam after Bitcoin pumps, albeit slowly, will we ever see $0.28 hive again?

It seems the days of cheap Hive are coming to an end and if so, I welcome that with open arms and I’ll def miss the cheap hive days, cheap hive is so good for accumulation. As the matter is now, no one really knows where we are going, but we have to be prepared to fly when the market says so. Are you ready to fly fren?

Posted Using InLeo Alpha

I always love me some uptober

cheers to that

I took a look at the graphs just now after reading your post. October 24, 2023 the value of Bitcoin is $34,000.00. I didn't expect this sudden surge upwards. As you wrote, October is bringing some excitement to the crypto market. !PIZZA

I’ll be more glad to watch the trend last longer into the end of the year

$PIZZA slices delivered:

@stefano.massari(1/5) tipped @mistakili

lol...no

my projections for a bull run starts next year. The market right now is reactionary. There is no real reason for the market to be up now asides the news of ETF. When that fades out we are heading towards $10k Bitcoin before any major upward movement. That is my taken.

But...if that doesn't happen and it is all bullish from here. I am fine with my position. I need hive to hit $3 to fund my last major project. After that crypto just becomes a retirement plan for me.

This was a nice overnight rally I a really hope we finally step out of this 26-31 range forg good to never come back!

Let's hope out precious follows and outpreforms!

I know right….especially for Hive, I wish hive gets out of $0.3 zones for good.