Has anybody for a second, thought that maybe, that just maybe the crypto markets have merely only been reacting to other circumstances that has led to this premature run....and the last Bitcoins halving has barely been priced in?

I have a couple of points that connect to each other to buttress this hypothesis, stay with me.

Let’s start from the first evidence. The Halving.

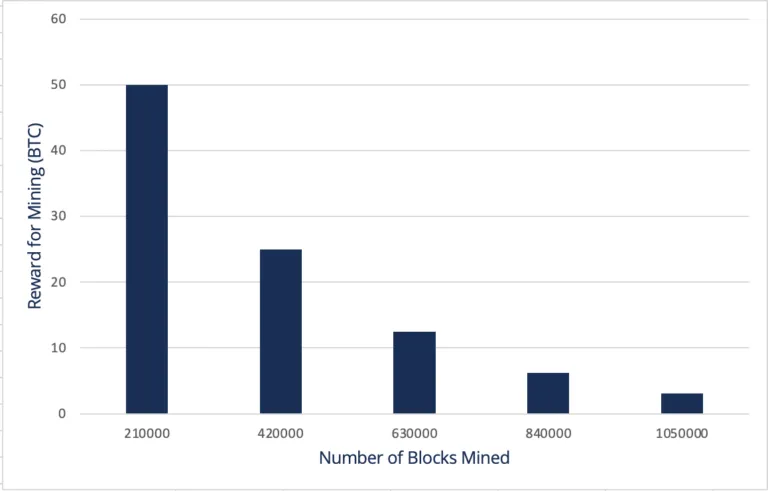

The Halving is when the block reward given to Bitcoin miners for processing transactions is cut in half which cuts in half the rate at which new Bitcoin is mined. It happens every 4 years with the last one occurring in May 11 2020. The aim of the Bitcoin halving is to ultimately make Bitcoin more valuable as the supply from block rewards is crunched.

According to history, Bitcoins halving are usually associated with huge price surges

First halving: Upon the first halving in 2012, the price of bitcoin was around $11 and rose to $12. Within a year, the price increased to $1,100.

Second halving: In 2016, the bitcoin network completed 420,000 blocks, and the second halving occurred. Bitcoin fluctuated between $500-$1,000 for a few months and then shot up to $20,000 by December 2017.

Third halving: The third halving took place in May 2020, which marked the beginning of another bull run for bitcoin. When the halving occurred, bitcoin was trading around $9,000. As at December 2020, bitcoin was trading near $20,000.

Source

Comparing these price surges with the latest Bitcoin ATH, does it seem like the halving has been totally priced in to you? Bear in mind that this previous Run up we’ve experienced in the markets have been largely fueled by institutional investments and deteriorating economies around the world due to the COVID 19 pandemic.

Also, this season has experienced the most developments in Crypto unlike any of the other years, DeFi, NFT’s, Meme Tokens,......with huge amounts of capital being pumped into them, are we so caught up that we underestimate the effect of Bitcoins halving so much? Such that some people are even saying the bull run is over?

Let’s think about it...

Posted Using LeoFinance Beta

This makes a lot of sense. History and facts. But would this mean that a bull market only occurs after a halving? Or am I missing something?

Posted Using LeoFinance Beta

Hmmn yes and no, a bull run is mostly triggered by Bitcoins halving,according to history.,,, due to its supply crunch and rate of demand. But other factors can also lead to high demand, for example technological developments, economic crisis like inflation, stuff like China announcing that they are going to start implementing Bitcoin for some reason...or some mega positive news on crypto....

Posted Using LeoFinance Beta

The bull run is not over. That's what I think. There are high chances that many will FOMO into Bitcoin just to get as much before next halving. This is just a shakeout.

Posted Using LeoFinance Beta

I agree...I mean, look at the price performance from other years compared to this year..,..it’s as if we haven’t seen anything yet

Posted Using LeoFinance Beta

You raised a valid point about the bitcoin halving, but people aren't currently thinking straight. The effect of the dip is making most people react illogically.

Posted Using LeoFinance Beta

You’re right...that’s why the ones who will likely enjoy the bull run most are those that know what’s going on behind all the noise

@tipu curate

Posted Using LeoFinance Beta

Upvoted 👌 (Mana: 11/22) Liquid rewards.

Thanks my G