Today we got a 50 bps rate hike out of the Fed and the markets are apparently really happy that 75 bps hikes are off the table for the moment.

Markets everywhere are up.

In the LeoFinance discord, bearbar made this comment:

How high can rates go and still make the debt payments sustainable?

Surprisingly not an easy question to answer exactly. Generally, they can go a lot higher.

If we look at https://usdebtclock.org/ we can see that the federal debt is approximately 30 trillion USD:

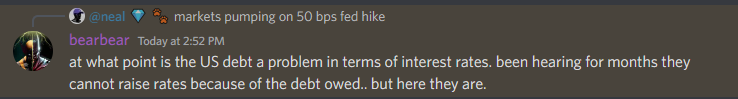

For fiscal 2021, the US government brought in about 3.8 trillion USD:

https://www.thebalance.com/current-u-s-federal-government-tax-revenue-3305762

So, if every single dollar of income was used to pay towards the debt, where does that get us?

3.86 / 30.4 = 12.6%

But of course, it's not that simple. The treasury debt that already exists has a given interest rate. They don't all change when the Federal Reserve changes rates. So you'd need a blended average rate of 12.6% across all durations of debt for that number to work.

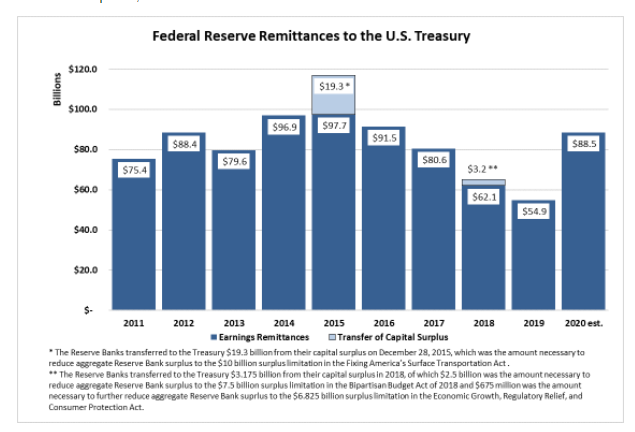

On top of that, there is a shell game going on between the Treasury Dept and the Fed.

For the portion of debt that the Fed holds, the Fed receives interest payments, pays operating expenses, and gives the rest back to the Treasury.

https://www.federalreserve.gov/newsevents/pressreleases/other20210111a.htm

I could easily imagine a scenario where this relationship is changed and the federal government just pays the operating expenses only and we don't have this back and forth kind of mechanic. That would shave 100 billion USD or so off the interest expense.

And then maybe they start cracking down on some of those operating expenses. Does JPow really need that jet? Enquiring minds want to know.

Bottom line, we are a long, long ways from the point where the government is unable to pay its interest obligations. The markets will crash well before that point.

Posted Using LeoFinance Beta

Biden just proudly announced that the U.S. had paid off some debt (or deficit, he was a bit vague) for the first time in six years. Less than one-tenth of one percent over a three month period. Yay?

At the same time, rates are going up. What could possibly go wrong?

I don't follow any presidential announcements. Got a link?

Posted Using LeoFinance Beta

https://abcnews.go.com/Politics/biden-touts-economic-growth-debt-deficit-reduction-ahead/story?id=84492487

and

https://finance.yahoo.com/news/u-treasury-now-sees-26-190000450.html

Yeah, cutting the deficit just means not going as upside down as planned. Which is good, I guess.

The actual debt paydown would be something. I am skeptical when I see that's expected to and based on projections

These things often disappear when push comes to shove.

Posted Using LeoFinance Beta

woooohaa very different Europe :D