Step 1: Set up MetaMask for Binance Smart Chain (BSC)

This tutorial is going to assume you are using MetaMask and already have it set up for Ethereum. There are other wallets you can use, but MetaMask is probably the most popular one.

BSC is a second layer on top of Ethereum that uses BNB to pay gas fees instead of ETH. BSC addresses are the same as Ethereum addresses. As a result, since MetaMask is an Ethereum wallet that can be set up to access different networks, it's a great way to interact with BSC.

binance.org has a great setup guide at: https://docs.binance.org/smart-chain/wallet/metamask.html

If you already have MetaMask installed, scroll down to the section titled, "Connect Your MetaMask With Binance Smart Chain"

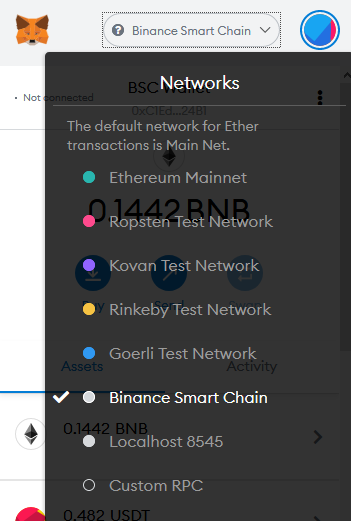

This guide will add the BSC network to the dropdown list in your MetaMask wallet, so your networks will look like this:

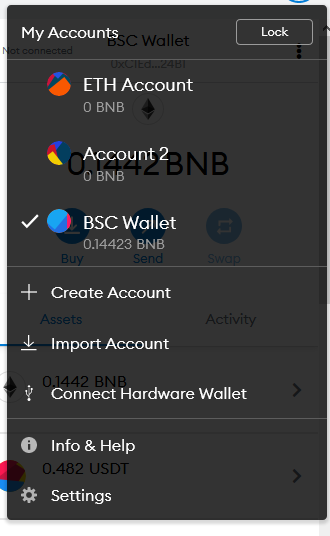

Personally, I created a second MetaMask address for all my BSC transactions. It's not required, but I just find it easier to keep things separate this way.

Once your wallet is set up, we're ready to do some transactions.

Step 2: Get USDT on binance.com exchange

Like I said before, BSC is a second layer on Ethereum and uses tokens called BEP20 tokens. All your usual players have BEP20-wrapped equivalents: BTC, ETH, BNB, USDT, etc. This guide is focusing on USDT, but the same process can be used for other tokens that have pools you find attractive.

The easiest way to wrap tokens into their BEP20 versions is to go through binance.com

So this step is fairly simple:

Send funds to your binance.com spot wallet.

If you need to trade funds to obtain USDT, do that.

Step 3: Get BNB on binance.com exchange

BSC uses BNB to pay for gas fees. The good news is that gas fees are dramatically lower than layer-1 Ethereum. At the time of writing, all the steps in this tutorial will cost about 1 USD in BNB-gas total.

If you don't already have BNB on your binance.com spot wallet, convert some of your USDT to BNB inside the wallet.

Click that convert button and convert some USDT to BNB. At today's gas prices, 0.2 BNB will last you a long time (about 50 USDT).

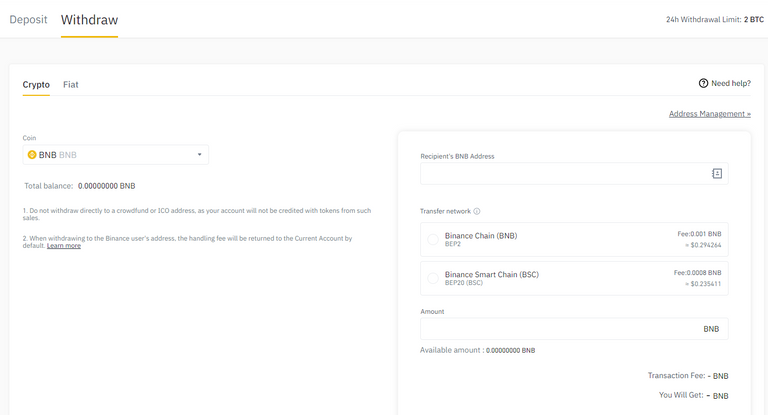

Step 4: Withdraw BNB from binance.com to BSC

From your spot wallet, click withdraw

Select Crypto, then choose BNB as the coin, copy your MetaMask BSC address as the Recipient's BNB address, select Binance Smart Chain (BSC) BEP20 (BSC) as the Transfer network.

If this is the first time withdrawing to BSC, binance will give you a little quiz to make sure you know what you are doing before it allows you to withdraw.

Important: General rule for life when doing completely new things is to test first. Send a very small amount of funds as your first transaction. Make sure everything goes through and you have no issues before withdrawing your total balances.

Step 5: Withdraw USDT from binance.com to BSC

Repeat Step 4, but withdraw your USDT instead of your BNB. It all goes to the same address.

Congratulations, you now have assets on BSC.

Step 6: Zap Half of USDT to BUSD

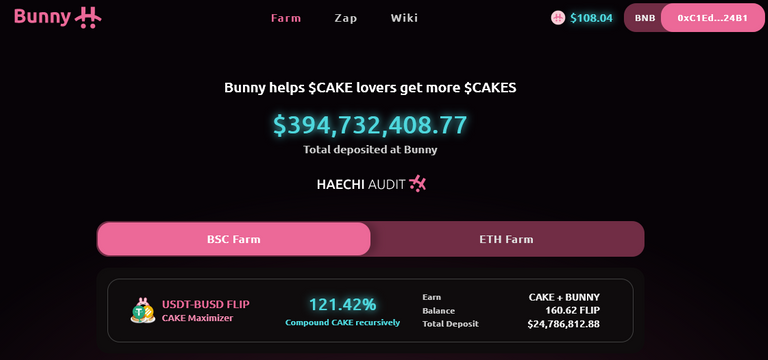

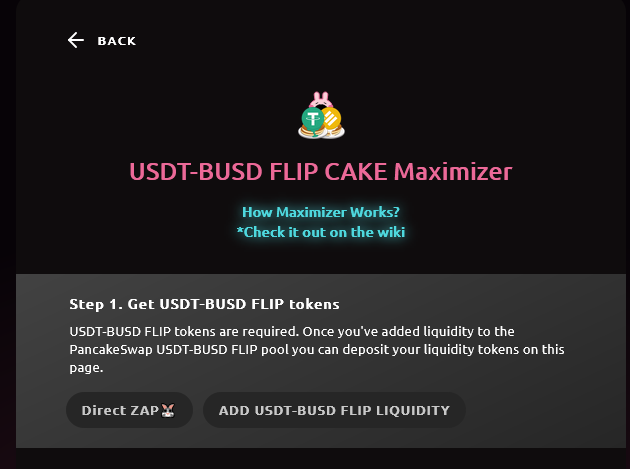

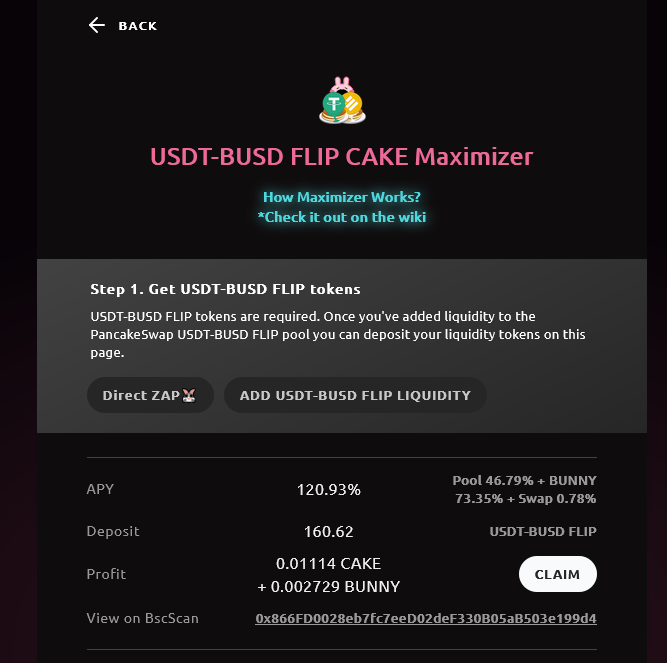

Go to https://pancakebunny.finance/farm/USDT-BUSD%20FLIP%20CAKE%20Maximizer

pancakebunny is the platform where we will be getting our CAKE and BUNNY rewards. The USDT-BUSD FLIP CAKE Maximizer pool is the one I'm using in this guide because I have a strong preference for stable-stable pairs that prevent impermanent loss. You might make more in other pools, but the impermanent loss potential creates far greater risk to your principal.

"Zap" is the term pancakebunny uses to trade one asset for another.

Click the "Direct Zap" button.

Change the top coin to USDT.

Change the bottom coin to BUSD.

Zap half of your USDT to BUSD. You'll need both for Step 7.

Like most Uniswap clones, you'll need to "Approve" the contract interaction before you actually execute the trade. So click "Approve USDT", accept the transaction in MetaMask, and then execute the trade.

After the you have traded half your USDT for BUSD, click the "<- Back" button to return to the pool page.

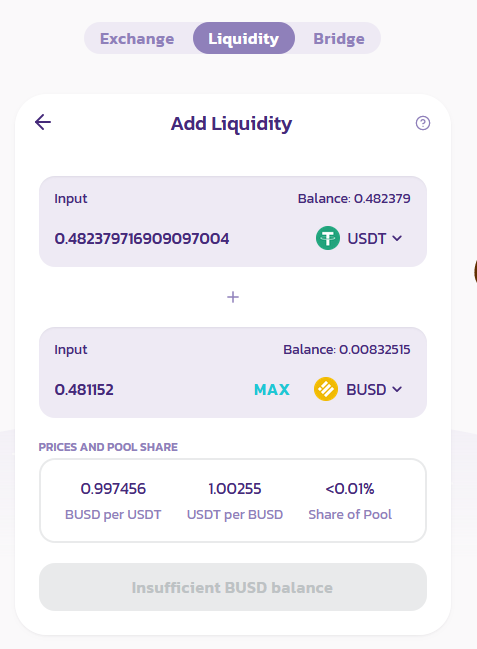

Step 7: Add liquidity to USDT-BUSD pool on pancake.finance

Now that you have the assets needed to enter the pool, click the "ADD USDT-BUSD FLIP LIQUIDITY" button. This will take you to https://exchange.pancakeswap.finance/#/add/0x55d398326f99059fF775485246999027B3197955/0xe9e7CEA3DedcA5984780Bafc599bD69ADd087D56

This should open in a new tab.

There are often some slight variances between 1 USD, 1 USDT, and 1 BUSD. So look at your balances for USDT and BUSD. Enter the smaller of the two numbers for both assets. Approve the contract and add liquidity.

You now have USDT-BUSD LP tokens.

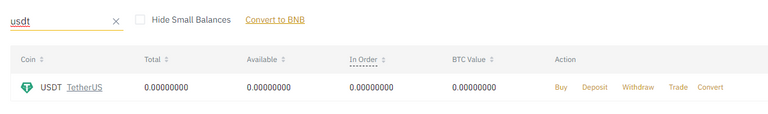

Note: In this image, I have already added liquidity. I had slightly less BUSD than USDT so I ended up with 0.48 USDT unused left in my wallet.

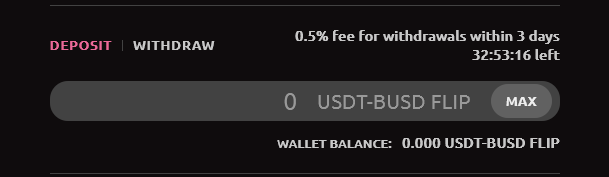

Step 8: Deposit USDT-BUSD LP tokens on pancakebunny.finance

Go back to the pancakebunny tab.

In the deposit section, click the Max button, Approve and Deposit.

You have now entered the USDT-BUSD FLIP CAKE Maximizer pool. Congratulations!

Step 9: Check back every so often to claim rewards

Now you are earning two tokens as rewards: CAKE and BUNNY. Check back every so often to claim your rewards.

Click the CLAIM button, confirm in MetaMask, and now you will have some CAKE and some BUNNY in your BSC wallet. You can then Zap them for other tokens, keep them for speculation, or whatever else you want to do.

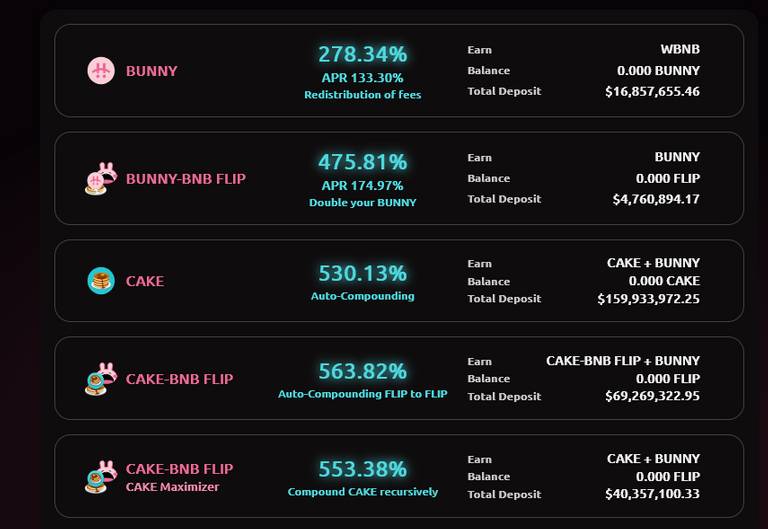

Bonus step 10: Stake rewards

Once you have your CAKE and BUNNY, you can stake those rewards in some of the other pancakebunny pools to compound your rewards. How much to do is up to you. Personally, I'm selling 80% of my rewards and compounding 20%.

Posted Using LeoFinance Beta

thanks for this my friend you made my life easy with this tutorial

Posted Using LeoFinance Beta

Glad to help

Posted Using LeoFinance Beta

yeah it was helpful

It's fun isn't it! Now I've been in for a fortnight I'm calming down a bit on the claiming of rewards and only doing so when I've earned over a certain amount, those fees may be small, but they can mount up.

I even went as far as using some BTC as collateral on Venus to mint VAI, then swapped that for some of these crazy pool tokens,

I even earn 1.5% on the collateral in SXP or something.

It's just a crazy crazy world.

I've opted for the autofarm vaults myself - you earn in stable coin and in Auto.

I've yet to really venture into the nefarious lands beyond the main two!

I think 80-20 is probably about right!

Totally fun!

Yeah, AUTO is another platform that works very similarly from what I can tell. I just wanted to keep things simple for this tutorial instead of showing every possible option :)

I'd love to see a guide on minting VAI with your BTC.

Posted Using LeoFinance Beta

I hadn't even thought to do one - I might put together something - It's quite straightforward although TBH paying back a loan does kind of take the fun out of farming!

Come and have a look at the dodgy others and let the greed take the best part of you haha

Posted Using LeoFinance Beta

Personally a second metamask addresses for the BSc transaction is a no-brainer because you could easily mix everything up without it. This is well detailed.

Posted Using LeoFinance Beta

Yeah, I 100% agree

Posted Using LeoFinance Beta

Exactly, Cheers!

Posted Using LeoFinance Beta

Nice tutorial, easy!

I didn't even know MetaMask supported BSC

Posted Using LeoFinance Beta

I didn't either until a few days ago lol

Posted Using LeoFinance Beta

Boom! That's what I'm talking about. Lets see if I can not screw this up. Thanks for the info bro!

Posted Using LeoFinance Beta

lol I believe in you!

Posted Using LeoFinance Beta

Great info! Thank you for this post.

Posted Using LeoFinance Beta

Any time

Posted Using LeoFinance Beta

Something that's not as well known is the fact you can participate in DeFi with USD pegged stable coins.

I've gotta take the plunge.

Posted Using LeoFinance Beta

Yeah, like-kind DeFi is by far the most attractive to me. And if I'm putting fiat USD into it, I like being able to pool in USD stable coins.

Posted Using LeoFinance Beta

Easy to follow guide. Thanks for making it easy. Best regards.

Posted Using LeoFinance Beta

Happy to!

Posted Using LeoFinance Beta

tutorial explained in a simple and detailed way

Thanks and great work!

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @nealmcspadden, here is a little bit of

BEERfrom @libertycrypto27 for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I'm pretty sure I can use BSC. Because I live in the US, I cannot use binance only binance-us. Can I still do the pancake or other swaps and liquidity pools?

Posted Using LeoFinance Beta

Someone else brought this up. A quick google found this:

So apparently it can be done through trustwallet. You'll have to figure that out.

DeFi isn't custodial anywhere. So there's no trading restrictions on it.

Posted Using LeoFinance Beta

That's true about DeFi. But, being able to access it is. Thank you for answering.

I was wanting to explore Binance's "cedefi", and your thorough guide came with the perfect timing! Thank you!

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

Very smart idea to explain how to use BSC on metamask !

That should prevent the very first feeling of "forget about, I just give up this BSC DeFi".

Good guide, let's bring more Lions in this juicy environment :)

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

I still haven't dabbled in DeFi mostly because the gas prices are far to high for me to just go in and start playing around lol.

However I still don't understand the "value" of most of these crazy coins. Is there actually value behind them? It seems more and more like 2017 where shitcoin after shit project was released to make a quick buck.

Posted Using LeoFinance Beta

I tried out the Staking of Pancake alone on CAKE POOL of Pancakeswap. So far it was good. Got out of it with some profit and will probably get in ASAP.

Posted Using LeoFinance Beta

Nice!

Posted Using LeoFinance Beta

Thanks for this detailed tutorial! I've just tested the CAKE-BNB liquidity two days back and while the setting up of the wallets alone (I linked my ledger to metamask too) took me almost the whole day, now this process you shared looks kinda easier for me already. Will try putting a few usdt to work in Bunny. Let's see how it pans out. 🤞

Posted Using LeoFinance Beta

bookmarked it, it will come in handy!

Posted Using LeoFinance Beta

Great guide, very easy to follow and I think it's very appropriate that your example uses the USDT-BUSD pool to avoid impermanent loss. Great for noobs!

Also a new user would get exposure to two very relevant platforms in PancakeSwap and PancakeBunny. Currently I'm only active in 1 yield farm on PancakeBunny where I farm CAKE and BUNNY by staking CAKE to an LP. When it's time to enter a low risk pool I'll be coming back to this guide for sure!

p.s. the bonus strat to reinvest and compounding 20% of the rewards is so solid.

Posted Using LeoFinance Beta

Very nice article.

I like the idea of stable to stable staking as a way to avoid impermanent loss, and I also like putting my profits into stable coins at the market high to protect my gains. I think I also learned that from you on Leo Round table.

I assume we can navigate yo Pancakeswap using the browser feature. And using our BUSD swap for assets on PCS to put in LPs?