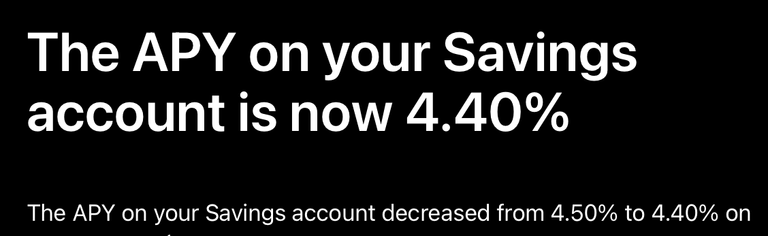

For many individuals, the prospect of earning a good yield on safe and liquid assets has long been a cornerstone of financial planning. However, the anticipation of rate cuts from the Federal Reserve has prompted banks to adjust their strategies, resulting in a decline in interest rates across the board.

This development is particularly disheartening for those who have diligently accumulated assets and relied on interest earnings as a source of income. The continuation of this trend only serves to penalize savers and investors who have prudently managed their finances.

The challenges posed by lower interest rates are compounded by the broader economic context. While there are potential benefits to lower rates, such as stimulating economic activity and encouraging borrowing, the long-term implications may not be as favorable for those seeking to accumulate capital over time.

One of the key drivers behind the shift in interest rates is the evolving yield curve, which reflects the relationship between short-term and long-term interest rates. As the yield curve flattens in anticipation of rate cuts, banks are compelled to adjust their pricing strategies accordingly, resulting in diminished returns for savers and investors.

Moreover, the traditional financial system continues to grapple with challenges stemming from unrealized losses on fixed income investments. The rise in interest rates to combat inflation has left many institutions with significant losses, further exacerbating the pressure to lower rates on earnings.

In navigating this new landscape, savers and investors must carefully consider their options and explore alternative avenues for generating returns. From exploring higher-yield investment opportunities to diversifying portfolios, there are strategies that can help mitigate the impact of lower interest rates.

While the current environment presents challenges, it also underscores the importance of adaptability and resilience in the face of change. By staying informed, remaining vigilant, and exploring innovative solutions, individuals can navigate the shifting tides of the financial world with confidence and determination.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.