Hello everyone!

How are you all?? I hope you are all fine.

Today Update

🗣️ Concerns around Liquid Staking Tokens

Let’s explore what’s happening with Renzo Protocol, a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer.

Acting as the interface to the EigenLayer ecosystem, Renzo Protocol secures Actively Validated Services and offers a higher yield than $ETH staking.

Renzo announced its token $REZ and airdrop plan on April 23, alongside Binance Launchpool, comprising 2.5% of the total $REZ supply.

⚠️ The depeg incident raised eyebrows as Renzo’s LRT - ezETH experienced a sell-off on DEX, with prices dropping to around $700 before recovering.

🛑 Renzo earmarked 10% of $REZ for the airdrop, with Binance stakers gaining a selling advantage over those claiming the airdrop later.

Insider trading concerns and airdrop ratio criticisms have surfaced within the community.

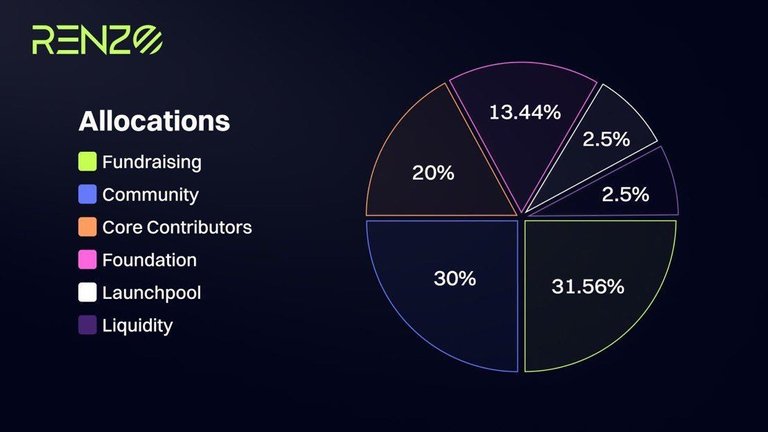

🧐 Community members have raised questions about the clarity of Renzo’s token allocation pie chart, highlighting potential design flaws and inconsistencies. Is this a simple mistake or something more?

A significant portion of tokens is allocated to investors and the team, raising concerns about centralization.

What's your take on the chart?

🌚 - The chart was intentionally designed this way.

❤️ - It was simply a designer's mistake.

. . . . . .

📰 Here's what happened in crypto in the past 24 hours

⚡️ Chainlink debuts new protocol aimed at boosting cross-chain interoperability

🥷 North Korean Lazarus hacker group using LinkedIn to target and steal assets

🇬🇧 UK regulator scrutinizes Big Tech's role in AI industry

💾 Linux on Bitcoin? Open-source framework BitVMX envisions BTC-powered programs

🏃 New crypto users shouldn’t ‘rush into DeFi’

Have a good day 😀....

Thanx for watching 👀