DeFi on Tezos

I recently began exploring defi on the Tezos chain a little over a month ago when PlentyDefi was lauched. Since then I've explored the Tezos defi space a bit more and we will be talking about some other options available like Wrap and Youves.

So far my experience as a whole has been very good. Transactions are pretty quick. Fees are extremely low. Feels great compared to what I've experienced with Ethereum.

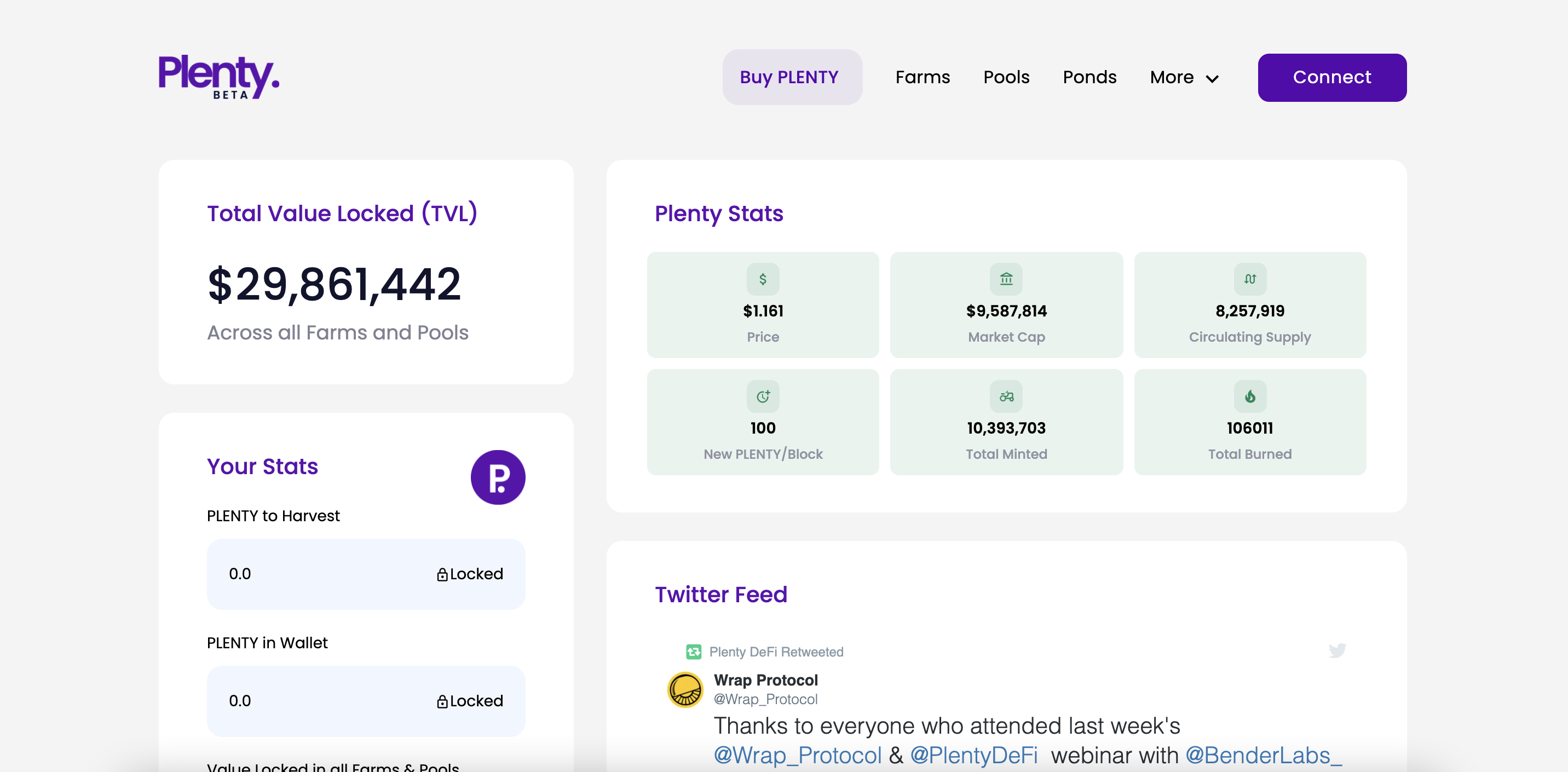

Plenty Defi

Plenty is a decentralized yield farm running on the Tezos blockchain with "a goal to bring more liquidity and users to DeFi in the Tezos ecosystem."

I got involved nearly right away and made a nice little profit. However, since then the token price has dropped about 90% from it's peak. But, TVL seems to be holding steady at 30M.

Plenty allows you to earn PLENTY and other tokens by liquidity pool farming, staking pools, and staking ponds (ponds let you stake PLENTY and receive another coin as the payout).

Plenty is the app I've been with longest on Tezos. I'm currently building up my wallet and planning on holding it for a bit. The project is backed by Tezsure and Draper Goren Holm. So, I'm thinking there is a lot of potential for upside in the future as it grows.

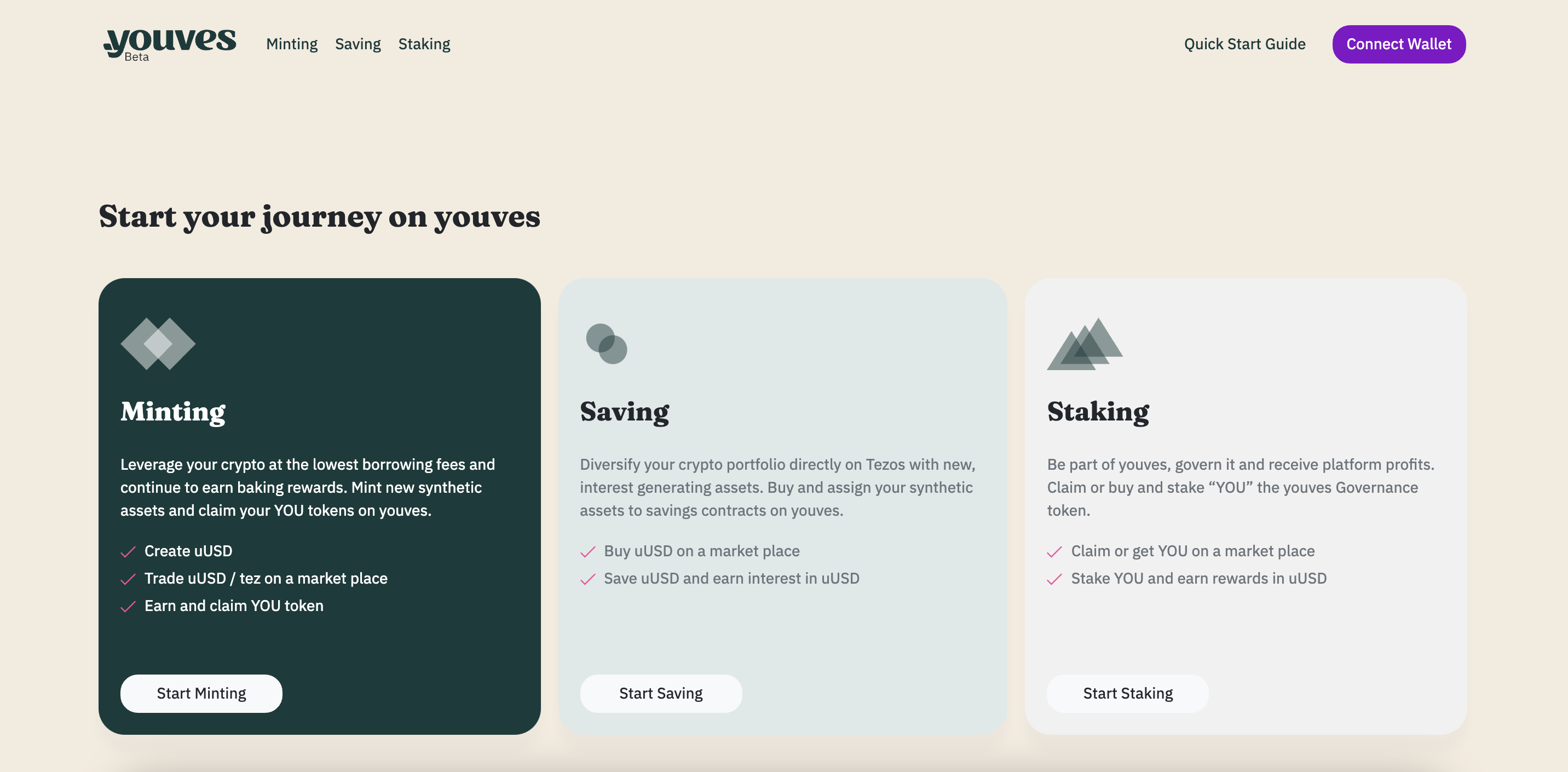

youves

youves is a decentralized, non-custodial and self-governed platform for the creation and management of synthetic assets. Minters of synthetic assets earn a passive income in YOU, the governance token on youves.

YOU tokens are awarded to minters by the youves protocol in relation to their minted synthetic assets. YOU holders have voting rights and the possibility to stake YOU tokens and receive their share of the platform profits.

youves allows you to mint, save, and stake. Each of which provides slightly different ways to utilize your crypto.

youves uses uUSD, a Stable Token pegged to the USD. It is fungible by design and backed by tez collateral. Conversion rights for the minter and the holder strengthen the peg. uUSD offers interest income in uUSD to its holders.

Wrap Protocol

The Wrap Protocol is a decentralized bridge between the Ethereum and Tezos blockchains. Through the Wrap Protocol, users can transfer their Ethereum ERC-20 and ERC-721 tokens to the Tezos blockchain in a decentralized way.

Through Wrap, users issue wTokens (wrapped tokens) which are representations of ERC20 and ERC721 tokens on the Tezos blockchain. wTokens can then be used on the Tezos blockchain, and their value is pegged to the original tokens. Wrap is a decentralized protocol, relying on a strong federation (the Signers Quorum) that guarantees the stability of the protocol, and a community of $WRAP governance token holders.

Users can earn tokens on Wrap by staking their Wrap Governance tokens in a pool (I currently stake mine in wCEL), or by providing tokens to one of the liquidity pools available in the app.

Conclusion

Well there's a quick rundown of the 3 defi apps I've recently gotten familiar with in the Tezos ecosystem. Overall my experience has been pretty positive. If you're into defi, definitely give the Tezos ecosystem a shot.

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @nolyoi.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for Proposal

Delegate HP and earn more