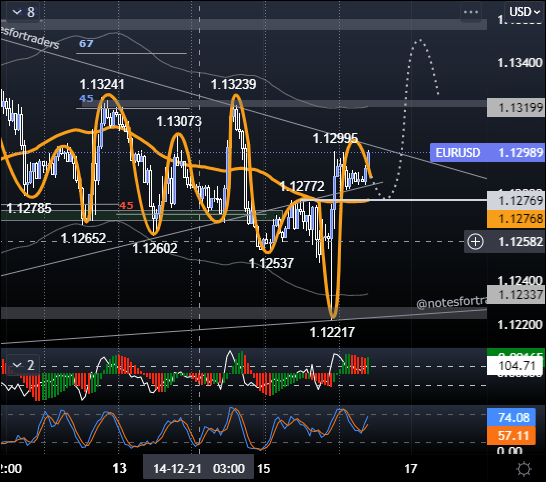

On Wednesday, December 15, trading in the euro ended with growth. The euro rose in price by 0.30% to 1.1292. High volatility in the market was observed during the American session. After the announcement of the decision of the US Federal Reserve, the pair dropped to 1.1222. After Powell's speech, the price recovered to 1.1300 (+78 p.).

The US Federal Reserve Committee on Open Market Operations kept the federal funds rate in the range of 0.00-0.25%, and also increased the rate of reduction of the asset purchase program to $ 30 billion from $ 15 billion a month. In terms of timing, it turns out that the Central Bank will curtail the QE program in March 2022. The regulator also confirmed its intention to keep rates near zero until the situation on the labor market shows further progress. FOMC members' new rate trajectory forecast, which is updated quarterly, implies three increases each in 2022 and 2023.

The rhetoric voiced by representatives of the Federal Reserve System on Wednesday was more aggressive than expected. The forecast for three rate hikes on the Fed's dot chart was the initial catalyst for the US dollar to strengthen. Although the Fed's tone became tougher on the stock market by the end of the day, precious metals and major currencies rose in price. The rule “buy expectations, sell facts” worked.

Scheduled statistics (GMT +3):

- At 11:15, France is to publish preliminary data on the PMI in the services and manufacturing sectors for December.

- At 11:30, the SNB will announce its decision on the interest rate.

- At 11:30, Germany is to publish preliminary data on the service and manufacturing PMI for December.

- At 12:00, A press conference of the SNB chairman and members of the governing council will take place.

- At 12:00, the eurozone is to publish preliminary data on the index of business activity in the services and manufacturing sectors for December.

- At 12:30, the UK is to publish preliminary data on the service and manufacturing PMI for December.

- At 15:00, the Bank of England will announce its decision on the interest rate.

- At 15:45, the ECB will announce its decision on the interest rate.

- At 16:30, a press conference by the head of the ECB K. Lagarde will take place.

- At 16:30, in Canada, there are data on changes in the number of employees (excluding agriculture) according to the ADP for November.

- At 16:30, the US is to publish a manufacturing index according to the Philadelphia Federal Reserve Bank, the number of initial jobless claims on December 3-10, and new home starts in November.

- At 17:15, in the US will be released a report with data on industrial production in November.

- At 17:45, the US is to publish preliminary data on the service and manufacturing PMI for December.

Current situation:

At the time of writing this review, major currencies are trading in the red. Major currencies are correcting after the evening rally. The single currency has come out in plus against the dollar and is trading at 1.1292. Sellers renewed their weekly low but failed to break out of the 1.1235-1.1383 range of November 30.

The focus of speculators' attention has shifted to the meetings of the ECB and the Bank of England. The ECB will announce the rate decision at 15:45 (GMT +3). The ECB is expected to maintain a soft approach to monetary policy. After the meeting, a press conference will be held by the head of the ECB Christine Lagarde. The Bank of England will announce its decision at 15:00 (GMT +3). It is expected that the Central Bank will not raise the rate because of Omicron. From the statistics, it is worth highlighting the indicators of business activity in the manufacturing sector and the service sector in the EU countries.

Technical analysis:

After renewing the low and rebounding, the EUR / USD pair returned to 1.1300. The scales again began to lean towards the buyers. The nearest target level is 1.1327. If the euro outlives the speech of K. Lagarde, who is in favor of easing monetary policy, the price will be there by the close of the day. The support zone remains at the levels 1.1230 / 50.

Summary: on Wednesday, the euro closed higher against the US dollar. The EUR / USD pair recovered from 1.1222 and 1.1299 after the speech of the head of the Fed J. Powell. The Fed's decision coincided with market expectations, so after the press conference, profit-taking on long positions in the dollar began. Today the focus of attention has shifted to the meetings of the ECB and the Bank of England. Increased volatility in the market is expected at 16:30 (GMT +3) during K. Lagarde's press conference.

Posted Using LeoFinance Beta

Source of plagiarism

Plagiarism is the copying & pasting of others' work without giving credit to the original author or artist. Plagiarized posts are considered fraud and violate the intellectual property rights of the original creator.

Guide: Why and How People Abuse and Plagiarise

Fraud is discouraged by the community and may result in the account being Blacklisted.

If you believe this comment is in error, please contact us in #appeals in Discord.